[$QRHC] Quest Resource Holding Corp

A high-quality "platform" business with inflecting EBITDA growth

I believe Quest shares at these levels provide an asymmetric investment opportunity, combining low downside risk with 3x+ upside potential over a ~5 year horizon. I think the business is on the cusp of sustained, ~15-20% organic EBITDA growth, as a result of a ramping in new logo growth combined with high (and increasing) operating leverage. Downside is limited by high recurring revenue (90%+ of revenue is contractually recurring under multi-year contracts), 100%+ historical net revenue retention, very limited cyclicality, and a reasonable entry multiple.

Business Overview

Quest is a ~$200m market cap “waste broker” based in Dallas, TX. It offers waste & recycling solutions for typically large, Fortune 1000 businesses.

Unlike most waste & recycling providers, however, Quest doesn’t own any physical assets and doesn’t do any pick-up/processing of waste & recycling itself. Instead, Quest utilizes a “vendor network” of over 3,500+ providers to perform these services. Quest earns a spread between what it charges its customers (who are typically contracted under multi-year agreements) and the rates it pays its “vendors” (contracts with its vendors are much more flexible; Quest can essentially re-arrange its vendor base at any point). Thus, Quest is much different than a typical waste provider in that it is “asset-light” and operates more like a “platform” business. Hence the term, “waste broker.”

As a result of the platform approach, Quest is capable of fully “managing” the processing over 100 different types of waste streams. Some of its major waste categories include:

General recyclables: cardboard, plastics, metals, pallets, etc.

Automotive waste: used motor oil, used oily water, used antifreeze, used tires (Quest has diverted more than 200m used tires from landfill since inception), paint waste, etc.

Food waste: fruits & vegetables, meat & seafood, used cooking oil, grease traps, recalls, etc.

Hazardous waste: all flammable liquids & solids, all toxic waste, electronic waste, light bulbs, batteries, compressed gases, etc.

Construction waste: concrete, dry wall, etc.

This flexibility and “know-how” is a useful fit for the waste & recycling market, as the best solution for a given material will vary from one region to the next. For example, food waste — depending on where it’s created — might be best sent to compost, or to an aerobic digester, made made into animal feed, or there may be no good “recycling” option (and thus will be sent to landfill). New avenues for recycling materials continue to proliferate (with food waste and plastics serving as key emerging opportunities), which benefits Quest’s offering.

So why would a Fortune 1000 business elect to work with someone like Quest?

Breadth of waste streams & geographies served. As mentioned, Quest manages over 100 different types of waste streams and operates in every US zip code. Therefore, for Quest’s customers, it can provide a “one-stop shop” solution. The alterative would be for a customer to stitch together a program itself, which is certainly doable. But for customers of a certain scale & complexity (think hundreds or thousands of sites, 20+ waste streams, regulatory complexity & environmental risks, ESG & regulatory reporting requirements, etc.), going with a provider like Quest can be a very nice, “simplifying” solution. In one case study, Quest reduced a client’s vendor count from 80 to 1, mentioning that this type of reduction “is not uncommon.”

Driving diversion from landfill. A key capability of Quest’s is its “know-how” in diverting waste from landfill — approximately 70% of material handled by Quest avoids landfill (vs. ~32% nationwide). This is a key consideration for generators that are pursuing zero-landfill and other sustainability initiatives. Diverting waste from landfill can also be an important cost-saving mechanism (provides savings on landfill tipping fees, recovers value from certain recycled materials).

Data & reporting capabilities. Quest provides a comprehensive reporting solution. Reporting on a customer’s waste programs and diversion (i.e. what is going where, and how much) is highly important for ESG & regulatory reporting (in addition to being a nice operational tool for clients). The traditional waste majors (e.g. Waste Management, Republic) can do this just fine on the waste they manage internally, but struggle to piece an offering together across a third-party vendor network in a useful way (if they provide it at all). This is a key and increasingly important differentiator for Quest.

Superior customer support. The waste majors (as well as many specialty waste & recycling providers) are notorious for poor customer service (lack of responsiveness to issues, egregious annual price increases, etc.). Quest prides itself on high-quality, superior customer service.

Potential cost savings…

…Whether brokers like Quest can produce cost savings relative to an incumbent solution is a more nuanced subject. The short answer is that they can, but it depends on the situation…

For example, if a potential customer has a waste major as the incumbent provider, and has not been actively managing its waste (e.g. letting price increases go unchecked, not recycling/diverting waste streams that would reduce costs, etc.), then there would be a prime opportunity to reduce costs. If a potential customer has been “on top of it,” the opportunity to reduce costs is more marginal. Similarly, if a potential customer is mostly a generator of solid waste (and does not deal with many different waste streams or with much complexity), and if that customer is based in a region where someone like WM has a strong presence, it would be very unlikely that a player like Quest would be a better option than WM.

My impression is that more often than not, Quest is actually not the low-cost option. However, Quest certainly can be in the right situation, and I believe this gap has been narrowing over the years (as cost of landfill has risen, as recycling options have increased, etc.). Quest can also offer internal savings for a client, removing much of the overhead of managing its waste procurement.

This quote from the Mar-22 Roth Conference seems to encapsulate management’s official position on the subject:

The perception is being greener is more expensive. It’s just not true. It’s truly not true…Depending on how well managed the company was before relative to that cost there’s a huge variance in what we can save. When we find somebody that has viewed their waste streams as totally an afterthought, the savings could be 20-30%. Then you find somebody that’s managed it pretty tightly but they’re just trying to enhance it (and can we do that for them), then savings will be smaller. But we have found that being green is not more expensive, we can be more cost effective.

According to a Jul-20 Tegus transcript with the Buffalo Wild Wings Director of Purchasing, Quest was the low-cost option in an RFP process consisting of Quest, WM, Republic, and four other brokers.

Notably, as Quest scales, its ability to compete on price improves. The larger its book of business in a region, the greater the amount of concessions it can generate from its vendors, which it can then pass on to prospective customers.1 Quest can also earn better rates on recycled materials (e.g. scrap metals) the larger the amount of supply it controls in a region.

Customers / End Markets

Quest targets large waste producers with high waste “complexity.” The greater the number of waste streams, the more regulated the waste, the greater the number of sites served, the better the fit generally speaking. Quest’s typical client profile is a generator of 5+ waste streams, and its average deal size is in the 7-figures.

Quest’s customer base has grown significantly in size and quality over the past few years. It has also diversified into new end markets. Just a few years ago, Quest generated much of its revenue from big-box retail and automotive services. Today, Quest is diversified across retail (big-box & specialty), automotive services, grocery, industrial & manufacturing, multi-family residential, transportation & logistics, restaurants, and food distribution.

For additional background on Quest, I highly recommend the following reading:

Kira Ambrose’s profile of Quest (Part 1 and Part 2) from 2021

“Porge’s” profile of Quest (published on VIC) from Jun-23

Key Investment Merits

Unique, Leading Player in Space

I believe Quest is a top 2 player in the broker space (with Keter Environmental Services being its #1 competitor) and one of maybe ~4 players with the ability to compete toe-to-toe for Fortune 1000 clients. Quest has a national platform, serves a huge breadth of waste streams, offers best-in-class data & reporting capabilities, and has a pricing advantage over just about every other broker. It has a blue-chip customer base and I believe a strong reputation in the industry. Moreover, the industry has consolidated meaningfully in recent years, with major players such as Waste Harmonics (acquired) and Rubicon (imploding) no longer serving as competitive threats.

Scale Advantages

Quest derives substantial advantages from its scale.

As mentioned above, perhaps most importantly, as the business grows in size so do its cost advantages. Essentially, as Quest grows its customer base, it enhances its leverage with vendors, thereby generating more favorable pricing. Quest is then able to pass these savings on to prospective customers. The more of a waste stream it manages, and the greater the density it achieves within a region, the greater its cost competitiveness. Quest, and all brokers, therefore have different levels of strength depending on the region and waste stream managed.2

Another key benefit of Quest’s scale is that it affords Quest the ability to invest in its technology platform and data & reporting capabilities. These capabilities separate Quest from other players in terms of efficiency and the strength of its offering in a meaningful way (more on its technology platform later…).

