Disclaimers: I own Veeva shares; this is not investment advice

Veeva is the global leader in cloud software for the life science industry, serving ~1,500 customers, including ~47 of the top 50 global biopharmaceutical companies.

Since its IPO in 2013, Veeva has grown its revenue more than 13-fold (a ~26% CAGR) while maintaining best-in-class operating margins (~40% non-GAAP over the last five years).

Yet despite this level of profitability, Veeva has spent the past 4+ years investing heavily in a range of new applications. These products are reaching maturity and beginning to take real share in markets where Veeva is generally out-innovating legacy providers. These markets are also large — many of them are ~$1bn opportunities.

With its tentacles now spanning virtually the entire commercial and R&D functions of its customers, Veeva is exceptionally well-positioned to bring AI to the industry. After some initial skepticism on the technology, Veeva’s CEO stated just last quarter that through AI he thought Veeva could increase the efficiency of the entire life science industry by ~15% over ~5 years. Across a $2 trillion industry, that would represent a staggering ~$300bn in efficiencies! Veeva’s AI offerings are slated to begin rolling out in earnest around the end of the year.

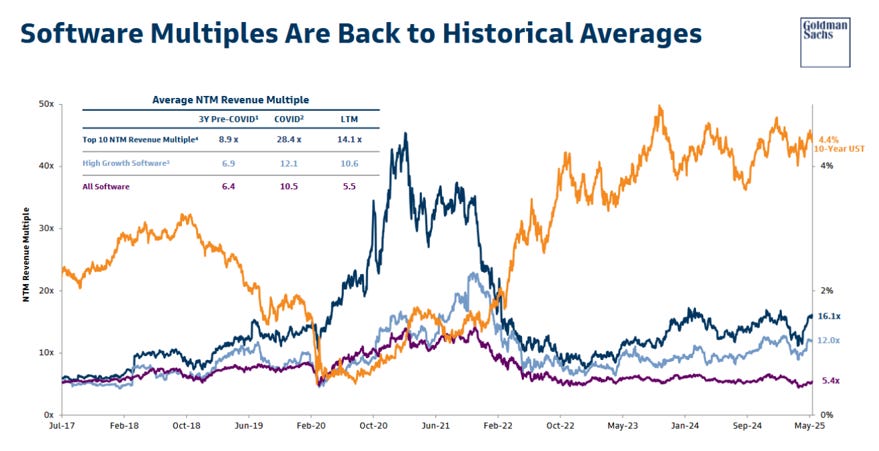

While Veeva will undoubtedly grow from here, is the future so bright that it justifies Veeva’s current ~15x revenue multiple? I’ll examine below.

Business Overview

Veeva was founded in 2007 by Peter Gassner and Matt Wallach. Its original product was a life science-focused CRM, built on top of the Salesforce platform.

The company chose life sciences as its initial area of focus because “horizontal” CRM solutions simply wouldn’t suffice for the industry’s complex and regulation-heavy set of requirements. Furthermore, at the time, Veeva benefitted from (1) there being no true cloud (i.e. multi-tenant) solution for the industry and (2) the fact that the industry’s primary incumbent — Siebel — had a solution so byzantine that certain clients reportedly felt it necessary to spend $5-10m on projects just to reduce its complexity.

Veeva won its first contract with Pfizer — on a niche product with just 6 sales reps. For the next ~12-15 months, Veeva focused the entire company solely on Pfizer’s success as a client. Veeva would graduate to a 23-rep product, then a 35-rep product, before winning an RFP for Pfizer’s entire US sales force. After cementing its position with Pfizer, Veeva continued to focus solely on CRM — first within just the US and later globally.

In 2012, Veeva began introducing products for the R&D (or “drug development”) function of its life science customers — a function basically entirely separate from CRM/commercial.

Over a decade of cross-selling ensued and continues to this day (in fact Veeva is still in the earlier innings of this). As it turned out, this was a very large opportunity as well as a landscape littered with point solutions.123 Veeva has replaced up to 200 different vendors for certain customers over time, generally charging less (and offering a better product) while itself generating super normal profitability.

Looking back, it was the perfect strategy at the perfect time with the perfect team…

Using just $7m of VC capital (and spending only $3m of that), Veeva today sports a market cap of ~$48bn on ~$3bn of revenue. It sells over 50 different applications across the commercial and R&D functions, with revenue split roughly 50/50 between the two areas.

