Disclaimer: I am wrong often, please do your own work

Trisura is a ~c$1.5bn market cap North American specialty insurance platform.

The business was founded in 2006 and formerly sat within Brookfield Corp. It spun out in 2017 and has performed impressively since.

Its valuation became stretched for a period (trading as high as ~6x P/B), but after 4 years of treading water, the stock now sits at 1.9x P/B and just ~11x adj P/E (<10x NTM).

Insurers don’t necessarily bring out the animal spirits. Growth is basically capped at some not-spectacular level like the mid-teens. Blow-ups can happen unexpectedly. I myself looked into Trisura a few times in the past only to give up at various points.

But there’s a certain varietal of specialty P&C insurer that produces acceptable ROEs, and does so rather consistently year after year. I believe Trisura fits solidly into this camp.

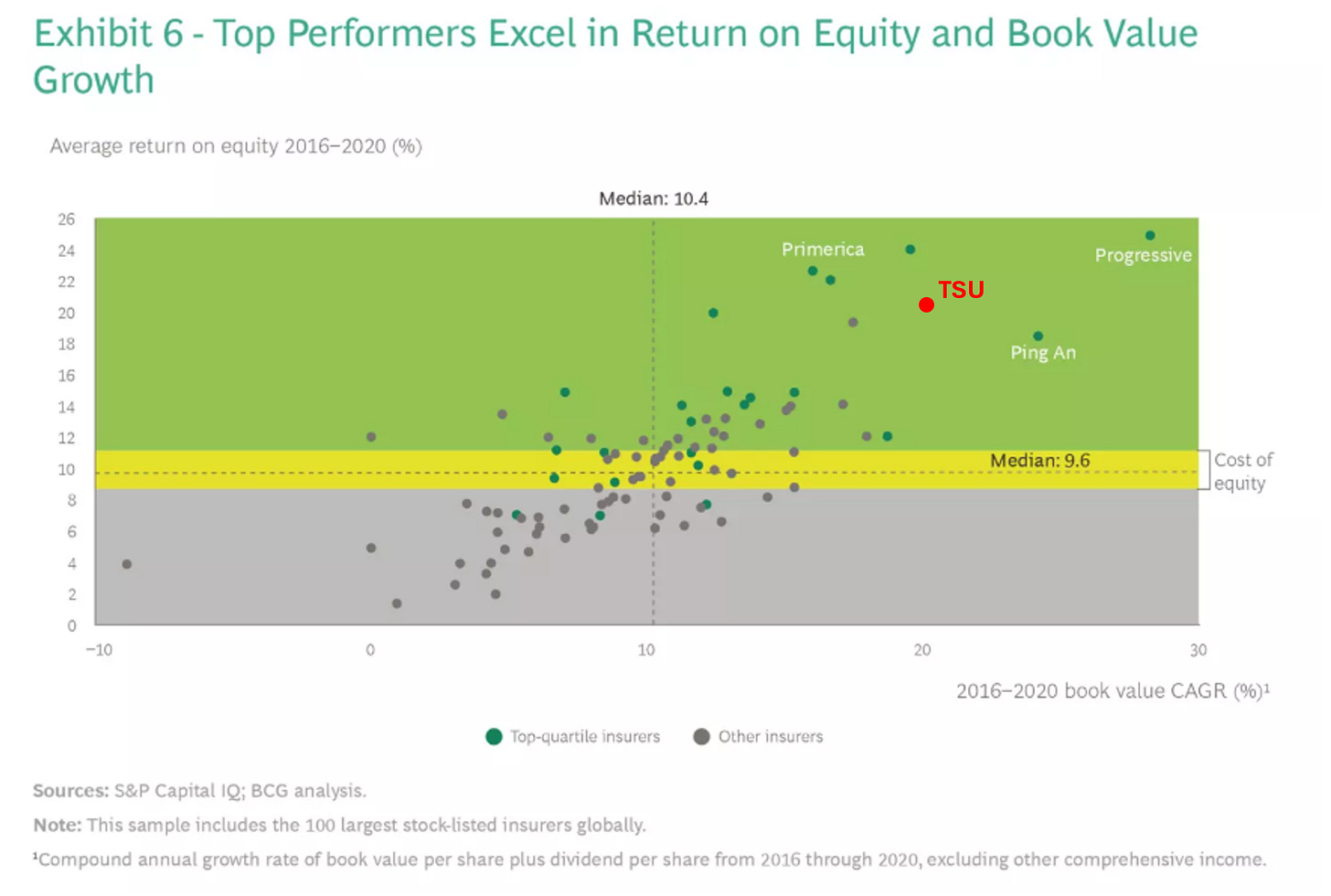

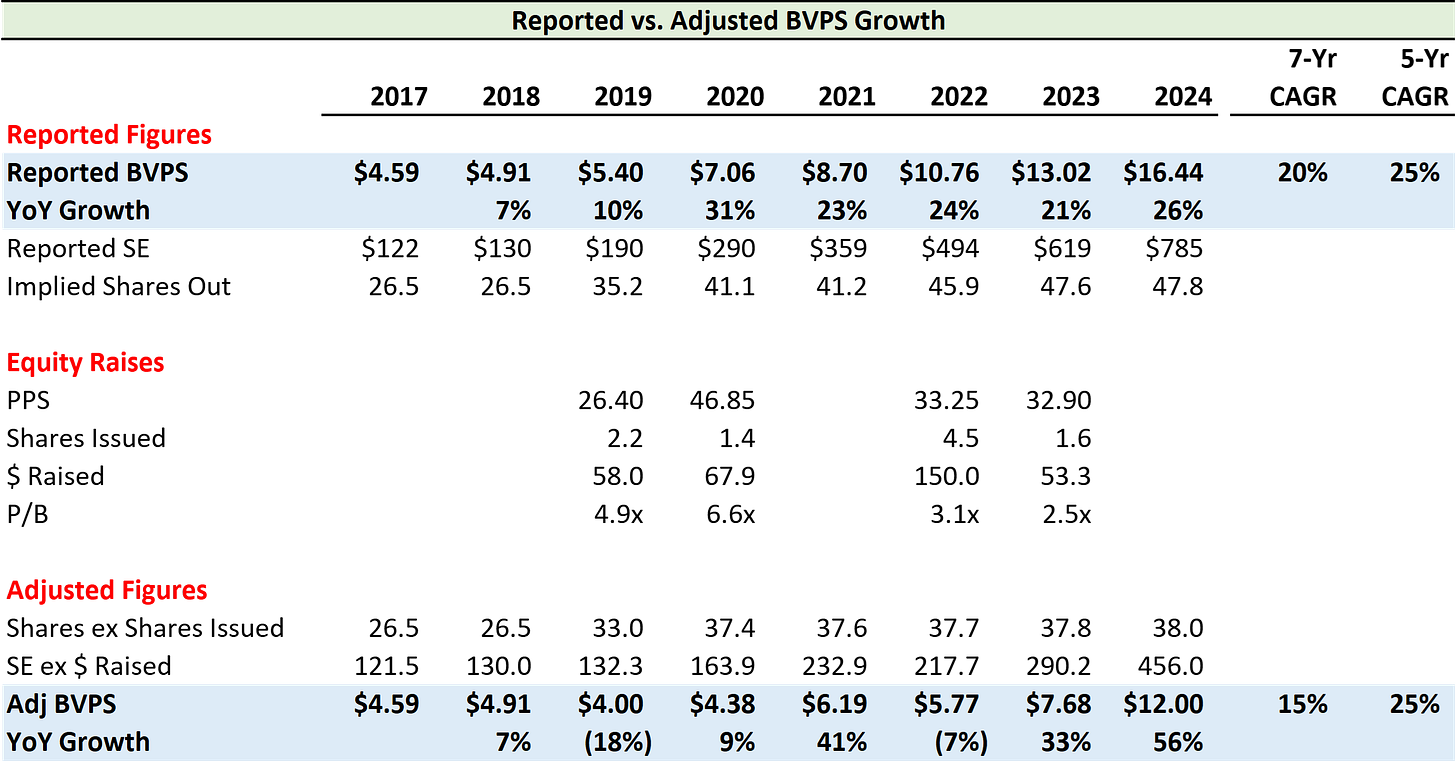

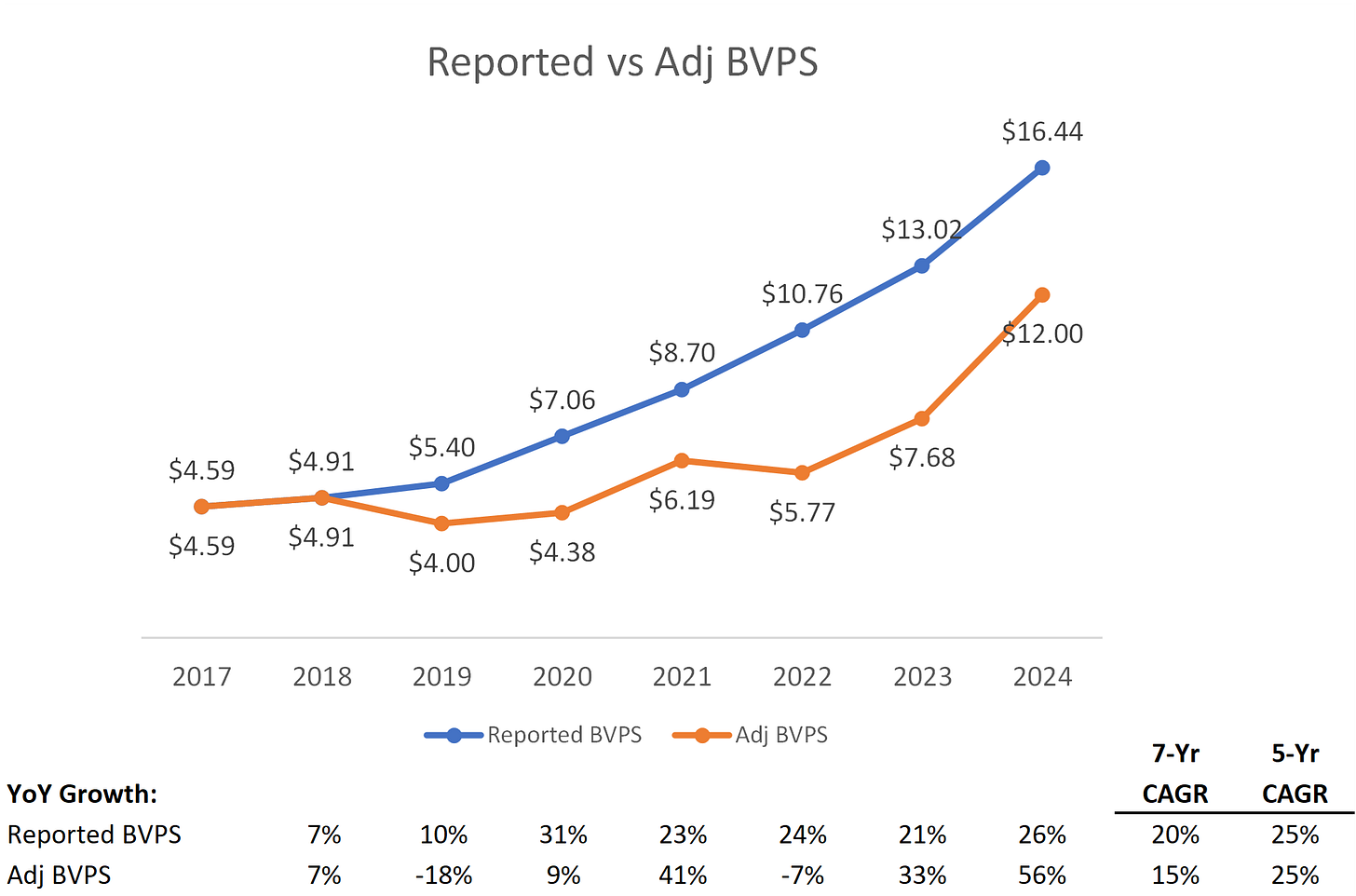

Further, Trisura is unique amongst its peers in that it is growing BVPS at a rapid rate, which I expect to continue. In fact, out of the peer set I examine, nobody other than Kinsale (which is actually growing BVPS faster) really comes close. Yet this peer group trades around ~3x P/B (and Kinsale ~7x).

My hope is that with the continued compounding of BVPS (and a bit of a re-rating as a result), Trisura shares will perform strongly over the next handful of years.

Business Overview

The platform today is made up of two operating businesses—Specialty and US Programs.

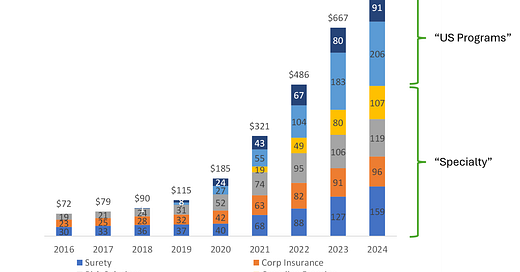

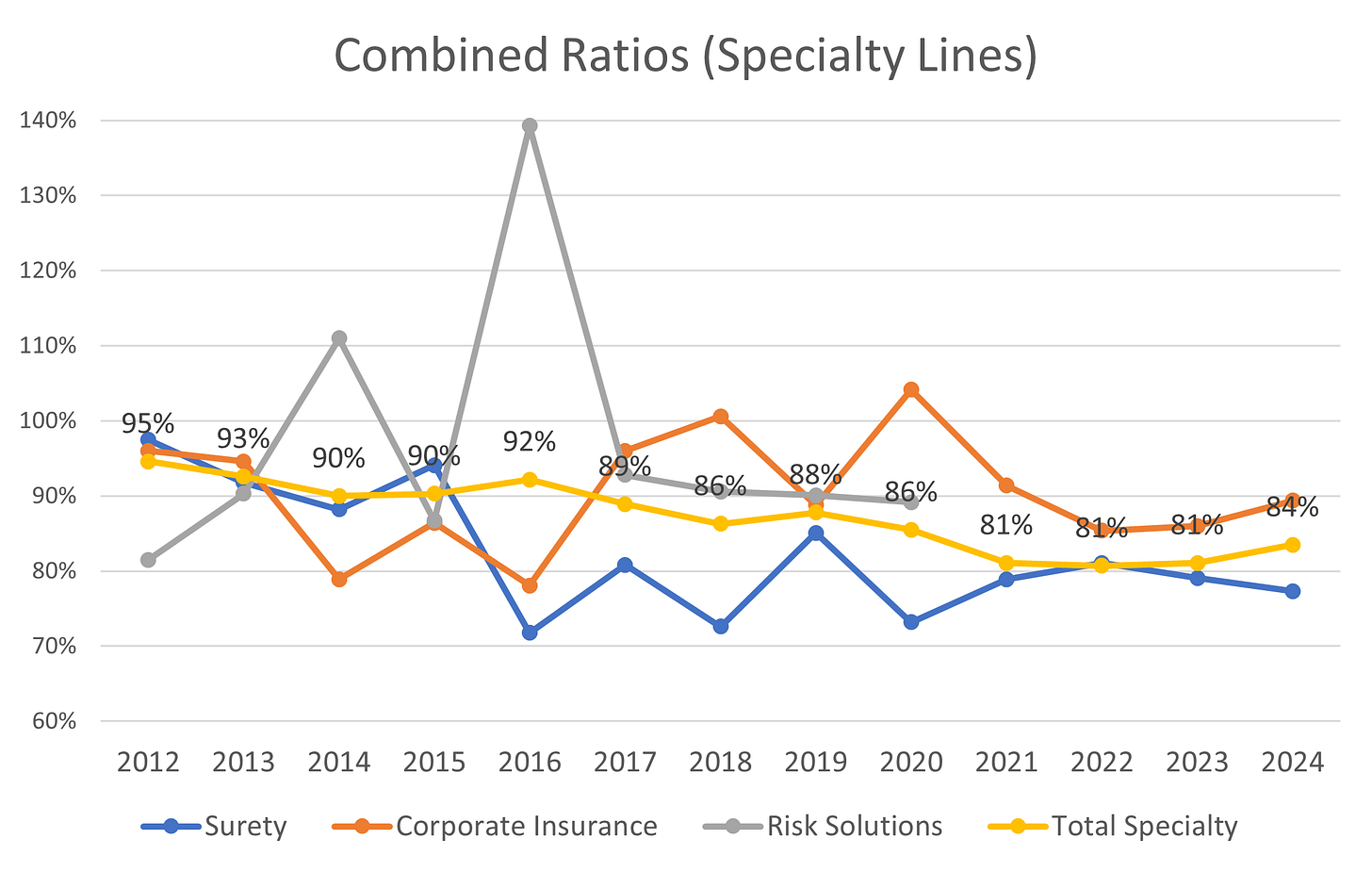

As you can see below, total NPE + Fee Income has grown at a CAGR of 35% since 2016. At the same time, operating ROEs have climbed into the 20s and combined ratios have fallen (into the low-to-mid 80s for the Specialty segment and below 90 overall).

Trisura Specialty

The “Specialty” segment is predominantly a traditional primary lines insurer—mostly based in Canada—operating across surety (focused on small & medium contractors and public sector projects), corporate insurance (such as D&O & professional liability, with a slant towards nonprofits) and “risk solutions” (mostly automotive warranties).

The Specialty segment has been around since 2006, generating a very impressive average ROE of ~20% since 2014 (and ~28% over the last 4 years) while growing NPE at an 8-yr CAGR of 27%. It’s a pristine track record.

It’s achieved its most recent performance despite a significant investment in growing a US Surety practice (as well as a US Corporate Insurance practice to a lesser degree). Historically, Trisura’s primary lines have operated within Canada only. According to management, there’s been enough capital in its new US Surety division to support a surety practice equal in size to its Canadian counterpart for at least a couple years running. However, US premiums were far lower than that prior to 2024 (and are still lower today). Thus, this investment has weighed on ROEs in a material way, even as ROEs have hovered around 30%.1