I believe Quest’s only competitor with meaningfully greater scale (other than Rubicon) is Keter, which might be roughly ~3x the size of Quest.

Strong Business Momentum

Since 2020, Quest has 3x’d revenue (~2x organic), and ~4x’d EBITDA. Yet for 2024, Quest might do more in new logo revenue than it’s done in the 3 prior years combined.

These wins have yet to materialize in the P&L (will start hitting in Q2’24), but I believe by the time they are fully reflected, Quest will be run-rating in excess of 15% organic growth.

Even if we were to assume that this is represents “peak growth” over a five-year window, and that growth steps down from there (~15% would actually be in line with the organic growth sustained over 2020-2023), I believe the shares still have ~3x potential given how efficient Quest is at converting incremental gross profit to EBITDA.

I think it’s likely the business will generate 15-20%+ growth in EBITDA for a sustained period (more on this later…).

Highly Attractive Financial Model

Quest benefits from a “platform-esque” financial model. Which is to stay, the company produces a very high return on capital (ROEs are tracking towards 100%+), is highly cash generative, and benefits from significant operating leverage. The business can scale rapidly, requiring little capital to grow.

Very Stable Business

90%+ of revenue is contractually recurring under mostly multi-year contracts (avg contract length is ~3 years). Net revenue retention is “obscenely high,” and I believe has averaged in excess of 100% in recent years (and there continues to be significant headroom to further penetrate existing accounts).

It is painful for customers to switch providers. Quest deals with large, bureaucratic organizations where the typical RFP process is complex and lasts around 6 months (but can last upwards of 12 months).

Quest’s revenue model is also tied to a customer’s waste volumes and thus the business experiences virtually no cyclicality. Inflation from vendors is passed-through to its customers and commodity pricing (on “recyclables” like carboard, metals, etc.) is similarly passed-through (due to the structure of their customer agreements).

Growth

Historical Growth

Quest’s historical revenue chart has an odd-looking “U” shape, and includes a steep revenue decline over the 2016-2020 period.

So what happened from 2016-2020? After Ray Hatch joined as CEO in 2016, the business began purposefully churning low margin/unattractive revenue. The company actually cut revenue approximately in half, shedding a total of $85m. Impressively, over this 2016-2020 period, gross profit actually grew by 32% from $14m to $19m.

Starting in 2020, after having “stabilized” the business, the company returned to revenue growth in a major way. From 2020-2023, revenue almost 3x’d, from $99m to $288m (I estimate ~2x of which was organic).

Organic Growth

Quest’s organic growth in recent years has been clouded by acquisitions (Quest closed on six small-ish acquisitions over the Oct-20 to Feb-22 period).

However management has discussed organic growth performance on earnings calls. Management stated that organic growth represented ~60% of its ~51% gross profit growth in 2021 (or ~31% organic growth)3 and ~33% of its 70% gross profit growth in 2022 (or ~23% organic growth in 2022)4. Adding in 3% organic growth for 2023, this would imply that the company grew organically at around a ~18% CAGR over the 2020-2023 period.5

Net Revenue Retention

While the company has never provided official retention metrics, I believe net dollar retention has averaged in excess of 105% over the last few years. A couple of recent quotes from management outline a range somewhere in ballpark of 105-110%.

From Q3’23 earnings:

George Melas-Kyriazi (MKH Management Company)

Ray, you talked about doubling over the last 3 years and about 1/3 of that coming from existing customers. So I did some very simple math that suggests that you're sort of growing with your existing base by roughly 10% per year. But it seems a little high to me and I wonder if that's about how -- where the numbers fall around 10% in terms of organic growth.

[…]

Ray Hatch

Yes. It does seem [high], but it's actually what this team has been doing. And that's growth in gross profit dollars, not revenue necessarily. And so we talked about the procurement initiatives about continuing to leverage and optimize the waste services and create more value from the commodities. And the team has been doing that. So they've been doing that for many years. So yes, George, those numbers are accurate and we're really thankful to have those long-term relationships with these great clients and we're able to do that.

From Q1’24 earnings:

Aaron Michael Spychalla (Craig-Hallum)

Could you maybe expand a little bit on the kind of land and expand strategy with the existing clients? Maybe touch on some of the services that you're seeing there? And then any way to quantify whether dollars or kind of percentage, just kind of the potential for growth that you see from that?

Ray Hatch

[…] The land and expand story really isn't any different than it has been, it's just continued to grow and accelerate […]

As far as the percentage goes, I think -- have we talked about a percentage in the past of growth [in] the mid-single-digits. As a percentage, we anticipate at least that on a go-forward basis. It could be more. We're hopeful. But the runway looks pretty good for us Aaron on that expansion with those existing clients.

Management has also stated previously that the business has had just one major churn event — a large customer in the grocery space, whose procurement consultant indiscriminately (according to management) canceled all indirect spend contracts. Quest later lost one additional material customer (that it acquired through the RWS acquisition) in Q3’23 timeframe (this customer was acquired and waste procurement was brought in-house). These are the only major churn events (that were not purposeful on Quest’s part) that I’m aware of in the company’s recent history. According to management, as of Q1’24 Quest’s top 20 clients have been with the company for an average of 9 years.

I believe the company continues to be positioned strongly to upsell revenue to its customer base, as a result of an expanding product portfolio (boosted by recent M&A) and significant recent new logo additions. Furthermore, in a couple of significant ways, the company is focusing more on “upsell” than it ever has (new teams focused on it6, tying compensation to it7). Essentially at the start of an average year, there is a level of organic growth baked into the P&L before any new logos are won, which is quite a nice feature.

Near-Term Growth

As mentioned, for YTD 2024, the company has shown impressive new logo generation. It seems Quest, for 2024, may actually generate in new logo dollars more than it has in the prior three years combined.8

New named wins for YTD 2024 I estimate are in the ballpark of ~$27-40m, which should be fully reflected in Quest’s financials by ~Q4’24. My midpoint estimate is ~$33m for YTD 2024, compared to a ~$39m midpoint estimate for 2020-2023 combined (granted, these are highly unofficial figures — see footnote 8 — but still instructive in my opinion). See midpoint estimates by year below.

Now, if we add to these wins the expected upsell to Quest’s existing base (of say 5% or so), we get to a range of 13-20% of “locked-in” growth. If we further assume that this revenue will come in at a 17% gross margin, and that 50% of that gross profit will convert to EBITDA, I estimate an EBITDA uplift of $3-5m that is “locked-in” based on these announced wins + upsell. That would put Quest’s multiple at around ~10-11x on a run rate basis exiting 2024.

These figures exclude any additional wins that could take place over the remainder of 2024, and exclude, for 2024 YTD, (1) two smaller wins, (2) expanding a smaller existing customer to 7-digits in revenue, and (3) “renewed and expanded services with two of our largest customers.” All together, this perhaps adds a bit of extra conservatism to the figures above.

Pipeline Commentary

Importantly, while the company has experienced notable dry spells in new logo wins in the past (see 2022), I think Quest is better positioned today to maintain momentum. Commentary from management suggests that the pipeline, even after Quest’s string of 2024 wins, is in good shape (and actually better than a year ago). So much so, management has opted to increase its investment in S&M in 2024 vs. plan.

From Q1’24 earnings:

I will also note that our pipeline of opportunities with new and existing clients has grown and momentum appears to be durable, which bodes well for the next few years…

In addition to closing several deals in recent months, we've continued to see a noticeable uptick in not only number, but also the size of opportunities in our pipeline. Given the success we are having with new client wins, we plan to accelerate our investment in organic growth initiatives, including investments in marketing and sales during 2024, reinvesting some of the profit gains generated in the business…

As far as the pipeline goes, it's significantly larger today than it was a year ago. And I think the quality goes two ways. So I said larger in size and in quality. There's two aspects of quality that I think are important. One is really the type of customer itself, is this the kind of customer that's aligned with our goals and our targets…Two is how close are they and how valuable are they as a client themselves in size.

I don’t believe Ray has made a comment quite like this ever before, and, in my opinion, would not say this if he didn’t genuinely feel this way. While he certainly strikes an optimistic tone of late on calls, he hasn’t always to this degree, and his optimism has built over time (which has been backed up by performance).

I believe a continued secular shift towards brokers in the market, combined with the increasing strength of Quest’s offering, is leading to strength in the pipeline. In one recent conversation with a smaller Quest competitor, the company indicated that “in just the last couple weeks” a 1,400 gas station chain (wanting to implement within the month), a beauty parlor chain (300 locations, ~$1.5m spend), a very large chain of cosmetic stores and a Fortune 500 beauty products company had all come to market. Management of this business claimed that these groups were “sold on brokers” and that “they are not looking at the Waste Managements and Republics of the world.” Though just one datapoint, I believe it’s indicative of the broader improvement in the brokers’ value proposition over time.

Other Notes

I believe management is anticipating growth in-line with the ranges discussed above. This comment below from the Jun-24 IDEAS Conference was by no means official, but does give an indication of the level of growth expected:

We do have a 20% CAGR [in gross profit dollars from 2016-2023], and actually it’s going to be higher, probably, in the near-future.

One of Quest’s main rivals, Rubicon, is in the process of imploding, which may present a “jump ball” on some portion of Rubicon’s ~$700m of revenue (rumors are that spooked customers have been coming to market already). Much of this revenue may not be attractive for Quest (its margin profile may be insufficient), but at least some portion of it likely is. Quest could be in an advantaged position to secure Rubicon revenue, having hired in Jul-23 a Co-Founder and former “Chief Advisor” to Rubicon in Perry Moss, who is now Quest’s Chief Revenue Officer.

Margins

The second major piece to the thesis (alongside healthy revenue growth), is a belief that EBITDA margins will continue to ramp in a material way.

Historical Gross Margins

GMs rose significantly over the 2016-2019 period as the business shed low margin revenue. GMs peaked at 19.3% in 2020 before a string of acquisitions + uptick in new business (which generally comes in at a lower margin, initially), reduced margins to a trough of around 17.2%.

The company has since worked margins back up into the 19% range. Working GMs up is an exercise in working vendors down on price (through more volume over time, providing better optimization/more density on routes, etc.). Quest is highly confident in its ability to work GMs up over time through this process, which it has done consistently for many years.9

Are Gross Margin Levels Sustainable?

In the past, the company repeatedly guided to “low to mid teens” GMs, which is a worrisome thought, given current GM levels of ~19%. So are recent GM levels sustainable? I believe so…

On the company’s current book of business, revenue is generally locked in for 3-5 years on the customer side, and vendors (whose pricing will generally not go up in a material way) are plugged in to service those contracts. In fact, on Quest’s current book of business, if anything, margins will likely go up over time as Quest finds savings in the vendor network.

New business, however, could be brought in at lower margins, providing a headwind to GMs. But in this case, we are still achieving growth in GP dollars, which is ultimately what we should care about (and if new business is brought in at lower GMs, the company’s goal will be to work GMs up over time, per above). The company has shifted its guidance, in fact, around gross margins from “low to mid teens” (they stopped issuing this guidance towards the end of 2019) to a focus on “double-digit” growth in GP dollars, which they continue to cite repeatedly on calls.

In terms of factors like inflation and gyrations in commodity prices, as mentioned before, these do not have a material impact on GMs, which is a very nice aspect of the model.10

Historical SG&A and EBITDA Margins

EBITDA margins increased rapidly over the 2016-2021 period, from negative -10% to 38% (of GP). Margins have plateaued a bit since 2021, hovering in the 37-39% range over the last few years.

Operating leverage is thus not a new phenomenon for Quest, and in fact, they’ve demonstrated a considerable amount of it. From the analysis below, you can see that they’ve actually converted ~47% of incremental gross profit generated since 2018 into EBITDA.

This is in line with the guidance management has provided on calls for many years, of converting roughly 50% of incremental gross profit to EBITDA.

Opportunity for Further Margin Expansion

While it would seem like this level of operating leverage would form some sort of upper limit, I actually believe the company is likely on the cusp of a further uplift to operating leverage.

This is a result of recent investments Quest has made in its technology platform. These investments have been in the making for a couple years11, but are just now rolling out and beginning to impact operations. They include:

Procurement tool. This tool allows Quest staff to look across its entire vendor footprint for qualification and pricing data. This tool will reduce the time needed to find optimal vendor configuration (e.g. for quoting new business) “from days to minutes,” in addition to providing increased accuracy in quoting.

Vendor onboarding. Launched a self-service vendor portal, which “automates” vendor onboarding and enhances data accuracy.

“Zero-touch” invoicing. This, I believe, will be by far the most important enhancement to roll-out. Essentially Quest is in the process of automating the vendor invoicing process, which was formerly highly manual. Bills from vendors will be “scraped”, “digitized”/added to the system, matched against the PO while errors like over-charging (if any) will be detected (and singled out for manual processing, if necessary), and payments will be made — all “automatically.” This sort of automation was not available in the recent past, but given the rise of RPA-like solutions, it is today (and we’ve seen tech like it among Quest’s broker peers). Company management has stated that these enhancements should have a “profound” impact on the business. And if we look at the company’s employee base, there is a huge skew to simple administrative personnel (as of Dec-23, out of 195 total FTEs, 108 were “administrative and customer services” employees, 74 were “accounting and finance” employees, and only 13 were “sales and marketing” employees).

From the Jun-24 IDEAS Conference, describing the “zero-touch” initiative:

The other is internal, which is less sexy sounding, but it’s all about driving zero-touch cost efficiencies. The SG&A to do that is where the vast majorities of our costs are. So the better we’re able to do that, the better we’re able to drive EBITDA margins. And we’re able to create more and more leverage with scale.

…our platform is scalable, and we have strong excitement about that. As we’ve improved our technology internally, our ability to automate functions and achieve higher levels of zero-touch on invoices, that’s where our G&A is primarily spent. And that’s what drives our EBITDA margins. In the past, unfortunately, as we’ve added business, in my opinion we’ve chased it with costs. We haven’t created that leverage that we’ve needed to in years past. Now we’ve started to do it and it’s an exciting thing.

…We handle a lot of invoices, and as Ray said, we’ve tended to throw bodies at those rather than process and discipline. We’ve spent a lot of time over the last year, one, investing in automation and some AI enhancements that allow us to do the zero touch, but also it’s on the process side as well, because the systems are only as good as the data there. So we’ve done a lot of work on cleaning up the data. So what we’re doing is building a platform that allows us to take the invoices, and more importantly, we talk about invoices but, that invoice may have 100, 200 lines of services on it. Our system is built to capture that line level detail, because, one, it drives the data as well. But that’s a lot of touches when you’re going through an invoice and pulling out that line-level detail. So our system will ingest the invoices, digitize them and then build a process to automate the matching of that against the PO, allow the payment to go through, all zero-touch. And then there’s some stuff on the SO side as well. So where we’re at right now, we brought our first vendor live in Q1. Our first run through the system we only achieved about 25% zero-touch. Today, we’re at 80% zero-touch with that vendor. And that’s through about 4-5 months [of working with them]. And every time we bring a new vendor on, we’re a little better the first time they get on. So right now, we’ve got about half of our invoice volume running through the system, and by end of Q3, early Q4, we should have the majority of our volume running through the system. Very excited about, not only on the efficiency side, and the flow-through, but it just creates so much more discipline, better data on the back-end as well.

Per above, Quest likely saw <10% of the total expected benefit from the zero-touch initiative in its latest quarter of Q1‘24. From the sound of it, by Q1‘25 Quest might be seeing something like 75%+ of the benefit. Whatever the case may be, it seems likely this will provide a substantial uplift to operating leverage over the next 1-2 years.