ROEs across the entire Specialty segment are expected to settle in the mid to low 20s assuming an ~85% normalized combined ratio.2

Trisura US Programs

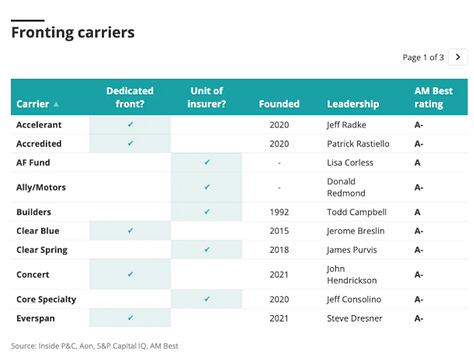

The other major operating business is the “US Programs” (or hybrid fronting) segment. This business is a top 5 fronting carrier in the US.

A fronting carrier is a different beast vs. a traditional insurer.

Simplistically, a fronting carrier will write insurance originated by a distribution partner (typically an MGA, in Trisura’s case) and then turn around and cede all of it to a capacity provider (typically a reinsurer, but also traditional insurers, collateralized reinsurance (from ILS funds, pension funds, etc.) and/or an MGA’s own “captive” pool of insurance capital). In the process, the fronting carrier will capture a fee of ~5% of the premium.

Growth in the fronting space has been dramatic over the past decade, driven by the growth of MGAs and their need to access “risk capital.” According to Conning, US Fronting carrier premium grew 27% in 2023 and has more than tripled since 2020.

MGAs are essentially specialty insurers who outsource their balance sheets. Given their attractive financial characteristics (asset-light, healthy 20-30% margin potential, ability to scale rapidly) and given the fragmented nature of the space, MGAs have seen an influx of PE investment. This has helped to catalyze growth in the space. MGAs overall have tended to be smaller, more nimble and more tech-enabled than traditional insurers, and have represented an attractive destination for experienced, entrepreneurial underwriters.3

At the same time, another shift taking place in the industry has been a slow marginalization of reinsurers by primary insurers. As primary insurers’ balance sheets have grown, they’ve understandably sought to retain on their balance sheets, as much as possible, their most profitable and least variable lines. As a result, reinsurers have been pushed further and further into “tail risk” positions that are more variable and generally less attractive (e.g. property catastrophe exposure).

Finding themselves increasingly marginalized by primary insurers, some reinsurers have sought to partner with MGAs as a way to move all the way back up the risk stack (as well as access less volatile lines of business).4 However, in order to work directly with an MGA, a fronting carrier will need to act as the conduit (for regulatory, operating complexity and tax purposes).

Thus, fronting carriers are in an interesting position—with MGAs growing rapidly and hungry for capital on one side, and with reinsurers increasingly seeking access to MGAs on the other.

While an MGA could and oftentimes will partner directly with a primary insurer (instead of reinsurance capital, et al. through a front), a fronting relationship is an attractive alternative. Naturally, as an insurer without a balance sheet, a/the chief concern of an MGA is the retention and continuity of that outsourced balance sheet.