A not-so-trivial additional benefit to this platform will be how this could position Quest on M&A. The closer Quest gets to fully automating its operational processes, the more it would seem they could strip out of a target’s G&A post acquisition (if that target lacked much automation). This would allow Quest to reduce its multiple paid in a very meaningful way post integration.

Valuation

Multiples

Off of 2023 figures (adjusted for the RWS integration impact), Quest trades for ~14-15x EBITDA. Off of Q1’24 annualized figures, it trades for ~13x. And as discussed above, if we give them credit for “locked-in” named wins + upsell, it trades for ~10-11x estimated “run rate” end-of-year 2024 figures.

Comps Analysis

There are no true public comps for Quest (I’m excluding Rubicon, which is a highly flawed business). In the absence of true comps, the waste majors and the 3PLs seem like instructive public peers to examine.

The solid waste majors trade at around a 16x forward EBITDA multiple. Of course the waste majors spend a great deal on capex, which Quest does not. Examining 2023 EV/EBITDA less Capex, the majors trade for an astronomical ~32x. While these are clearly very stable businesses that benefit from certain impenetrable moats and way more scale than Quest, their ROE profiles are not necessarily world-beating, and their organic growth profiles are perhaps just a touch higher the GDP type growth. Quest benefits from a similar type of stability, but much higher ROEs and much stronger growth prospects. While Quest’s “moat” is not on par with the majors at this point, I think it’s still formidable. It seems to me the solid waste majors are benefitting from a huge premium due to their stability and trade at “unnatural” levels as a result. So it’s unclear how much we can learn from how they trade. You can see from the chart below, the waste majors’ forward EBITDA multiple has almost doubled since ~2012.

The 3PLs are a nice business & financial model comp for Quest. They are brokers of a different sort — for the cargo space, connecting shippers with cargo carriers. They benefit from a flywheel to scale similar to that of Quest’s — the bigger a book of shipping business a 3PL represents, the more attractive they are for truckers looking to fill capacity. The 3PLs generate very strong ROEs, and have very similar margin profiles to Quest (median GM of 14%, median EBITDA margin of 6%). Growth has slowed more recently for this group, but they were double-digit organic growers for many years. The group trades at around a 17x forward multiple today, and over the past 20 years have traded in the ~12-15x range.

Waste Majors — EV/NTM EBITDA over time

3PLs — EV/NTM EBITDA over time

M&A Comps

Based on precedent M&A comps, a range for a business like Quest would seem to be in the ~12-15x range.

I believe Waste Harmonics sold in the mid-teens range in Dec-19 (doing ~100 revenue / ~10m EBITDA at the time).

I believe Waste Harmonics sold again in the ~14-15x range in Jun-23 (EBITDA was multiple times larger at this point)

RWS/Instream sold in the ~12-13x range pre-synergy in Dec-21, per Quest disclosures

I believe New Market Waste sold to Waste Harmonics in the ~10-13x range in Jan-23. New Market Waste was about a quarter the size of Quest at the time, I believe.

Simple Model & Returns

So what kind of returns should we expect from here?

In putting together a simple forward model, I assume for a “base case” the following:

Growth peaks at 16% in 2025, before tapering down to 10% in 2029 (implies around ~$55m of incremental revenue is added per year)

50% of incremental GP converts to EBITDA

12.5x exit multiple

Growth of 16% assumes essentially the midpoint of the “locked-in” growth analysis, giving them no credit for additional wins in 2024, in theory. In terms of operating leverage, we assume a 50% level (of incremental GP converting to EBITDA) which is in line with historical results. This, in theory, gives them no credit for any impact from their technology investments. A 12.5x exit multiple seems on the conservative side for a business like Quest’s.

The resulting EBITDA growth profile of a mid-teens CAGR through 2029, combined with the business’ strong cash generation, produces a 3.5x+ MOI and a ~30% IRR over 5 years.

From this “base” level, I believe there is certainly upside potential. I don’t think it’s a stretch that organic growth could peak somewhere higher than 16%. Nor do I think it a stretch if we assume operating leverage comes in well above 50% for some reasonably sustained period, or that Quest might trade for more of a teen-ish multiple.

To see what an “upside” case could look like, I assume the following:

Growth peaks at 18% in 2025, before tapering down to 12% in 2029 (implies around ~$65m of incremental revenue is added per year)

60% of incremental GP converts to EBITDA

14x exit multiple

This results in a ~5x MOI and a 35%+ IRR over 5 years.

Note this “upside” case assumes no acquisitions, and I would expect the company to execute on more than one over the next 5 years — and to pay at least reasonably attractive prices — which adds further upside.

In a “downside” scenario of only ~10% growth, ~40% operating leverage, and an 11x multiple at exit, Quest still produces a 2x+ and a ~18% IRR over 5 years.

What Might the Market be Missing?

Quest’s shares are trading in the ~$8-9 range, up ~2x over the past 5 years. Over the past 3 years, the stock has traded in a band between $4 and $10, but has generally trended from the ~$6 level to the ~$8.50 level.

Today Quest trades for ~15x “reported” LTM EBITDA — not exactly a cheap multiple at face value, and it could certainly be the case that Quest is, in fact, properly or even overvalued. Nonetheless, below are some factors that may be leading to its “under-valuation:”

Micro cap. Quest is a sub $200m market cap business with limited analyst coverage (Roth, Craig-Hallum, HC Wainwright)

Not a well-known or easily understood niche. It’s a unique company/model within the environmental services sector, without any scaled public comps other than Rubicon, which has melted down since a 2022 SPAC

Doesn’t screen particularly well:

Appears to be a very low margin business. It’s a gross/net revenue type of business, and on a gross revenue basis, margins are not attractive at around a ~6% EBITDA margin. On a “net” revenue basis, however, margins are a highly attractive 35%+.

ROE appears to be <10% based on reported figures, but this misleading. ROE, correctly calculated, is 50%+ (and climbing quickly). There is a legacy goodwill balance that resulted from Quest’s transition to a public company, which muddies the SE line. To assess Quest’s true ROE, this balance should be “backed out” of SE.12

Growth has been inconsistent. Revenue was cut in half over 2016-2020, then 3x’d over 2 yrs from 2020-2022 (but this period was clouded by M&A), then did not show any growth in 2023.

Leverage appears meaningful. Quest is showing a ~4.1x gross leverage ratio on LTM “reported” EBITDA. However, I believe the company is on the verge of pushing leverage below 3x on a run rate basis exiting 2024

Valuation doesn’t scream bargain, per above

Confusing RWS adjustments & impact on margins. EBITDA has been weighed down over 2022-2023 by $2-3m annually due to complications arising from the RWS acquisition integration. While the company detailed these issues on calls, they did not adjust for them formally in their financial disclosures. These issues were resolved in the Q4’23/Q1’24 timeframe, and should no longer be a drag on performance.

Management Assessment & Ownership

Management Assessment

Ray Hatch took over as CEO in 2016. Prior to Quest, he was an EVP/SVP for 6 years at Oakleaf, the original 800-lb gorilla in the broker space, which sold to WM in 2011. Ray has spent a total of ~25 years in and around the space (including many years in food distribution) in mostly sales and operations roles.

Since taking over, it’s hard to argue much with the track record:

Got out of low margin/unattractive accounts. From 2016-2020, Quest reduced its revenue by 46% (from $183m to $99m). Over that period, gross profit increased by 32% (from $14.4m to $19.0m) and EBITDA grew from -$1.5m to $4.5m. This transition was carried out with little cash & margin for error. Today, Quest operates with much higher margins than public peer Rubicon (margins in the ~7% range), and I believe higher margins than virtually all of its broker peers, including Keter.