A high-quality fronting carrier (with strong reinsurance relationships) should provide a higher degree of certainty that capacity will be there (and can be accessed to support growth), so long as a program remains attractive. A primary insurer relationship could more readily disappear based on a change of strategic direction, a desire to take a line in-house, etc. Thus, a high-quality fronting relationship, in theory, allows the MGA to retain more control over its destiny and generally leads to a higher franchise value.

A distinction to make about Trisura’s fronting practice is that it is not a “pure” front—it is a “hybrid” front. What this means is that Trisura retains a portion (typically 5-15%) of a program’s risk on its own balance sheet. Trisura was one of the first in the industry to operate as a hybrid front. Reinsurers are attracted to the concept of a hybrid front as it better aligns a fronting carrier’s incentives with those of the reinsurer (i.e. it better incentivizes fronts to underwrite profitable business). Reinsurers have pushed for increasingly higher levels of retention (by both fronts and MGAs) in recent years, taking advantage of a “hard” reinsurance market.

As a first mover in the hybrid fronting space, and benefitting from the dramatic tailwinds at their back, Trisura has grown its Programs business from a standing start in 2017 to ~c$2bn in DWP in 2024 (and about ~10% share of the US fronting market).

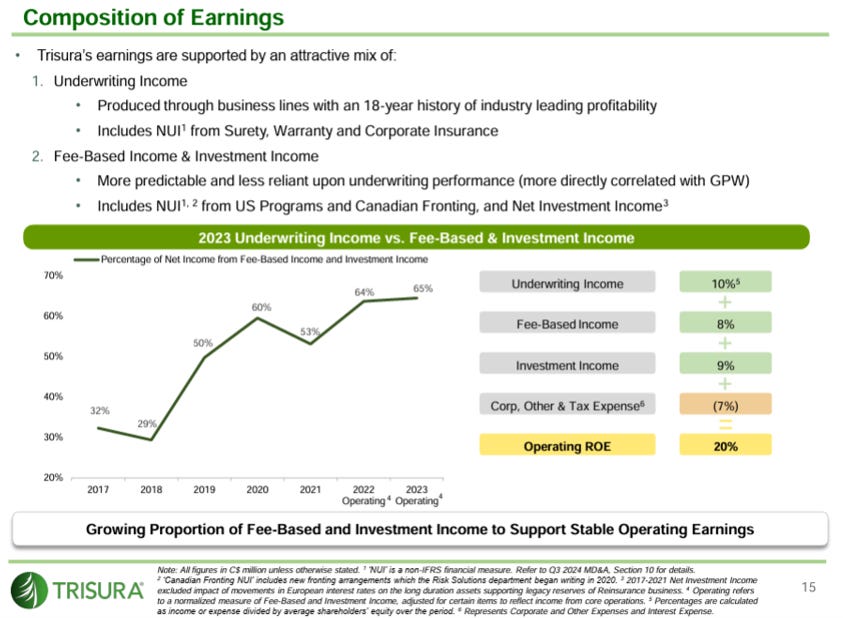

Operating ROE for this segment was 17% in 2024 and is expected to settle in the 15-18% range.56

High ROE Growth Opportunities

Simplistically, with Specialty ROEs expected to settle in the mid-to-low 20s and with US Programs ROEs expected to settle in the 15-18% range, on a consolidated basis the business should, in theory, generate around a 18-21% ROE.

If we look more granularly at some of Trisura’s specific areas for expansion/investment, this also supports the case for high returns. In fact, digging deeper into these areas, it feels that Trisura really has an array of high-return options to pursue.

This kind of optionality should add greater resilience to returns. Trisura can pursue the best areas a little harder without necessarily needing to go overboard. It can pick off the low hanging fruit in other areas which are less attractive overall (or that are more mature), but where there is still attractive business to be had. If certain areas aren’t working as well, they can pivot. Etc.

Below is an examination of these areas in more depth.

The TL;DR version is that US Surety (and US Specialty more broadly) as well as Canadian fronting are both high-return and large opportunities for Trisura. They should offer high-ROE growth for many years to come. Other areas, which are either a bit less attractive or more mature, are still 15%+ ROE type options where Trisura can likely still be quite successful, perhaps picking its spots a bit more.

US Surety

US Corporate Insurance and US Risk Solutions

Canadian fronting

Continued growth of Canadian Specialty

Greater retention of US Programs

Growth/”High-Grading” of US Programs

US Surety

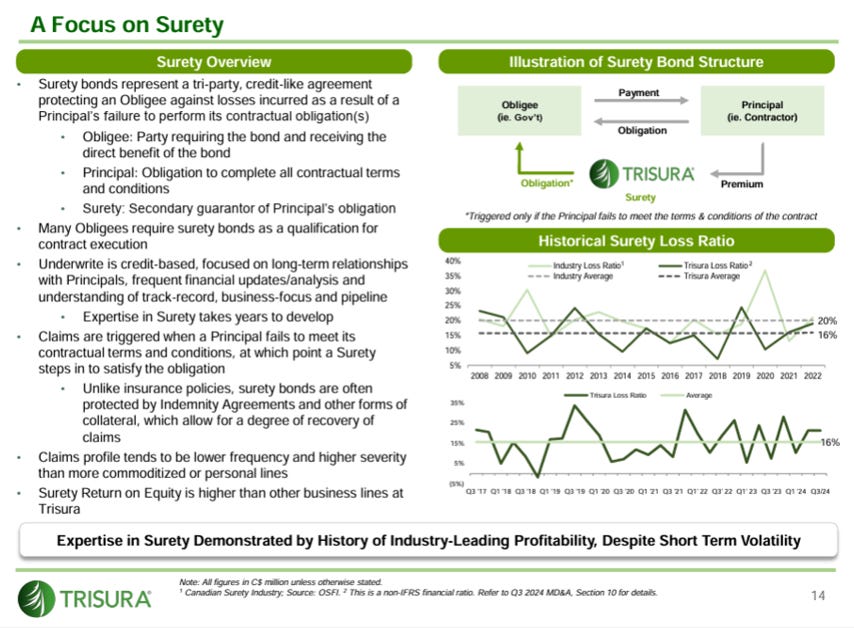

Surety is Trisura’s oldest and best performing line. In Canada, Trisura is the #4 player with ~12% overall market share.

Since 2016, the surety segment has averaged a combined ratio of around 80% while GWP has grown from c$44m to c$209m, a 20% CAGR. ROEs have likely averaged north of 25% over this period.

Clearly this a line you’d want to grow if you could and, indeed, Trisura is most focused on growing this line today—just in the US market, where it has little presence.

Trisura began laying the seeds for US expansion around 2021. And there is reason to believe they can replicate Canada’s success: (1) the industry loss ratio in the US is actually better than it is in Canada (see top right of slide below) and (2) the US surety industry is about 13x larger than Canada’s (same chart). Thus, Trisura need only to carve out a small fraction of the US market for its US operation to be meaningful for Trisura’s overall business.

To date, Trisura has had promising results in the US and management expects that the US Surety business will generate a “mid-to-low 80s” combined ratio in 2025.7 Thus, at full scale, US Surety is expected to be a mid to low 20s ROE business—equal to the Canadian segment.

While the US segment remains 1-2 years away from matching the size of the Canadian segment, it is growing quickly (197% growth in ‘24 to c$75m of premiums), and has drastically exceeded prior timelines.

Growth in US Surety should be nicely accretive to overall ROEs, as not only is it high ROE in theory, but the segment has also been significantly overcapitalized. As US Surety fully scales over the next year or two, it will eliminate the drag it has represented to overall ROEs the past couple years.

As a final point, though the US Surety market is quite competitive (it’s a who’s who of top P&C names), it certainly seems like a well-timed expansion attempt given the current tailwinds in US Surety. The infrastructure bill is expected to more than double federal spend on infrastructure projects vs. historical levels, and spend is expected to remain elevated for many years to come. The vast majority of infrastructure bill spending has yet to be deployed.

US Corporate Insurance and US Risk Solutions

Trisura has already began the process of standing up a US Corporate Insurance segment. This segment won’t move the needle near-term, but will start to make a more material contribution in 2-3 years. Following Corporate Insurance, Risk Solutions is next in line for US expansion.

As you can see below, these lines have also performed very well over time.8

Each line has been consistently highly profitable (likely north of 20% ROEs over the past 4 years). And taken together, Corporate Insurance & Risk Solutions have grown NPEs at a 23% CAGR since 2016 (and 28% since 2019).

In both cases, like in surety, the company will be sticking with lines that they know well, and simply expanding them geographically. The North American surety platform is run out of Canada under the same folks who’ve made it successful historically. I would expect the same to hold true for Corporate Insurance and Risk Solutions.

Canadian fronting

Confusingly, embedded within Trisura’s Specialty division is actually Trisura’s Canadian fronting business (not to be confused with its US Programs business). Unlike the US Programs business, it operates more like a “pure” front. This segment launched in 2020 and has grown dramatically since.

Being a Canadian-based company, and as a leading fronting player in the US, Trisura is uniquely positioned to offer fronting solutions in Canada. And the market seems to be far less competitive than it is the US.910

As such, this has been a very profitable line for Trisura. While its profitability has never been disclosed explicitly, commentary from management suggests its profitability has been higher than the Specialty segment overall (which has been running in the 30% ROE range).11

Thus growing this line should be and is a strong priority, and a large opportunity remains for the segment.12

Continued growth of Canadian Specialty

Despite being its most mature segment, growth in Canadian Specialty has continued at a very healthy pace. Meanwhile, ROEs for the segment (while benefitting from the fronting business) have eclipsed 30%. Thus, finding ways to grow this segment remains a very good use of capital.

Greater retention of US Programs

On its last few calls, management has indicated that it will be pursuing greater balance sheet retention of certain lines within its US Programs business (from the 5-10% range to the 10-15% range). While this move has likely been precipitated by pressure from reinsurers (rather than management’s desires), this also seems like an attractive use of capital.

Trisura has been working closely with its MGA partners for many years, with some relationships dating back 5+ years. What could be a better use of capital than retaining a larger piece of its best performing MGA lines—lines which Trisura should know intimately? And there seem to be good lines to pick from. Across Trisura’s entire US Programs portfolio (excluding exited lines), premiums grew by 27% and the book achieved a 81% operating combined ratio in 2024.

Across a DWP base of c$2bn in the US, a 5% greater level of retention would put an incremental c$100m of capital to work (almost a full year’s worth of profits).