Unlocked organic growth. Quest began targeting the right customers. The company focused on prospects with complex & regulated waste profiles. They brought in higher quality sales leadership and accelerated spend on S&M once it was clear their value proposition was resonating with customers. In just YTD 2024, the company has won more large new logos than it did in the prior 2.5 years combined.

Diversified into different industry sectors. Historically Quest had been focused almost entirely on big box retailers & automotive services. Today, Quest has significant presence in retail, automotive services, industrial/manufacturing, food service & distribution, and multi-family residential.

Intelligent M&A strategy. Quest has made 6 acquisitions since 2020 at seemingly highly attractive multiples (acquiring a combined ~$10.3m of post-synergy EBITDA for a total of $68.1m, or a 6.6x multiple). Furthermore, these acquisitions were almost entirely funded by debt. Not only has M&A driven attractive financial returns for Quest, but it has considerably improved the business: (1) adding greater scale/buying power, (2) reducing customer concentration dramatically, (3) establishing a stronger vendor base in certain key waste verticals, (4) establishing new “product lines” (e.g. scrap metals, pallet recycling) that could be resold across its customer base, and (5) providing entry into key new verticals (such as multi-family residential through Green Remedies).

Focused on customer service & success. I believe the management team has placed a clear emphasis on customer satisfaction, which has paid off in the form of very high retention and a strong referenceable base on clients.

Ray seems to “get” what good long-term stewardship looks like. From Q1’21 earnings:

During the downturn, we worked with our customers prioritizing their service needs, helping them to adjust to react to sudden changes in demand. It is straightforward, treat your customers right and they will remember and reward you. For example, during the downturn, many customers were generating lower volumes of waste or were forced to close locations. We found ways to flex their service levels so they were not paying for services they didn’t need. In other cases, where customers had increased volumes, we were able to help them manage their customer levels more efficiently and stay within budget constraints. We did the right thing during the downturn, and as a result, created stronger customer relationships. In turn, these customers are rewarding us with more business.

He also strikes me as a straight-shooter, does not tend to over-promise, and is willing to address faults/areas for improvement.1314

In 2019, he guided to a 4-6% EBITDA margin goal over the following 3-5 years.15 Quest’s EBITDA margin has been 6%+ since 2021.

He repeatedly guided to a gross margin of “low to mid teens”.16 He stopped doing so in 2019. Gross margins have been 17%+ since 2019.

He has repeatedly stated that in the ballpark of 50% of incremental GP should convert to EBITDA. Since 2018, 47% of incremental GP has converted to EBITDA. While performance has been essentially on-target, he has mentioned disappointment in not being able to convert more.

Acquisition Track Record

In the beginning of 2020, Quest established a dedicated M&A effort, hiring a resource to lead corporate development. Since then, they’ve made 6 acquisitions representing ~68mm of EV. These deals were done at a 6.6x weighted avg EBITDA pro forma multiple, an attractive use of capital (particularly in light of having financed most of it with leverage).

Management has been focused on “slam-dunk” opportunities, seeking both an attractive financial return as well as a strong strategic fit.

From Q1’22 earnings:

To illustrate these benefits, I'm going to give you a few examples of a fully developed service program that RWS and InStream [ have ] built. We believe these programs will be highly leverageable in terms of expanding our service offering with our existing clients. They also give us greater purchasing power for vendors, increased value from waste streams and enhanced value proposition for potential clients.

My first example is with recycling pallets. RWS has built an impressive offering with a large network of vendors to refurbish our recycled pallets. We're introducing the service to existing clients across our end markets. There's a lot of interest, and we've already added pallet service to an existing Quest client, which when fully integrated, should add $1 million in incremental annual revenue.

Moving on to another example. InStream has built a significant focus around metal recycling for both ferrous and nonferrous metals. By adding InStream, we've expanded the variety of waste streams that we can recycle. And we've expanded the number of metal recycling vendors by 10x. The greater scale from incremental volumes and larger vendor base gives us opportunities for reduced costs.

Another good example is cardboard. RWS already had a sufficient volume to create direct relationships with paper mills who are the end user of this commodity. With their added volumes and direct relationships, we can garner higher value for the cardboard that we recycle. We've also added several plastic recycling vendors to our network through RWS. A lot of the recyclers are complaining because they can't get enough plastic. RWS has a good network that we're tapping into to recycle, increased volumes of plastics have better economics.

I will also add that there is strategic value from those acquisitions and attracting new clients. With greater scale and expertise from RWS and InStream, we've enhanced our ability to respond to opportunities that were previously not a good fit for our capabilities.

All of Quest’s acquisitions, according to management, have met expectations. The RWS integration was mishandled to a degree, but the business itself seems to be performing (the churned customer notwithstanding) and I believe if given the option, they’d acquire the business again.

Ownership

The largest owner is Dan Friedberg of Hampstead Park, who is Chairman. Ray is a ~5% owner. Combined, insiders own ~25% of the business. Ray’s stake, at about ~$9mm at today’s prices, is certainly a meaningful number.

Market Overview

Total Addressable Market

Though Quest has long since stopped providing TAM figures, this analysis below is taken from a 2019 Quest investor presentation.

The analysis would suggest that based on current figures, Quest would be about 8% penetrated into its core market (which is $3.3bn in size, according to the analysis). If you added in Rubicon ($700m; granted this business may be coming back to market), Keter (similar size to Rubicon), and everyone else (say $1bn), that gets you into the range of $2.5-3bn. This would suggest that brokers are very heavily penetrated into their core TAM.

When asked about this analysis recently, Quest management stated that they believed their TAM was, in fact, much higher than the $3.3bn figure presented in 2019. For one, this analysis excludes mid-market customers, where we’ve seen other brokers have very material success. For example, within an industry like industrial, many more than just the top 50-100 waste producers are prospects for a group like Quest (the analysis above only counts the top 50-100). Management would tell you that the industrial vertical alone represents well over $1bn in TAM. Additionally, across virtually all verticals (for example logistics, which is not included in this analysis), any very large waste producer is also a prime prospect. Thus, the analysis above has excluded a very meaningful number of addressable end markets.

I would estimate Quest’s total TAM is in the vicinity of $6-10bn, and that brokers are therefore more in the range of ~30-50% penetrated. If we exclude Rubicon, brokers could be as low as ~20% penetrated.

Competitive Landscape

Keter Environmental Services (backed by TPG Growth)

Top player in the space by EBITDA; I estimate roughly 3x Quest’s size

Acquired Waste Harmonics in Jun-23, a broker that was significantly larger than Keter, for a mid-teens multiple

Historically focused on malls, was largest provider to REIT industry; focused on growing presence in food processing, restaurants, manufacturing/industrials

Strong reputation in market, though some might characterize as “tech-enabled” solid waste mgmt. (i.e. not as strong on diversion/specialty waste streams, mostly a focus on traditional trash & basic recycling; developed an in-house bin sensor technology)

GMs likely below Quest due to greater solid waste focus

Waste Harmonics claimed 99% client retention & a 25% “compound growth rate” in a Nov-20 Authority Mag interview

Waste Harmonics acquired New Market in Jan-23 (a large 2nd tier player, ~$70mm rev, 20% CAGR from 2018-2020) for ~10x

Founded in 2011; TPG Growth acquired in Nov-21

Northstar Recycling (backed by Ridgemont Equity Partners)

I estimate a similar size to Quest

Focus on light manufacturing, distribution, warehousing

Customer include: GoodYear, Folgers, United Technologies, TempurPedic, Land O’Lakes, Kraft Heinz, Smucker’s, Ashley Furniture, US Foods

Founded 2011; Ridgemont made investment in Oct-21

Recycle Track Systems

Similar focus as Quest: restaurants, retail, grocery, auto repair; also stadiums/campuses, office buildings

In-house bin sensor technology (Pello)

Citigroup’s Impact Fund led a $35mm Series C funding in Jun-21

Other competitors:

Rubicon (public: RBTC)

~$700m in rev in ‘23

M.O. was going after low margin (though very large) customers (WalMart, Amazon, Starbucks of world); poor gross margin profile (~7% range)

Invested heavily in an uber-esque technology platform for haulers that has struggled generating traction

Roadrunner (backed by General Atlantic)

More of an SMB, multi-family focus

Technology focus: smart routes/on-demand collection; monitoring of bin levels using sensors/AI (own their own tech through acquisition of Compology)

Founded in 2014; Raised $70mm in Series D funding from General Atlantic in Jan-22

M&A Opportunity

Quest closed six acquisitions in a ~1.5 year span between Oct-20 and Feb-22. For the last 2.5 years, however, Quest hasn’t made an acquisition.