Growth/”High-Grading” of US Programs

In its US Programs business, after an initial 5 years of extremely rapid growth, Trisura has been in the process of “high-grading” the portfolio for the last couple years. Even if this business doesn’t grow at all, but rather treads water while increasing its mix of high-quality business, this will have a beneficial impact on ROEs.

However, as a top 5 player in a space with very strong secular tailwinds, there will be ample opportunities to grow.

As mentioned above, management expects the segment to settle in the 15-18% ROE range (it did 17% on an “operating” ROE basis in ‘24). State National, the largest player in the space, likely achieves a 20%+ ROE.13

State National also generates a ~80% operating margin. While the US Programs segment doesn’t run anywhere close to that and likely never will, it’s reasonable to expect there should also be some margin expansion as this business further scales.

Given all the above, the company’s current level of ROEs do not feel unsustainable to me. Trisura seems to have a clear line of sight to at least doubling the business in a high ROE fashion. I would be surprised if ROEs aren’t at least 15% over such a period, and would expect them to more likely hover in the ~17-19% range (absent any major issues).

Officially, the company has stated goals of “mid to high teens” operating ROE and BVPS growth (per below, from its 2023 and 2024 investor days).

I believe these stated goals are slightly (and appropriately) sandbagged.

Other Investment Merits

Profitability Should be Relatively Consistent

Yes there will be some off-years. But for the most part, I would expect relatively consistent performance.

Reason #1 is that, as you can see below, ~2/3rds of NOI is actually generated by either “fee income” on its fronting businesses or investment income, neither of which are subject to underwriting uncertainty.14

Reason #2 is that the company actively avoids volatile lines such as property cat & “long-tail” risks.1516

Reason #3 is that the underwriting portion of NOI is relatively diversified, and combined ratios tend to be sticky over time (see risk factors discussion).

Additionally, the fee-income generating MGA customers also tend to be very sticky over time. At Trisura’s 2023 investor day, management claimed to have never lost a program to a competitor.1718 Trisura also benefits from a relatively high program count, which means lower premiums per program. Thus if a program does churn, it will have on average a lesser impact on the business. Groups like SNC and Clear Blue have a stronger bent towards very large programs.19

Reasonably Strong Differentiation

Specialty

Within Specialty, Trisura differentiates through (1) deep expertise in niche spaces, (2) broker/client relationships built up over many years, and (3) a broker-focused, service-oriented culture where employees on the front lines are empowered to act quickly/autonomously.

I believe in an area like surety, brokers/clients tend to be very loyal. As long as a contractor is getting its bonding needs met and there are no issues, a contractor and its broker will stick with the same insurer for years and years. This quote from a Nov-21 Tegus call with a former Trisura surety exec seems to sum it up well:

“Contractors are generally very loyal. Like if they're getting all the bonds that they need, they're going to continue working with that broker for many years. So the business is pretty sticky that way. If a contractor has been getting surety bonds from one broker and from Trisura, they're not likely to move unless there's a problem. So it's relatively easy to set up, but it's like switching banks.”

Further, my understanding is that most brokers will have a pretty concentrated group of underwriters with whom they regularly work. If a broker comes across a more borderline type of risk, it might expand beyond its core group of 2-3, but for the most part, a broker will tend to stick with its tried & true relationships.

While not the strongest of moats you will see, the track record in this segment does lend credence to the existence of some level of real differentiation.

Programs

Within the Programs segment, Trisura has effectively two clients—the MGA and the reinsurer.20

Trisura differentiates with MGAs through:

Most importantly, the quality of its reinsurers and the certainty with which it can guarantee risk capacity

Service-orientation

Underwriting capabilities and sophistication in interaction

Being fully licensed in all 50 states + Canada (across both E&S and admitted lines), AM Best size 10 (FSC X) rating (allows Trisura to underwrite larger programs; there are only a few fronts at this scale)

Trisura differentiates with reinsurers through:

Most importantly, a strong book of MGA programs

Service-orientation

Underwriting capabilities and a willingness to align interests through program retention

Data/tech capabilities21

There is a bit of a flywheel dynamic at play, where the stronger your set of MGA programs, the better your reinsurance partners. And the better your reinsurance partners, the more likely you are to attract the strongest MGA programs.

On the reinsurance side, Trisura is off to a good start in that its ongoing programs seem quite strong, and it is a relatively scaled fronting organization that can command more attention from reinsurers. Looking at Trisura’s group of reinsurers (see Gallagher report, page 21), it is indeed a high quality group (and superior to many of the other fronts profiled).22

Additionally, both MGAs and reinsurers seem to prefer a fronting partner with substantial scale and that is part of a broader, diversified organization. Trisura claims there are only ~3 such parties in the US, and that deal flow has been somewhat coalescing around this group.

Management claims that the vast majority of fronting carriers haven’t achieved the scale and sophistication to distinguish themselves in the market, and as a result, resort to beating each other up on price. Trisura (along with SNC and Clear Blue) have never waivered on their ~5% fee.2324

Valuation

Multiples

Trisura trades for 1.9x P/B and ~11x trailing adj P/E.

Assuming 18% growth in BVPS / NOI for ‘25, it trades for just 1.6x forward P/B and <10x forward P/E.

Comparables & Benchmarking Analysis

Below is a comparison of Trisura vs. a set of specialty P&C peers.

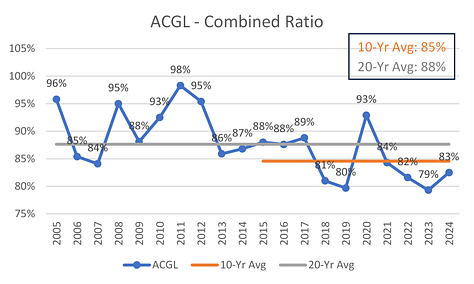

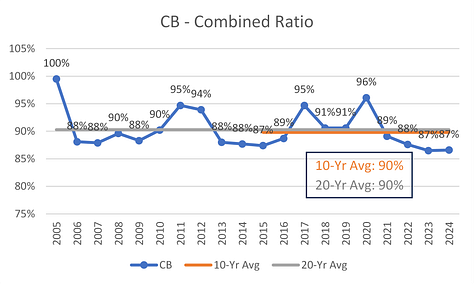

This group has generated a 10-yr avg ROE of 15%, a 10-yr avg combined ratio of 90% and a 5-year avg BVPS CAGR of 9%.

Trisura outperforms the group in essentially all categories. Trisura has generated a 10-yr avg ROE of 21%, a 10-yr average combined ratio of 84% and a 5-year BVPS CAGR of 25%.2526

Despite its outperformance, Trisura trades at 1.9x tangible book vs. the group median of 2.9x. Here’s a plot of P/B (tangible ex AOCI) vs. 10-year ROEs.

As they say, one of these things is not like the others. I’m not saying Trisura is worth RLI/KNSL/PGR type multiples. But if Trisura traded for 3x P/B, I think you could still make a good case it was undervalued. It trades as if the market believes current ROEs are not sustainable, which I believe they mostly are.

Below is an analysis from BCG showing the ROE vs. book value growth of the 100 largest stock-listed insurers globally for 2016-2020. I added Trisura’s approximate figures to show just how much of an outlier it has been—it would’ve outperformed about 95 of the 100. Note that many of these names are reinsurers or life/health insurers (i.e. not pure P&C comps), but it’s very impressive nonetheless.

Below is a look at where the peers have traded over time.

All-time and 10-year P/B:

All-time and 10-year NTM P/E:

All-time and 10-year ROEs:

It seems the peer group has generally traded in a 1.5-2.5x P/B range and a 10-18x NTM P/E range. Multiples have tracked ROEs in the space, which suffered in the years following the GFC due to a confluence of issues including low interest rates and slow premium growth.

Simple Returns Analysis

Below are a few simple forward model cases and returns analyses. These analyses simply project out ROEs/growth in BVPS for a few years, then assign a multiple.

Base case: ROEs drop from 20% to 16% over 5 years; exit P/E of 14x (12x Fwd)

Upside case: ROEs drop from 20% to 17.5% over 5 years; exit LTM P/E of 16.5x (14x Fwd)

Downside case: ROEs drop from 18% to 14% over 5 years; exit LTM P/E of 12.5x (11x Fwd)

These cases generate 5-year returns of:

Base: 2.7x, 22%

Upside: 3.5x, 28%

Down: 1.9x, 14%

Base case:

Upside case:

Downside case:

In all cases, I assume some level of drop off in ROEs.

Reasons to believe that ROEs/growth will stay elevated:

Demonstrated track record of high ROEs, including 4 years running of ~20% (despite a significant drag from growth investments & subscale business lines)

Array of high-return growth opportunities to pursue

Material operating leverage still on the come in US Programs, US Surety, US Corporate Insurance

Trisura is overcapitalized, with an 11% debt-to-capital ratio vs. a long-term target of 20%. Operating at its target level of 20% would conservatively add another ~1.5% to Trisura’s ROE

Reasons to believe that ROEs/growth will taper off:

A soft(er) P&C market will pressure combined ratios (more on this later)

Operating ROEs will continue to lag actual ROEs (more on this later)

A significant decline in interest rates

Generally, it would be a rare outlier case if Trisura maintained a ~20% ROE over the long-term. Only Progressive and Kinsale have done it out of the peer group over the last 10 years (Trisura Specialty has also, for what it’s worth, though on a much smaller premium base)

Management & Ownership

David Clare (CEO)

David Clare has been the CEO of Trisura since 2018. He’s 39 years old, and prior to Trisura, spent time at PVI (the Brookfield exec owned investment partnership), Power Corporation of Canada (a financial service conglomerate) focused on corporate development and strategy, and CIBC (within their financial services group) in investment banking roles to begin his career.

He is responsible for “group strategy, corporate development, investor relations, capital allocation, and managing the investment portfolio.” He is not responsible for management of Trisura’s operating businesses, which currently falls to Richard Grant (Specialty) and Michael Beasley (US Programs). So while he’s not a seasoned operator, he’s also not being asked to be one, either.

The good news with Clare is that he seems pretty smart and he is young. So if he is indeed very talented, he has a long runway ahead of him. It shows quite a bit of confidence that Brookfield/PVI inserted him as CEO when he was only ~34 years old, though I believe it is a Brookfield MO to give young, hungry & promising folks a lot of responsibility early. While I’d say the jury still has to be out on Clare, I feel confident that under his and the Board’s direction, that Trisura will both (1) stick to their knitting27 and (2) likely make smart capital allocation decisions.