While it has been a dry spell, and the number of sizable targets has dwindled given continued consolidation in the space, there should be opportunity for M&A going forward. In fact, with the number of top groups consolidating (Rubicon was an active acquirer, now likely out of the picture; Waste Harmonics was as well, now combined with Keter), and with the roll-up opportunity less ripe for PE, I think conditions for M&A have improved slightly of late. In any given process, Quest will be up against the likes of Keter, RTS and Northstar. Northstar itself, though, will likely be up for sale at some point in the not too distant future (Ridgemont Equity acquired in Oct-21, ~3 years ago).

As mentioned above, I also believe Quest should be in a strong position to extract synergies in an acquisition due to the increasingly automated nature of its operations. This will position them better than ever to compete on acquisitions, especially relative to a standalone PE buyer.

Recycle Track Systems CEO Greg Lettieri told WasteDive in Jan-22 he estimated that there were ~250 active waste brokers in the US. I think the number of viable targets (i.e. targets Quest would actually want to own) is likely in the 30-50 range, which still presents opportunity over time. Ray has said on calls that there are more targets than Quest could ever work through near-term and that the team continues to find sizable groups that had formerly been completely unknown to them.

Key Risks

New Logo Growth Stalls

Sustained new logo generation would be a relatively new development for Quest; they have never quite strung wins together consistently in the past.

Furthermore, in order to achieve teens-level growth, because of Quest’s much larger scale today, the business will need to add in the ballpark of ~$55mm in new annual revenue. That’s not a level they’ve hit in the past. In 2021-2023 Quest added around ~$38m, ~$44m, and ~$4m of organic sales, respectively. That’s a 3-year average of ~$30m, about half the bogey needed.

New organic revenue should easily eclipse that number over the NTM, and be in the $50m range. But can Quest sustain those levels?

Below are reasons for optimism:

Quest’s pipeline seems to be in a very healthy place, better than one year ago (before they proceeded to put up record new sales numbers), if you believe management

Quest has never been better positioned to secure new logos: (1) the business has a more complete solution & more pricing power than it ever has, (2) it has grown its referenceable base of clients substantially, while securing initial toeholds in many new, attractive end markets (two in just the last two quarters17), (3) the broker value proposition continues to strengthen due to helpful secular tailwinds (sustainability/regulatory pressures + increasing recycling options/investment + increasing cost competitiveness of recycling with landfill)

Quest has more and better sales resources than ever

Quest’s scale increases its potential upsell dollars in absolute terms. For example, if they can maintain a 105% net retention, they’d be adding ~$15m of new sales from existing customers alone. At 110%, Quest would be adding in the range of $30m.

I’m optimistic that Quest can at least match its trailing 4-year average new sales (if we include 2024, this would be in the $35m range). Doing this would produce a ~10% revenue CAGR, which still results in satisfactory returns. I think more likely, Quest achieves somewhat higher levels of growth that are more in line with my base case figures.

Operating Leverage Fails to Materialize (or is Competed Away)

Given the track record of operating leverage, and that Quest seems to be on the cusp of a material boost in this area, I don’t see this as a major near-term risk. Though it is worth monitoring, and it may be possible that gains arising from these technology enhancements are competed away. Nothing seems to necessarily prevent the other large brokers from benefitting from similar types of investment. In such a scenario, however, the cost savings would pass on to end customers, which would make the brokers relatively more attractive in the marketplace, and could lead to more volume.

Competition

I don’t see the competitive landscape changing dramatically.

I believe the threat of new entrants is low. A key to being a credible broker is the buying power that results from representing a large book of business. Breadth of waste streams served is also important. A new broker will find it very challenging to achieve these things, and in turn, not many new successful brokers have emerged of late. Those who have grown the quickest (e.g. Keter, Quest) have done so through M&A. And an aggressive roll-up strategy would be very difficult to achieve at this point given the number of quality targets that have been taken out.

According to Quest management, they do not come up against many of their broker peers in competitive situations. However, it does seem that many sales processes are decided by RFP, and that Quest is competing for, in many cases, high-profile Fortune 100 type businesses that should be highly sought after. Thus, I would expect that Quest does run into broker peers fairly often, but I would not characterize the level of competition as “fierce.”

Another clear threat are the traditional waste majors, who are viable alternatives. The majors offer “National Accounts” programs, which are in effect an internal “broker” offering. Oakleaf, the first very large broker in the space ($500m+ of revenue, I believe), actually formed WM’s national accounts division after its acquisition by WM in 2011. Majors, however, struggle with (1) reporting, (2) creating bespoke solutions for complex waste situations that requires significant landfill diversion (WM & Republic recycle <20% of materials handled) and third-party vendor coordination, (3) customer service, and (4) competition on price in geographies where they have a weak presence.

Customer Concentration

Two customers represented 29% of revenue in 2023, up from 24% in 2022 (but down from 38% in 2021). While this is not a dealbreaker for me, it does ratchet up the discomfort. I believe this percentage should fall over time, however, and could be pushed closer to 20% in a couple years if new logo growth pans out.

Leverage

Quest’s leverage profile is not insignificant, yet it does not worry me. The business currently carries ~$72m of debt that generated interest expense of $7.8m in ‘23 (before non-cash interest such as amortization of debt discount, etc.). Quest’s resulting leverage ratio (debt/EBITDA) is ~3.5x and its interest “coverage” ratio (EBITDA/interest expense) is ~2.6x.

I believe the leverage ratio is trending towards <3x over the next 12 months. Further, the business is highly recurring, provides a mission-critical service, has almost no capex needs, and experiences virtually no cyclicality.

I believe Quest will refinance its term loan around the end of the year which will reduce their interest rate/expense substantially. A ~300 bps spread seems doable for their type of credit profile, which would equate to a blended interest rate of ~8-8.5% at today’s SOFR and total interest expense of closer to $6m vs. $8m today. This will increase their interest “coverage” ratio from ~2.6x to ~3.5x, providing more breathing room.

Today, Quest pays a whopping ~12% interest on its term loan (SOFR + 5.5-7.5%), the result of putting it in place during COVID times (Oct-20) and when Quest was about a quarter of its current size (and had meaningfully higher customer concentration).

Reliance on Majors for Hauling

Quest has network of 3,500 haulers and minimal reliance on WMs and Republics of the world. In a “franchised” market, Quest may have no choice but to use a major (however the major would be required to provide services for Quest in such a situation). But in the absence of a franchised market, and especially outside of solid waste, Quest uses the majors very infrequently (my understanding is well less than 10% of the time) and in fact makes it a point to actively avoid them. Though the majors have been consolidating the market slowly over time, this risk does not seem to be a major one.18

Consolidation of the Vendor Network

Certain pockets of waste in particular (e.g. Liberty Tire in tire recycling; Safety-Kleen/ Clean Harbors in used oil recycling) have become highly consolidated over the years. In theory, this should limit Quest’s ability to extract concessions (and compress GMs), but management would tell you that’s not necessarily the case. Even in a market like tire recycling, which is dominated by Liberty Tire, Quest does not necessarily earn a lower GM. Liberty Tire, for example, is supposedly poor at reporting and customer service, which provides Quest an opening to layer in a value-added offering.