Clare has been able to support Trisura’s growth through four separate equity raises amounting to ~c$330m, done at a weighted average P/B of ~4x. With this capital, Trisura has established a leadership position in US/Canada fronting and expanded its Specialty operations into the US, setting Trisura up for its next leg of growth. Clare has also led a few smaller acquisitions/team “lift-outs”/book rollovers which have helped supplement Trisura’s growth.

Richard Grant (Head of Specialty)

Richard Grant has been with Trisura Specialty since its inception leading the Corporate Insurance practice and most recently acting as Trisura Specialty's COO. He took over the division from Chris Sekine in 2025, who led that segment for 5 years after taking over from Greg Morrison (who co-founded Trisura in 2006).

It isn’t the continuity you’d ideally like to see for this segment. But this division has yet to do anything but outperform, even with Morrison out of the business now for 5 years.

Michael Beasley (Head of US Programs)

Michael Beasley founded the US Programs division in 2018. After starting his career in reinsurance, in 1999 he joined State National to help launch their fronting business. He led SNC’s fronting business for several years, and SNC went on to become the dominant fronting franchise in the US. After running a couple other carriers, he began raising capital for a hybrid fronting business around 2016, eventually partnering with Brookfield (Clare helped lead this investment while at PVI). When Trisura was spun out from Brookfield in 2017, the Specialty and US Programs businesses were joined together.

While there have been some real hiccups along the way (the Q4’22 write-down, the newly exited lines—more on those later), I think for the most part US Programs has executed well:

Scaled the business into one of the top fronting carriers in the US from a standing start in 2017, holding it together through a period of extremely rapid growth

Made seemingly intelligent strategic decisions: avoided unprofitable “insure-tech” customers28 and other dubious lines29, focused on high-quality “super MGAs”30, mostly avoided/protected against property cat and other volatile lines that might’ve permanently derailed the business

Created an organization with legitimate underwriting expertise that retained business on its balance sheet (one of first to do this), appealing to both reinsurers and MGAs

Attracted a high-quality set of reinsurance partners

Their current book (which is a very substantial c$2bn in DWP) grew 27% in 2024 with an 81% operating combined ratio. This is not shabby, hard market notwithstanding

BoD

George Myhal (Chairman)

George Myhal spent 37 years at Brookfield, including 14 years as a Senior Managing Partner. He joined Brookfield when it was only 12 people. From 2015 to 2018, he was President & CEO of PVI. I believe he was David’s “boss” at PVI.

Robert Taylor

Robert Taylor was a co-founder of Trisura Specialty. He served as the CEO from inception in 2006 until 2012. Previously, he was the President and CEO of London Guarantee Insurance Company, which sold for $125m in 2001. At the time, it looks as if London Guarantee was the #2 player in the Canadian surety market and also wrote financial/professional service lines (basically the Trisura Specialty of yesteryear). It had NWP of $65m in 2000, 2/3rds of which was surety business.

Barton Hedges

Barton Hedges was CEO of Greenlight Capital Re, a specialist P&C reinsurer, from 2011 to 2017. He was previously President and Chief Underwriting Officer of Greenlight Re from 2006 to 2011. Prior to joining Greenlight, he served as President and Chief Operating Officer of Platinum Underwriters Bermuda, a property, casualty, and finite risk reinsurer, from 2002 to 2005. Before Platinum, he served as executive vice president and COO of Scandinavian Re. He has over 30 years of experience in the P&C insurance/reinsurance industry.

Paul Gallagher

Paul Gallagher has been Vice President Investments of Carfin, an investment vehicle with holdings in private and public companies, since 2016. Previously, he was the CFO at Wittington Investments.

Ownership

Management ownership (from Mar-24; 2025 levels haven’t yet been disclosed)

Insider Buying/Selling

The record of insider buying at Trisura is not going to blow you away. There has been just one larger block purchased on the open market in recent years from what I can tell—a ~c$1.2m purchase by George Myhal in Jan-24 at $33.44.

This is a stock that’s traded at elevated multiples, however. So perhaps being net sellers as a group can be forgiven. Further, this is also a management team that may not have the resources yet to be making large purchases.

In terms of sales (since 2022):

Clare sold a ~c$1.8m block in Jun-22 (at $33.41)

Beasley sold ~c$5.2m in stock from Jun-22 through Sep-24 at an avg PPS of ~$38

CFO David Scotland sold a ~c$1.8m block in Jun-24 (at $41.85)

Former CEO of Trisura Specialty, Chris Sekine, has sold off c$9.6m of stock since Mar-22 at an avg PPS of ~$39

The most eyebrow raising of the sales would be Beasley’s. It appears he’s sold off the vast majority of his stake in the company, despite still leading the US Programs business.

Market Overview

Surety

The vast majority of the surety that Trisura writes is contract surety bonds in the construction sector.

A surety bond is a three-party agreement involving a surety, a contractor, and a project owner. The surety guarantees that the contractor will fulfill its obligations as outlined in the construction contract. If the contractor fails to meet these obligations, the surety steps in to complete the work or compensate the owner—though this is generally limited to the bond amount. In the event that the surety incurs any costs while resolving issues, it actually has the right to recover the amounts from the contractor through a general indemnity agreement.

Any federal construction contract valued at $25,000 or more requires a surety bond. Most state and municipal governments have a similar requirement. And many private owners also elect to require contract surety bonds.

A bond typically costs the contractor between 0.5% and 3% of the contract amount.

The surety market in Canada is roughly c$900m. The top 10 players represent about 90% of the market. Trisura has ~12% market share and is the #4 player. Its competitors in Canada are predominantly the “large international insurance giants” (e.g. Travelers, Zurichs, Intact). Trisura has historically focused almost entirely on small to medium contractors. However, Trisura very recently added a team (poached from a competitor) that will target large Canadian contractors, which opens up a new segment of the market.

The US market is ~$10bn in size and the top 10 players own roughly 60% of the market. As mentioned before, the overall loss ratio for the US market is very similar to that of Canada’s. Trisura finished 2024 as a top 35 surety underwriter in the US, up from 51st in 2023.

As you can see above, loss ratios across the surety industry have been pretty benign for the last ~20 years. However this hasn’t always been the case, as you can see in the chart below. Per the SFAA:

“Throughout the 1990s, set in a thriving economy with falling interest rates, the surety industry was profitable. Contractor failures were at low levels. Excess capacity built up as a number of new surety companies entered the market. Competitive pressures to maintain and even grow market share led to softened underwriting (which resulted in sureties writing contractors that may not have been fully qualified for the work they were seeking) and softened pricing. These contractors were not able to withstand the shock caused by the financial downturn in the mid-2000s, leading to increased surety losses.”

“Since the early 2000s, the surety industry (committed not to repeat the mistakes of the past) appears to have maintained an underwriting discipline as the industry has recovered and profits have returned. Thus, when a weak economy returned and job opportunities became scarcer during 2007-2008, sureties generally were bonding quality contractors that could financially withstand the downturn and make the tough but sound decisions to scale down their operations. Quality contractors also were able to undertake the completion risk of struggling subcontractors.”

My understanding is that a combination of the Enron blow-up and Boston’s “Big Dig” project would have contributed substantially to the loss ratios of the early 2000s. These would represent pretty unique/outlier events, though of course such events can and surely will happen again.

Programs

The US MGA market is about $100bn in size, and accounts for ~10% of the overall US P&C market. As you can see below, the MGA market grew by 80% from 2019 to 2022 (see chart on right).

According to Insurance News:

“The top five [MGAs] together represented approximately 17.6% of global MGA revenues in 2023. The shares for the top 50, top 100, and top 300 groups were 55.4%, 67.5%, and 84.4%, respectively, reflecting a fragmented yet highly dynamic sector. According to Insuramore, there are around 3,000 enterprises involved in MGA activities worldwide, with over 1,650 projected to write premiums exceeding $10 million this year…By ownership, the top 300 groups in 2023 included 58 broker-owned, 31 insurer-owned, and 211 independent groups, many backed by private equity firms.”

Fronting carriers account for around 15% of the MGA market, or $15bn of DWP. Thus Trisura, at around USD1.5bn of fronting DWP, accounts for about 10% of the US fronting market (and 1.5% of the entire US MGA market). According to Conning, US Fronting carrier premium grew 27% in 2023 and has more than tripled since 2020. If you go back ~13-15 years or so, the fronting industry was approximately $1.5-2bn DWP in size, so it’s grown approximately 10x over this period.

The fronting industry was pioneered by State National, and they are still the largest player in the space at ~$4.9bn of DWP in ‘24. Historically, fronting companies had more of a pure regulatory slant to their value proposition. For example, if you were an insurer working with a multi-national company, in order to write insurance worldwide, you might need to partner with a front in certain jurisdictions (many jurisdictions—US, Canada, Australia, UK—require local policies to be issued, and thus require the underwriter to be licensed in that jurisdiction). By partnering with a fronting company, the insurer avoids the complexity of having to get licensed itself in a situation where it may not be worth the hassle. Similarly, for an MGA’s captive vehicle, working through a front could make good sense for the same reason.

Since 2017, against this backdrop of rapid growth, a flood of new fronting companies have entered the space. In all, there are an estimated 20 dedicated fronting carriers and, if including fronting units of traditional insurers, over 30 altogether.

According to the table below from this Gallagher report, looking at the reinsurance ceded column, Trisura is the 3rd largest group by this metric in the US, behind SNC and Clear Blue.

Over time, as growth slows in the industry, many expect it to consolidate around a handful of the most scaled groups.

Key Risks

Counterparty Risk

A major risk that could spoil this story is counterparty risk in the fronting business.

While the fronting business cedes the vast majority of the premium/risk it underwrites, the front is ultimately on the hook for all of it should its counterparty fail to pay its obligations. And because the fronting model runs with a higher degree of “leverage” (gross premiums to capital) than a traditional insurer, this magnifies this counterparty risk.

As you can see below, Trisura’s counterparties, weighted by dollars of expected recoverables, are 43% A+/A++ rated, 13% A rated, 14% A- rated, and 30% B++ rated & below. For the recoverables that are rated B++ rated & below, Trisura requires collateral equal to 100% of expected recoverables (with collateral growing as expected recoverables grow).

While maintaining a high-quality and diversified panel of reinsurers (as well as requiring collateral for weaker counterparties) goes a long way towards limiting counterparty risk, it is still a significant issue.

A failed reinsurer, even an A+ rated/top-3 reinsurer, is not outside the realm of possibilities, as industry expert Warren Buffett would tell you:

“It’s interesting. In the last 30 years, the three largest reinsurance companies and I’m counting Lloyd’s as one company…and they’re all in fine shape now, they’re first-class operations, but all three of them came close to extinction sometime in the last 30 years, or reasonably close.

And we didn’t really have any truly extraordinary natural catastrophes. The worst we had was Katrina in, whatever it was, 2006 or thereabouts, 2005. But we didn’t have any worst-case situation. And all three of those companies, which everybody looks at as totally good on the asset side, if you show a recoverable from them, two of the three actually made some deals with us to help them in some way. And they’re all in fine shape now.

But it’s really not a good business, if you’re a standalone insurer, if you keep enough capital to really be sure you can pay anything that comes along, under any kind of conditions.”

— 2019 BRK Shareholder Meeting

As you can see from Trisura’s reinsurance relationships above, their largest counterparty represented c$382m of “reinsurance contract assets,” or money that is expected to be owed to cover losses. If this reinsurer were to completely fail to pay, Trisura’s book value (of ~c$800m) would be cut in half. I believe this counterparty is Swiss Re, the largest reinsurer in the world with $40bn of GWP. But nonetheless, it is still a risk.

Furthermore, Trisura does not have a clean record when it comes to managing counterparty risk. In Q4’22, the company wrote down a reinsurance recoverable to the tune of c$81.5m (~15% of book value at the time) related to a program in the US fronting business. While the recoverable was backed by an MGA’s captive reinsurer (and therefore supported by collateral), Trisura maintained an additional layer of catastrophe reinsurance to support the program. Over the course of 2023, the prices of catastrophe reinsurance increased dramatically, which “reduced the amount of collateral available” to this program. This caused a “disagreement over obligations” with the captive, which ultimately resulted in the write-down. Thus, the driver of the write-down was not claims experienced but rather higher catastrophe reinsurance costs. But regardless, the write-down took out a big chunk of book value and resulted in a full-year overall ROE of 6% (vs. 20% excluding the impact of the write-down).

This incident resulted in the share price falling from a high of ~c$45 around ‘22 year-end to a low of c$30 later in ‘23. Trisura went on to raise c$50m in a Aug-23 offering priced at c$32.90 to help shore up its capital base.

Industry-wide, another counterparty incident occurred in 2023 when Goldman-backed “alt capital” provider Vesttoo was revealed to have posted fraudulent collateral, causing fronts (including Clear Blue most prominently) to take write-downs and scramble to backfill Vesttoo’s capacity with other counterparties.

I could understand how this issue alone would cause an investor to pass on Trisura. And if this were a pure fronting business, I would.

But (1) I don’t believe Swiss Re will go bankrupt, (2) Trisura is a diversified insurance platform which limits the impact of a counterparty event, and (3) Trisura is further diversifying away from US Programs towards its primary lines.

From the Mar-25 TD fireside chat:

“I think there’s been a historic association of Trisura with certain lines of business in the public sphere. So the size and scale and rapidity of growth in the US Programs business or in the Canadian fronting business has sort of obfuscated for people what the core drivers of this platform are. I think if you talk to me in five years, the evolution of this business will be continued growth in those US Programs and the Canadian fronting lines of business. But a proportional shift in the contributors to the business—so surety as a North American platform, corporate insurance as a North American platform. You should just see a larger Specialty business in those traditional lines…I think there’s going to be disproportionate growth in surety and corporate insurance over the next couple of years as we build out those US platforms.”

Today, if one of the non-Swiss Re A+ reinsurers were to go bankrupt, it would represent a hit to BV of ~15%. In a few years, this should be closer to 10%. While such an event would be far from ideal, it does not scare me away given (1) the low likelihood of such an event (1 in 25 yrs?), (2) the damage would be limited to 10% of book and (3) that absent such an event, Trisura in theory gets to post ROEs of 15%+ in this line in a highly consistent manner.

Other mitigants:

Even in the case of extreme financial distress or bankruptcy to one of its counterparties, the likelihood that Trisura couldn’t collect on any recoverables owed seems quite low. Insolvent reinsurers often go into runoff, meaning they continue paying claims using available assets. Further, if a reinsurer’s obligations are taken over by a solvent company, claims may still be honored

As discussed earlier, Trisura has a relatively high number of programs, and therefore a relatively low DWP per program. Thus, if there were ever a disagreement over a recoverable between Trisura and a counterparty (say where the counterparty could pay but wouldn’t), this would mitigate its impact

State National had famously navigated this risk for 28 straight years (prior to being acquired by Markel) without a single unpaid reinsurance recoverable, thanks in part to its exceptionally tight reinsurance contracts. The head of Trisura’s fronting operation, Michael Beasley, set up State National’s fronting business back in 1999

The Canadian fronting market is unique in that even highly rated reinsurers are required to provide collateral to the fronting carriers. Thus in its Canadian operation, Trisura has an extra layer of risk protection.31

Soft Market

“Hard market” conditions in the insurance industry generally means: (1) increasing rates, (2) less competition, (3) stricter underwriting criteria, and (4) stricter terms of coverage. Hard markets are a set up for lower combined ratios and stronger performance.

A “soft market” is the opposite: (1) softening rates, (2) increased competition, (3) relaxed underwriting criteria, and (4) weaker terms.

The P&C industry has been in a hard market since 2018, an unusually long period. The average length of a hard market since the 1980s has been roughly 3-4 years. There also haven’t been that many of them (mid-’70s, mid-’80s, early 2000s, early 2010s and the current market).

From ALIRT Insurance Research:

“The chart below shows the change in net written premium as a proxy for rate, in the absence of broker surveys before 2000.”

“Annual price percentage increases in the last couple hard markets have been less steep but more protracted. Annual price boosts in this commercial lines cycle peaked at the end of 2020, and over the last five quarters, the increases have leveled out at the mid- to high-5% mark. This suggests that typical hard market competitive dynamics are occurring on the margins only; i.e., price discipline is holding across most business lines.”

ALIRT attributes the current hard market conditions to, amongst other factors:

“Persistent economic and social inflation that has produced much higher losses and loss adjustment costs than anticipated by pricing actuaries

Greater insured losses from weather-related events across a broader swath of the United States, again unanticipated and still seemingly impossible to model

Much more expensive and scarce reinsurance protection, especially for property coverage

A 15-year run of historically low interest rates (note: investment income historically accounts for the lion’s share—if not, at times, all—of P&C operating profitability).”

How much has Trisura benefitted from the hard market?

Surety. Management would tell you that the hard market has had very little impact on Surety. Surety, in fact, has been a soft, highly competitive market for the last ~5 years.3233

Risk Solutions. This segment also seems to have seen a relatively muted impact from the hard market according to management.3435

Corporate Insurance. In Corporate Insurance, while the hard market has been beneficial, Trisura plays in a niche area of the market less swayed by overall pricing trends.36

Programs. While the hard market no doubt has helped with the profitability of the Programs book, a soft market is beneficial in terms of greater reinsurance capacity and easier terms from reinsurance partners. Management would tell you that the last couple of years have been a very difficult period to navigate in the fronting space for this reason.

In all, while I expect a soft market to negatively impact the business, I don’t believe it will have a dramatic effect. As mentioned above, only 1/3rd of NOI is subject to underwriting uncertainty. I believe the rest of NOI would not be impacted materially by soft market conditions. Additionally, by assuming the Specialty business settles in the low 20s ROE (from ~30% levels the last few years), and by assuming Programs settles in the 15-18% range, I believe this reflects a normalized/balanced environment.

Lastly, over the past few years the hardest of hard market trends, I believe, were in cyber (which was seeing 50-100% annual price increases for a period) and property cat (supposedly one of its hardest markets ever). Neither of these areas would have had much of a positive impact on Trisura. In fact, property cat is a risk for which Trisura takes out additional “horizontal” protection across its US Programs, which eats into its margins there. Any savings it can generate on this reinsurance will fall straight to the bottom line.

Poor Underwriting

Poor underwriting is of course a risk, and it would be hard to know if Trisura (or any insurer) was in the process of writing a lot of bad business.

I think comfort can be gained here by (1) Trisura’s pristine track record (they’ve consistently beaten industry average combined ratios over many, many years) and (2) because generally, combined ratios tend to be pretty sticky industry-wide (i.e. top performers tend to stay top performers, etc.).

You can observe this phenomenon amongst Trisura’s specialty peer group.

I would expect Trisura’s combined ratios to be relatively sticky as well (as they have been historically).

Recent Unfavorable Claims Development

Trisura has a history of strong favorable prior year development in its primary lines. From the Jan-25 CIBC Conference:

“Our platform has had a very strong history of conservative reserving. If you look at the Canadian vehicle, it has a 15 year track record of very strong and positive reserve development.”

You can see their history of reserve development in the table below.

After 2020, as we can see, the results are more mixed. This has been the result of the growing US Programs influence, and especially the poor performance of the “exited lines” within that segment. From its Q4’24 earnings call:

Doug Young

“And then just lastly, when I look at the reserve triangle and the reserve developments, it looked like it was negative for the year. But I think there's kind of a bigger story underneath it. Can you talk about the split between the 3 buckets, the split between Canada, the U.S. ongoing program and the U.S. exited lines. Because in my head, I think Canada would be positive I think U.S. ongoing would be neutral and then the U.S. exited lines would be negative, but just hoping to get some color around that.”

David Clare

“I think that's a fair summary, Doug. We've had a pretty strong and consistent track record in Canada of positive reserve developments. You can see the delineation and profitability in our new disclosure in the MD&A between those exited lines and the ongoing lines. And there was a disproportionate impact from those exited lines on that negative development. You can see strategically why we've moved away from these types of lines. [Those] are lines that we've been out of for some time now.”

As we can see, the main culprit for the negative reserve development has been the “exited lines” in US Programs. Management indicates that the Canadian lines have likely continued to have positive developments, and that US Programs (ongoing lines) have been more neutral (sounds like moderately negative).

Thus, I believe comfort can be gained here by the fact that:

The exited lines are a relatively small cohort for Trisura. In the ’24 AR, it states that c$226.8m of GPW was written in these exited lines in ’24. On a NPE basis, that’s likely in the neighborhood of ~c$20m. And that compares to a company-wide NPE of almost c$700m, so ~3% of total NPE.

Trisura has already fully reserved for these lines in their minds (we’ll see if they actually are, but they’ve at least gone through the exercise)

Management states that the duration on these lines are 2.6 yrs and that 80% of claims will be paid out in 4 years.37 So for those real problem years (2021 & 2022), the impact should be waning significantly

Thus for these lines to continue to dampen results very meaningfully would seem pretty hard, just mathematically speaking.