Historical Summary Financials

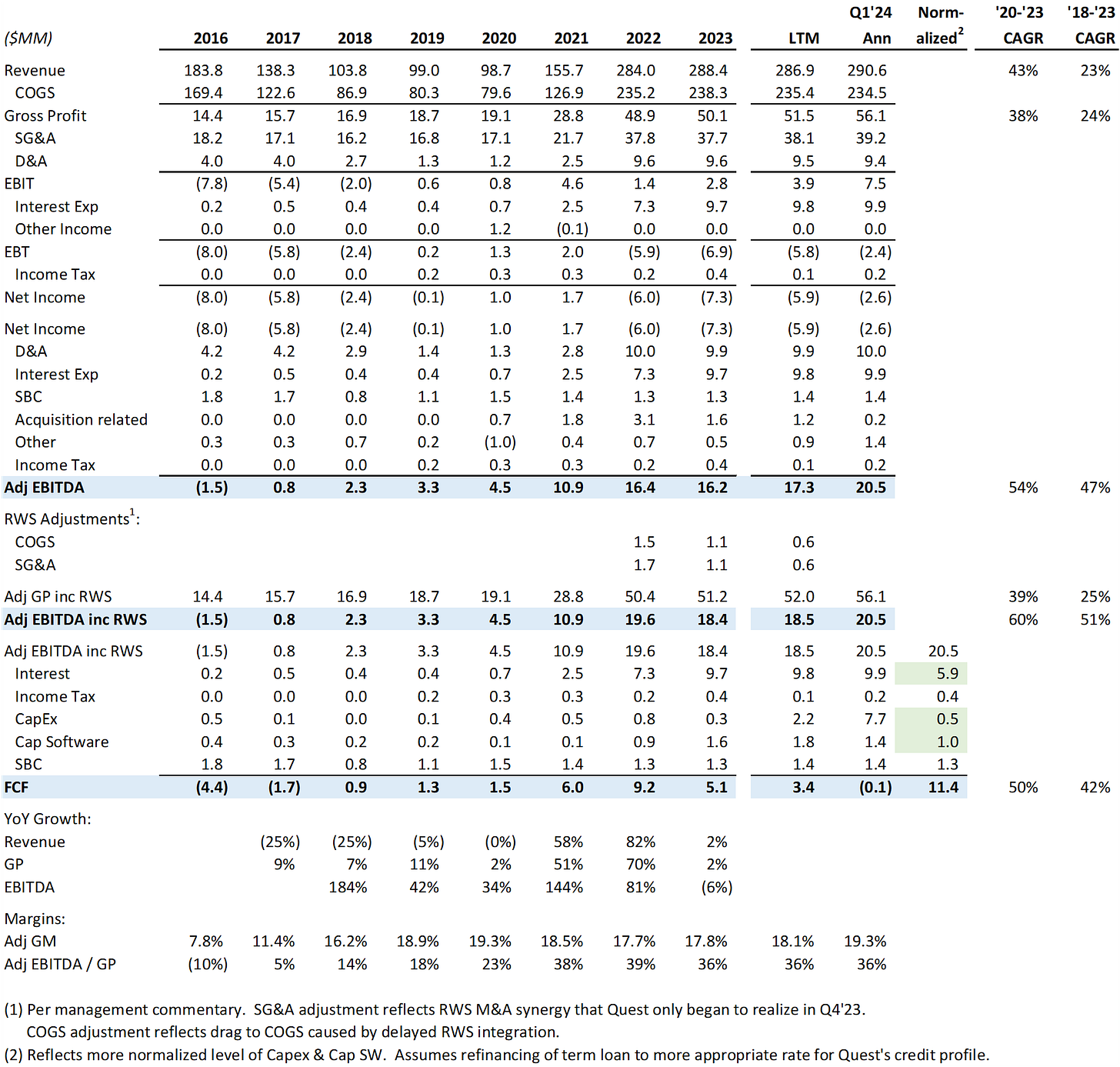

Below is a snapshot of Quest’s summary financials since 2016.

The “adj EBITDA” figures are the company’s own “reported” adjusted EBITDA. These figures do not account for the impact of the RWS integration, however, that has weighed on results since 2022. I make further adjustments to incorporate the RWS impact (using management estimates provided on calls). These adjustments do not give me much heartburn, as I believe they were real factors that weighed on results and will not be going forward.

The other major set of adjustments I make is in the “Normalized” column, which I believe reflects a more normalized cash flow profile for the business once its debt is refinanced (and excluding non-cash interest expense), and with more normalized levels of capex and capitalized software. Capex has been elevated recently due to opportunistic compactor purchases to support certain new logo(s), which, while a good use of capital, are not expected to be a major part of the go-forward strategy. Capitalized software has been elevated recently related to Quest’s technology investments discussed earlier, and are expected to taper off per management commentary.

Corporate Timeline

2007: Quest founded. Launched “Supertruck” tire recycling service in partnership with Walmart, shredding tires in route to collection point / processing facility (ensuring scrap tires could not be returned or re-used)

2008: Launched national program to recycle used motor oil and oil filters for one of largest US retailers

2009: Launched animal feed donation program, connecting retailers with excess meat & seafood with animal rescue shelters; launched used cooking oil recycling solution

2010: Launched first nationwide retail food waste recovery program, recycling food waste as compost, animal feed additives and a source of energy

2011: Launched closed-loop re-refined motor oil solution for AT&T’s global fleet operations as part of comprehensive waste service solution for the company

2012: Launched a sustainable facilities practice, including energy modeling and water minimization solutions

2013: Added municipal solid waste management service; IPOs and begins trading publicly

2016: Ray Hatch and Dave Sweitzer join as CEO and COO, respectively; Quest begins sunsetting unprofitable accounts; business assessment led to focus on delivering complex, differentiated services to select, high-value customers in strategic verticals

2016: Launched offering to help construction sites minimize waste footprint

2018: Launched comprehensive recycling solution & vent hood cleaning for restaurants

Apr-19: Revamped ownership base through secondary offerings of 4.3mm shares at $1.50 and 1.8mm shares at $2.00 (to Hampstead Park Capital). Prior Chairman Mitchell Saltz and board member Jeffrey Forte stepped down from board. Dan Friedberg (Managing Partner of Hampstead Park) joins as Chairman, Stephen Nolan joins board (designee of Hampstead Park)

Nov-19: Appointed Mathew Lewis as SVP of Sales

Aug-20: Sold 2.95mm shares at an offering price of $1.15, raising $3.4mm to help fund Green Remedies acquisition

Oct-20: Acquired Green Remedies Waste & Recycling, a provider of environmental services with a focus on multi-family housing in the southeastern US

2021: Launched Proganics, a process that delivers significant diversion levels of organic waste away from landfills. Proganics provides a single collection process for multiple waste streams, including floral, cardboard, unpackaged food as well as packaged food, along with the packaging. Organic materials are 100% diverted from landfill recycled and repurposed to create compose, biofuel or animal feed

Jun-21 – Feb-22: Made 5 additional acquisitions

Jul-23: Hired Perry Moss as SVP of Sales

Apr-24: Added United Natural Foods, an 8-figure customer and its first in the food distribution vertical

Annotated PV Chart

In Conclusion

While Quest’s PPS has risen steadily over the past 5 years, it has also “de-risked” in meaningful ways, and the stock may be better positioned than ever from a risk-reward standpoint. The biggest question mark that remained for me was how strongly they could grow organically. Its recent string of new logo wins + continued strength in the pipeline has eased these fears.

I believe shares at this level provide good prospects for attractive returns — both near-term on account of inflecting operating leverage + organic growth, and longer-term due to attractive secular tailwinds + a flywheel driven by scale (that results in an increasingly stronger offering and competitive position).

Important Disclaimer

This presentation is intended for informational purposes only and you, the reader, should not make any financial, investment, or trading decisions based upon the author's commentary.

Although the information set forth above has been obtained or derived from sources believed to be reliable, the author does not make any representation or warranty, express or implied, as to the information's accuracy or completeness, nor does the author recommend that the above information serve as the basis of any investment decision.

Before investing in a security, readers should carefully consider their financial positions and risk tolerances to determine if such a stock selection is appropriate. At any time, the author may trade in or out of any securities that are mentioned in the report as long or short positions in his portfolio without disclosing this information.

This report’s estimated fundamental value only represents a best efforts estimate of the potential fundamental valuation of a specific security, and is not expressed as, or implied as, assessments of the quality of a security or an actionable investment strategy for an investor.

“Q: We’ve talked in the past that as you get bigger, you’re giving some of your third-party partners more business and scale, and so I would assume you have some of the best pricing out there as well?

Ray Hatch: Yeah I would assume that as well, I really hope so and we believe that. Part of our model with our sub-contractors is utilizing excess capacity, that always existing to a certain degree. So, when we bring a book of business, is how we term it – a national account that we’re working on or just picked up. When we bring a book of business to a marketplace, there are several players that we could utilize in most cases. Some people are going to want it more than others. If they’re driving by these locations that we’re talking about with this national account. And they can stop in there and have little to no incremental costs on the variable side and no cost on the [fixed] side. The term we use for our suppliers is asset utilization and route optimization, is really what we bring to them.” — Mar-22 Roth Conference

“And we've talked about it before. I think we do like 100 -- over 100 waste streams. But out of that 100, there's quite a few of those we have relatively little scale just because there's not a lot of it out there with the clients that we have. So I would say probably 2/3rds of that we could really use more scale and will get more scale as we add strategic customers to fill those out. And I mean, there's some -- without getting specific, but I'm thinking of one waste stream, we thought we were really, really strong, and we were, but then we made -- one of our acquisitions brought us I don't know, another 20 or 25 vendors that we didn't have in that space that all of a sudden, with the same commodity or recycled material we had infinitely larger leverage and geographic coverage. So I don't know, it's a tough question to answer, but I'd probably say at least 2/3rds of the waste streams that we have today, we've got significant opportunities to expand scale within those.” — q2’23 earnings

"For the year, we estimate that approximately 2/3 of the increase in gross profit dollars came from acquisitions and the remaining 1/3 from organic growth. Of the organic growth for the year, the bulk was also driven by new customer growth." — q4’22 earnings

GP increased by 70% total in '22. 1/3rd of that would equate to ~23% organic growth for 2022

"During 2021, we also delivered accelerated organic growth. Overall, we grew gross profit dollars by more than 50%. The growth in gross profit and EBITDA was driven by strength across our business, from existing customers through new customers and via acquisitions. Our growth would split 60-40 between organic and acquisitions, with organic being the larger of the 2 drivers. Over the last few years, our strength has been in our client relationships, and we see that as our core strength." — q4’21 earnings

GP increased by 51% total in '21. 60% of that would equate to ~31% organic growth for 2021.

“I want to comment on the growth from existing clients. We have long said there is a great deal of opportunity with our existing client base, and that is still very much the case. We've done a good job over the last several years of adding new business with existing clients, which has been a stable source of growth for our company. However, I believe we're just beginning to scratch the surface of what we can do for our existing clients. During the last several quarters, [due to the capabilities we’ve demonstrated,] several of our largest clients are coming to us and asking us to do more.

They've been -- they have seen the value of our platform and give the corporate level not only greater visibility into their spend at the local level, but also auditable data that allows them to confirm that waste is being handled according to local, regional and national regulations as well as their own corporate level specifications. It's very rewarding that customers are coming to us and asking for solutions, and it shows how well we are regarded.

As a result of this interest, we plan to take a more proactive approach to working directly with our clients. We are creating dedicated project teams to work with our larger clients to identify issues and help them understand how we can help. For example, we have been working with a large customer and uncovered more than 50 potential projects where we can help them improve waste management. There are large and small projects that range from the tens of thousands of dollars to 8 figures. And almost all of these projects have recurring waste management services once the initial projects are completed.” — q1’24 earnings

“We recently made a slight tweak to our compensation structure of our client service managers, offering them a chance to earn incentive pay based on growing the contribution from existing customers. We made this change in the first quarter of '23, and it's been rewarding to see all the excitement level with the entire team. This small investment in incentive compensation will go a long way to increase growth. In addition, we expect these changes to help us retain and attract the best talent and to further align us with our clients' growth goals, diverting more waste from the landfill.” — q4’22 earnings

We know this because for new clients that represent in excess of $1m of spend, the company will highlight these wins on earnings calls. The company, however, only provides color along the lines of “a 7-figure customer” win or “an 8-figure customer” win, thus I need to fill in considerable gaps (i.e. does an 8-figure win mean $10m or $99m?). However, reviewing these wins I think is still a useful exercise, even if these ranges are more “directional” in nature…

“In many cases, gross margin tends to be relatively lower as we bring on new business, which we traditionally grow over time. Margin from new business tends to improve over time as these accounts mature, and we optimize service levels. This is the same process we have successfully utilized to drive margin improvement over the last several years. As we said last quarter, this will likely continue to be a factor with the continued organic growth we anticipate for 2022… We've always been able to expand margins. And actually, in many cases, significantly without a negative to the customer. As a matter of fact, many times a positive to the customer by sharing some of that improved costs. So the answer to your question is, I feel like over time, the team here will do what they've done for years and expand margin in the existing clients. And definitely, I think we can have impact through improved sourcing on the new acquisitions.” — q1’22 earnings call

“In a market that continues to see inflationary pressure and significant fall of commodity values and certain recycled materials, our business model held up well. As Brett mentioned earlier, we structured our agreements so that the gross profit dollars are not affected by swings in commodity prices. But despite the significant decrease in prices for scrap metal and other commodities during the second half of '22, gross profit dollars generated were not significantly affected by those swings. In an inflationary environment, we're able to offset cost pressures [due to] flexible contracts that allow us to pass through increasing cost as fuel surcharges.” — q4’22 earnings

At the end of 2021, Quest hired a SVP of Strategy “to lead our efforts and manage new investments in technology and changes to our process that will further improve operations and scalability.”

As mentioned, I believe the correct way to calculate returns on capital for Quest is to exclude the “initial” goodwill balance of $58.2m that resulted from Quest being acquired by a public entity (the process through which Quest “went public”). As you can see below in the “Normalized” run rate column, I expect ROEs to ramp well north of 100% in the near-term, once Quest’s term loan is refinanced.

“One area that we're not satisfied with is the pace at which we're adding new business. We've achieved considerable success by expanding the relationships with many of our existing customers, and we've added several new customers but just not as many as we would have liked. Our focus on the right customers is working. It's just the speed of adding new business is not where we want it to be. To address this, late in 2019, we made changes in our sales structure and really broadening our focus on new customer acquisition. We now have a leadership in the team with deep domain experience in our targeted end markets.” — q4’19 earnings

“In the past, unfortunately, as we’ve added business, in my opinion we’ve chased it with costs. We haven’t created that leverage that we’ve needed to in years past. Now we’ve started to do it and it’s an exciting thing.” – Jun-24 IDEAS Conference

“So what we have talked about was getting to a 4% to 6% EBITDA percentage in the next three years to four years and we are making great progress towards that. But that is what our guidance was on that that we are looking at accomplishing that over a three-year to five-year time period.” — q3’19 earnings

“Going forward we intend to continue to manage the business to maintain gross margin in our targeted range of low to mid teens, but gross margin can vary considerably from period-to-period.” — q4’18 earnings

“We're also having success adding new end markets, having added 2 in the past couple of quarters. These areas have significant growth potential, and we're well positioned to add additional new clients in these markets, as well as new service lines where there is a crossover of services within our existing client base.” — q1’24 earnings

“One of the beautiful things about this business, it seems to be bottomless as far as the ability to find good quality companies that are looking to partner with someone like us to enhance their earnings. So we haven't seen - those consolidations haven't created issues.” — q4’21 earnings

Great write up! I’ve been a shareholder of QRHC for a bit now and I’m still quite intrigued with their upside. I was wondering what you thought of the most recent earnings?

What are your latest thoughts?