Of course more issues could crop up in US Programs, but (1) growth has been & will be far more controlled in this segment than in the past (and likely flat for ’25), (2) Trisura has been in the process of “high-grading” this portfolio for multiple years now (i.e. keeping the good, getting rid of the bad), (3) it seems management is very focused on taking a more conservative approach to reserving going forward (and have consolidated reserving responsibility for US Programs under their head offices in Toronto) and (4) management claims to have gone through their whole US Programs book with a fine toothed comb as part of this broader exited lines/reserve strengthening process.

Operating ROE vs. Actual ROE

Trisura has reported an adjusted ROE it calls “operating ROE” since 2019, which strips out “non-recurring” events like the Q4’22 write-down and the 2024 exited US Program lines. Since 2022, Trisura’s actual ROE has trailed its operating ROE by a cumulative 23% points, or 8% per year on average.

There is reason to believe that operating & actual ROEs will converge, however.

For one, the Specialty segment has already been “converged” over the years. It’s been US Programs that’s been the “problem child.”

And in US Programs you could chalk up the Q4’22 write-down to a unique, not to be (hopefully) repeated issue. And the recently exited lines, I think you could ascribe to a period of exceptional growth (which is bound to create a few substandard lines). Now that the book has been fully “high-graded” over multiple years, and now that growth will be much more controlled, I think it’s reasonable to expect a minor or no delta going forward.

But I can fully appreciate the skepticism here until Trisura is able to converge these numbers consistently.

Lack of Growth in US Programs

The lack of recent growth in this segment may be causing some investors to believe that Trisura’s fronting business has fallen behind its peers in the space. However, I believe Trisura’s largest program, At-Bay (a cyber-focused insurer), is simply in the process of churning.

Per the Gallagher report, At-Bay (or more specifically, At-Bay’s “captive” pool of insurance capital) was Trisura’s 2nd largest counterparty as of Dec-23. In Jan-23, it was announced that At-Bay acquired a licensed US insurer. There would be no reason to make this acquisition unless At-Bay intended on becoming a fully blown primary lines insurer. In such a scenario, a fronting relationship would no longer be necessary.

I believe, reading between the lines on recent management commentary38, that this program will fully churn off in the coming quarters. At this point, growth should begin to reaccelerate.

No “Structural” Moat

The seemingly best insurers benefit from a clear structural moat.

Progressive and GEICO benefit from a low-cost advantage in a sector that’s been riding strong secular growth for decades

BRK Reinsurance has a true “Fort Knox” balance sheet, and is maybe the only counterparty in the world that can be relied upon to make a payment in full, no matter what

Trisura does not benefit from this type of advantage. While I like the lines they are in and think they will do well, consistently strong execution will be required to outperform. Success does not feel as “preordained” as it does for certain other top-quality insurers.

Others

Lack of insider ownership & buying

CEO turnover in Specialty

A significant decline in interest rates would reduce investment income & profitability

Risk that exited lines (or US Programs generally) are still under-reserved

Insurance is generally a tough, commodity business

Conclusion

Trisura has already ~2.5x’d BVPS since the spin (ex capital raises), and it looks well on its way to at least 2x’ing again over the next 5 years.

Despite its track record & prospects, it’s perhaps a bit unloved/forgotten due to the continued languishing of the share price, the recent hiccups in US Programs (and the resulting worrisome-looking claims development) and it being a bit of a unique animal (i.e. not a pure play primary lines insurer).

My hope is that with continued strong performance (and a bit of re-rating as a result), the next handful of years will produce strong results.

Downside should be somewhat limited due to an undemanding multiple, significant room for error on ROEs (it seems ~15% would still be deemed “acceptable” by the market) and performance that should be (in theory) fairly predictable from here.

Important Disclaimer

This post is intended for informational purposes only and you, the reader, should not make any financial, investment, or trading decisions based upon the author's commentary.

Although the information set forth above has been obtained or derived from sources believed to be reliable, the author does not make any representation or warranty, express or implied, as to the information's accuracy or completeness, nor does the author recommend that the above information serve as the basis of any investment decision.

Before investing in a security, readers should carefully consider their financial positions and risk tolerances to determine if such a stock selection is appropriate. At any time, the author may trade in or out of any securities that are mentioned in the report as long or short positions in his portfolio without disclosing this information.

This report’s estimated fundamental value only represents a best efforts estimate of the potential fundamental valuation of a specific security, and is not expressed as, or implied as, assessments of the quality of a security or an actionable investment strategy for an investor.

“Q: We talked about the US surety business potentially growing equal in size to the Canadian operation. Can you give us an update in terms of how that expansion is progressing and what investors should expect over the next 12 to 24 months?

A: In the near term, I’m not expecting a huge material change in that US surety premium. We’ve seen some good momentum this year, we talked about that in Q1 and Q2. But the inflection point for that business is going to be a widely licensed platform. So we closed in Spring of this year our acquisition of a US [treasury-listed] surety platform. Our next job is to expand that platform across the US. We’re going through that right now, it’s a very regulatory and legal heavy process. That means the next 12 months the growth that we expect to achieve is really based on that old platform that we have in surety. Candidly it’s performing well, we are seeing accelerated growth in that. But that inflection point, where we start to say ok when can I expect to have a platform in the US that starts to mirror the size of the platform in dollar amounts in Canada – that’s probably 3 to 5 years away. And we’re talking about a platform that hopefully at that time that’s $100m CAD in top line. But what that means, if we take a step back, is we’ve got an entity today that is fully funded, fully set up for that type of premium base, and a combined ratio, reporting statistics that includes the drag of that build-out. So what’s interesting about our platform today is that we’re investing in the entity, we’re building out new platforms that will be very significant for the entity in a few years. We’re absorbing the cost of those through our platform today. And if at any stage if we start to get through that breakeven point into the profitability, which we sort of expect in the next 2 years or so, that starts to get really attractive from a return perspective.” — Sep-24 Scotiabank conference

“Q: So Trisura Specialty, formerly referred to as the Trisura Canadian segments, has generated impressive ROEs over the past few years. What would be the near-term ROE outlook and what do you see as a sustainable mid-term target for that platform?

A: Just to level set for anyone who isn’t familiar with these figures, the Canadian platform has historically been writing close to a 30% ROE. Something that we’re very open with people about is that’s likely not the long-term level of return for that business. I think it probably settles in the low to mid 20s. In the near-term, in Q1 and Q2, we did see the high 20s ROE level, and so certainly I think that’s an expectation that’s fair for the next quarter or so. As we think about that in the long-term, as we think about a larger business, as we think about an entity maybe that’s not writing at a 81% combined ratio – maybe something like 85%, which is still very strong – you’re probably closer to that low to mid 20s ROE which we still think is spectacular.” — Sep-24 Scotiabank conference

“President and CEO at Trisura Specialty Insurance Company

To give you kind of the back history, MGAs have been around pretty much since the 70s. They started to proliferate quite a bit in the late 80s, early 90s. But most of them were kind of wholesale operations that controlled certain niches in certain areas. But they’re really sales organizations.

And then some of the better ones started to hire some underwriting talent and they started to kind of morph into more, what I would say would be an underwriting, managing, general agency of a book of business versus just trying to be a distributor of a certain book of business. If you flash forward to the late 90s, early 2000s. Some of the better ones started to buy other ones and they started to add on more books of business.

And then what really happened after about 2010 is professional capital, mainly private equity, others started to take a notice at the space and thought this was a really interesting way to grow premiums without a balance sheet, without really being a traditional retailer or wholesaler. So a different nuance, but a great way to control business and control the customer and certain niches and lines of business.

So these private equity groups and other professional capital providers started to move into the space and provide money. And these MGAs got much more professional, started to really look and act like an insurance carrier just without the balance sheet and flash forward into the 2020s.

And now they’ve become the hottest space in the insurance industry. They control now upwards of probably $100 billion of premium, where back, say, in the early 80s and 90s, they were maybe a billion. So the proliferation has been tremendous. And they’ve gotten better access to the customer. They literally have better technology than insurance carriers. They’ve been able to outperform, and they service the brokers better.

So, while before a lot of these MGAs were kind of quasi-distributors, quasi-underwriters, now they’re much more professional and they – and some of the bigger ones will have multiple books of business in those spaces and they continue to get more capital and they continue to grow. And the business continues to move out of large traditional insurance carriers for numerous reasons we can certainly get into, and into the MGA space.

Tegus Client

Got it. And so, do you feel like this trend toward MGAs or this really robust growth of premiums going through the MGAs, is that sustainable in your opinion?

President and CEO at Trisura Specialty Insurance Company

It’s sustainable. It’s not going to grow like it has between 2000 and I would say ’13, ’14, and 2024. You saw tremendous growth upwards of 10%, 20% a year. I think you’re going to get more down to that 5%, 10% that moves over there. And part of the reason for that is insurance carriers are just getting smarter.

They’re getting better at what they do. And they’re starting to figure out how to be more efficient, where a lot of times they just say, for instance, AIG, they couldn’t write a policy from an expense ratio standpoint internally for less than like $40,000 or $50,000.

So MGAs are able to come in and take these $1,500 to $50,000 policies away from these guys because they’re able to do it more efficiently and effectively. Now, some of these traditional carriers are starting to deploy technology and they’re starting to figure this out. So, they’re starting to get more efficient. So, I think there is going to be a little bit more competition going forward now between MGAs and carriers, but I think you will still have some growth in this space.” — Tegus, Mar-24

“Carriers like Trisura and others have been able to jump in the foray and give these MGAs a different alternative as well as access to the reinsurance market, where a lot of these traditional carriers have gotten more and more capital, so they buy less and less reinsurance. So you have a lot of trapped capital in the reinsurance space, looking to figure out how to deploy that capital. So they come to people like me to do that through MGAs.” — Tegus, Dec-22

“Q: What’s a reasonable expectation for mid-term ROE for the US platform?

A: We’re running today at about a mid-teens operating ROE. I think as that continues to scale, my hope and expectation is that starts to creep into the mid to high teens. You’ve seen precedents in that space achieving that and we’ve seen the potential for it to get there. So I think as that entity continues to grow and scale, that mid to high teens ROE is what we’ll be targeting.” — Sep-24 Scotiabank conference

“David Clare

Well, and that’s a good segue into the types of economics you’d be expecting from a fronting model. Where do you – what’s your touchstone on return on equity?

Michael Beasley

Yes. I think once you kind of start to hit that $1 billion premium number, if you’re doing all the other – you’re doing the blocking and tackling internally appropriately, you should be in that mid- to high teens ROEs. And if you outperform that, you could go higher. But I think for us, that’s really our target goal and that’s kind of what we presented back in 2016 was if this is done well, we should be able to hit ROEs in that 15% to 18% range.” — ‘23 investor day

“This year, I would expect US Surety should be a mid to low 80s combined ratio. So you’re starting to see that contribution at a level that you would maybe not totally see on the Canadian side—we may be a little bit better in Canada with some more operational leverage. But you are profitable in that US Surety business now, and you should start to see some kick in of contribution. That’s important to note because for the last three years, US Surety has not been profitable. You’re building up, investing in people—you’re not scaled on a top line basis.” — Jan-25 CIBC Conference

Note the company switched from reporting full combined ratios by specialty line to just loss ratios by specialty line in 2020. Thus, for Surety, Corp Insurance and Risk Solutions, after 2020, I use the reported loss ratio + the avg of the 2016-2019 expense ratio for each line. Using this expense ratio should be conservative, because each line has scaled considerably and should have benefitted from at least some degree of operating leverage since the 2016-2019 period.

“Jeff Fenwick

I just wanted to start my questions off with the Canadian fronting unit. I mean that’s an area that has surpassed, I guess, my expectations for growth. And I think you’ve mentioned it’s been a bit better than you might have been expecting also. Can you just give us a bit of color about why it’s been able to be so successful? Is it – was it just some identified gaps in the market?

Is it that the reinsurance partners just have a better cost of capital, it can price a bit more aggressively in the market? Or what have been the dynamics that have helped that unit grow so much?

David Clare

Yes. Appreciate the question, Jeff. And it’s a good narrative to highlight that Canadian fronting practice has grown ahead of our expectations. And more importantly, it’s contributed better profitability maybe than we anticipated at this stage. The nuance of Canadian fronting is a bit different than U.S. fronting. I mean what we do in Canada is more often fully fronting transactions and provides access to the Canadian market to reinsurers outside of Canada. So Trisura has been somewhat uniquely positioned to take advantage of that opportunity.

We have the infrastructure and scale to provide the right platform and partnership for these reinsurers. But it’s typically in lines we don’t compete in. So this sets us up uniquely in the market to provide this access. And frankly, the demand from these reinsurers has been significant, probably more significant than we anticipated it would be in these Canadian markets. So it is a slightly different structure than the U.S., much more of that fully fronted model and driven by reinsurance demand for our Canadian business…

Jeff Fenwick

I guess the follow-on then is, is it an instance here where they are – you’re effectively taking share from the existing market, I assume, rather than being an absence of capacity locally. And when you think about that, I mean, how much further could this business scale potentially?

David Clare

It’s difficult to estimate. The Canadian market doesn’t have the same statistics of the U.S. market on tracking originated premiums and foreign reinsurer participation. But you’re right, in the interpretation here is that we are providing new capacity to the market. So this capacity we’re providing obviously provides more opportunities for risk to be placed in other markets.

That is a great narrative for our broker partners, for insurers to have more access to solutions. So it’s difficult to say exactly how big that market is. We expect – usually, we do this kind of a bottoms-up basis that the growth rates for Canadian fronting are likely the high teens to low 20s in the next year. So still significant momentum in that group. But I don’t have a top-down estimate of that market at this stage.” — Q4’23 earnings

“David Clare

Can you talk to me a little bit about Fronting in Canada, maybe the opportunity that we have and the types of risks we’re navigating?

Chris Sekine

Yes, it’s a great question because there isn’t necessarily a Fronting market like other lines of business. In a lot of ways, it’s – I feel like we’ve made the market in some ways. And the types of risks that we have written are really risks that Trisura does not write directly ourselves. And so the appetite and the capacity comes from our fronting partners.” — ‘24 investor day

“David Clare

How have you been able to scale this Canadian practice and continue to outperform an ROE basis? It’s been a very strongly growing platform, but one that’s actually increased its ROEs through that period of time.

Chris Sekine

Yes, absolutely. Our Fronting business has certainly helped us improve our ROEs, but growth – profitable growth has really been impactful to that on an overall basis. And that’s our continued plan for the future is growth, but not just growth for growth sake. It has to be profitable underwriting growth that we target. And that will be our continued formula for outperforming on the ROE side.” — ‘24 investor day

“Jaeme Gloyn

And then last one, shifting to the Canadian Fronting business. It sounds like it’s a lot of foreign reinsurers and it’s their demand, and it’s really like based on their demand, that’s what kind of premiums you’re going to be writing. So maybe kind of went through some of the factors that make Canada attractive. But what are some of the factors that could lead to a foreign reinsurer just deciding to turn the taps off one day?

David Clare

Yes. I think it’s a smart question, Jaeme. I mean, the question would be does reinsurance appetite go away for this Canadian business. And we would say 2 things. One, the scale of this business is still very small in this market.

And so there’s a lot of room for these groups to grow. And they want to grow today, right? Many of the partners that we’re working with are keen to continue to do more. That opportunity, we think, again, is still only scratching the surface for those vehicles. But the item that could change that is performance, right?

The performance of these programs, the performance of these partnerships, to the extent they’re not meeting hurdle rates for us or for those reinsurance partners, that’s when you’d start to see a reduction in premium generation. And I would highlight, we look at this a lot in trying to size the market. The absolute size of these premiums coming in both in the context of these reinsurance portfolio but also in the Canadian market, still quite small today. So we do think there’s a lot of room to grow.” — ‘24 investor day

According to Markel filings, State National (the largest US fronting carrier) did ~$3.7bn in GPW in ‘23, generating revenue of $156m and $124m of income before taxes (an 80% operating margin). While Markel does not disclose the capital position for the State National business, if we conservatively assume a 7x premiums-to-capital ratio (Trisura runs at ~6x), the business would’ve required roughly $500m of average capital in ‘23. That would equate to a pre-tax ROE of ~25% ($124 of pre-tax income / $506 of equity capital), and ~20% after-tax.

“And from Trisura’s perspective, today, that investment income is very, very predictable. Investment-grade bonds today, we know very quickly where they’re going to produce income in the next 12 months. But fee-based income is also worth highlighting because, from our perspective, the fees that we collect in our Fronting practices and our hybrid Fronting practices, they’re very predictable and they earn out in a very predictable way. And so what you have in Trisura, if you translate this on an earnings per share perspective, is if you look at Q1, from our perspective, roughly 2/3 of our earnings per share is coming from components of the book that are predictable and recurring. And what that means is a lot of our income, therefore, is predictable and should be relied on in a different way than other insurance companies.” — ‘24 investor day

“Jaeme Gloyn

Okay. Great. And with respect to the E&S market on the U.S. side, are there – given the high grading of the program portfolio at this point, are there particular lines that you’re more interested in, less interested in? Can you give us a little bit of context around how you’re viewing the next several months in E&S?

David Clare

At a high level, we’d like to target about a 60% casualty, 40% property mix. If you drill down into that segmentation, we don’t love property exposure that has significant catastrophe potential. We really just don’t think it’s appropriate for a company of our size, not an entity that’s focused in prioritizing recurring fee income. So that is a bit of a result of – or driving a bit of the result in high grading in these programs. Those two that they took out had a little bit more catastrophe exposure than we thought was appropriate.

From our perspective, going forward, you’re going to see us continue to focus on that 60% casualty, 40% property mix. And staying in lines that we think have an appropriate loss ratio experience and volatility experience for an entity of our size and focus.” — Q2’21 earnings

“David Clare

What about on the other side of that, when you see a program coming in, into the pipeline or a submission. What’s a red flag you look at that would kick it out of your consideration process?

Michael Beasley

Yes. A lot of it’s reputation and then you have a lot of – if it doesn’t have – we don’t think it can attract reinsurance. If it’s in a line of business that we don’t like, such as workers’ comp, long-term liabilities like Med Mal or if it’s property cat exposed. We believe this is going to be one of the worst property cat seasons in the history of the insurance industry, and we’ve completely transformed our book to be mostly out of property cat. And the ones that we have, we’re very well protected.” — ‘24 investor day

“We have a very exhaustive intense due diligence packet. So if I get 10 of them in, I'll send -- or 10 submission opportunities in, we'll send out these due diligence packets. And then unfortunately, our hit ratio comes back at about 20%. And then we spend a little bit of time trying to fill in all the gaps…

The reason we like to vet so much is because we want to take risk, and we want to be comfortable with the MGAs that we're vetting and that we're doing business with. And in order for us to be comfortable, that's where it takes to the reinsurers comfortable. So where some of our competitors go to the reinsurance market first and do their due diligence afterwards, we do the opposite…

And then the nice thing is once you do this and as long as you service your program well and keep the reinsurers happy on the back end, these programs are very sticky. We have not lost any program since we've started to another carrier or anything else. Some have gone into runoff or poor results, but I would say 90% of our business is very sticky and it's stuck with us.” — ‘23 investor day

“David Clare

We’ve got a question here on fronting fees. And we’ve usually talked about fronting fees as sort of averaging kind of 5% to 6% in this platform. One of the questions I get a lot is, there’s been a lot of new competitors in this space. There’s been a lot of new entrants. Do you see pressure on that? I think we’ve had general success in defending those rates of fronting fees. Is that fair?

Michael Beasley

Yes. That’s been part of our back end, like Chris said earlier. Being able to service your clients and being able to keep them happy enables you to continue to charge an appropriate front fee and being able to take risk and do some other things that some of our competitors can’t. We’ve had a couple of competitors try to target a lot of our higher profitable programs, offering much more reduced rates, front fees over what we currently charge and we did not lose a single one. So I think part of that is a known commodity or a known entity is a lot better than someone that they’ve never done business with before.

And moving your business to another paper just over price, most of these guys don’t want to do that. And I think that would be very shortsighted if they did.” — ‘23 investor day

This chart is outdated (from 2021), but shows you how much of an outlier Trisura was in terms of its DWP per program. For example, Clear Blue, which had slightly more DWP in 2021, had far fewer programs (12 vs. 62).

“So we have two clients really. It’s the program administration – or program administrators in the market, and it’s the reinsurance community. So the program administrators, we needed to be able to demonstrate access to capacity, a flexibility of licensing, a broadly licensed platform across both E&S and admitted markets and sophistication of interaction. So you need to have good IT systems. You need to have good auditors, good actuarial teams to evaluate and work with these program administrators in running their programs.