Key Investment Merits

Extremely Sticky

Veeva is maybe the preeminent example of vertical SaaS stickiness:

The software is built from the ground up for the life science industry. In life sciences, regulatory forces are onerous and change by the geo (from country to country and even state to state).4 Things like “pharmacovigilance” must be tracked meticulously5 and applications that seem simple on the surface, like Events Management, are muddied by industry-specific compliance requirements.6 Veeva has a deep, deep understanding of the industry and offers products that are built from the ground-up to address these requirements.

The software is mission critical. Pharma companies can’t operate without Veeva’s solutions. In some cases (i.e. the Safety suite), if Veeva were to fail, a customer would have to immediately stop all commercial activities.

Veeva’s offerings are predominantly “system of record” solutions. Veeva acts as the primary, authoritative database for much of the data it touches. This increases switching costs in a major way.

The software consists of integrated suites of solutions. These suites are designed to talk to each other seamlessly and remove very material integration headaches for Veeva’s customers. Customers are thus incentivized to “standardize” on Veeva, or adopt Veeva for every application in a suite.

Veeva has a highly trusted brand. Veeva has become the “no one gets fired for buying IBM” brand. Except it’s really that on steroids — many Veeva offerings are in areas of ultra-high conservativism for its customers (clinical trials, safety, quality). You simply cannot mess up one of these applications.7

For all these reasons, a competing product doesn’t stand much of a chance — and indeed, Veeva really hasn’t seen any credible new entrants since its founding ~20 years ago. A competing solution would need to be perhaps 2x better to have any real shot at success. And there’s just no way to be 2x better at this point over any reasonable period (expect perhaps through through a paradigm shift like AI — I’ll address that later).

Product Excellence

From its founding, Veeva’s greatest priority has been product excellence. From its 2014 investor day:

“So if you look at Veeva and how we're founded, we were founded by some super product people. I'm a product person in my bones. And we have people that know how to really develop product, design product, market product, sell product, service product. Product, product, product. And we decided, and we wrote this down very early in the company, probably within the first 3 months, we're going to have product excellence.”

Veeva’s approach to product is that every application it introduces should win on a standalone basis, or be “best of breed.” The fact that an application integrates neatly with the suite around it should simply be an added bonus — not the reason for winning. From its 2015 investor day:

“When we say it's integrated and best-of-breed, best-of-breed means if they were going to go do an RFP for just e-mail, if we have an e-mail product, they should be choosing ours. We're going to invest until it is the very best product in the market, and the fact that it's beautifully, perfectly integrated with the rest of the Commercial Cloud, it's kind of gravy.”

Getting there isn’t easy. According to management, it requires great product people working intelligently for 4+ years. It requires making the right product decisions over and over again, day in and day out. And while it’s a subjective metric, I think its fair to say Veeva has achieved this (or will achieve it) across the majority of its offerings.

Product excellence makes everything easier:

It makes sales easier. Sales come much easier when you have a reputation for great products. Even more so when you are selling to a customer where you’ve already sold and delivered on great products.

It makes professional services easier. Veeva believes its professional services personnel enjoy their jobs more/have longer tenures because they are working with customers who generally like and appreciate Veeva’s products.

It improves morale throughout company. If you are constantly dealing with customers that like & appreciate you, you will have a lot better morale than if you are dealing with customers that don’t.

Product people enjoy working there. Product people at Veeva are building the industry’s best products for the industry’s leading customers.

Gassner, a platform engineer by trade, still reportedly sits amongst Veeva’s platform engineering team.

Customer Goodwill

Veeva prides itself on its customer friendly behavior.

Veeva has a goal of being the “leader and liked.”8 They want to be essential to the industry, but also appreciated by the industry. From a Jan-23 JPM conference:

“We want to be essential to each company in the industry and appreciated by each company in the industry. That's a super high bar because when you become essential, truly essential, you tend to not be appreciated because there's some resentment towards that. And you also get — you get arrogant and lackadaisical when you're essential. But that's our bar. We want to be essential to the industry and appreciated by the industry.”

Some examples of their customer-friendly behavior:

Lack of price increases. Veeva didn’t increase subscription pricing on existing customers from 2007 through — wait for it — 2023. Yes, that’s right — zero price increases over 16 years despite a clear ability to do so (and a competitive set that was supposedly raising prices by ~5-7% annually). When Veeva was ultimately somewhat forced to as a result of COVID-era inflation, they pegged increases to the lesser of CPI or 4% annually.

PBC. Veeva converted to a public benefit corporation (PBC) in 2020. This means that Veeva now has a legal obligation to balance the interests of customers, employees and shareholders (vs. just prioritizing shareholders). This was always how Veeva strived to operate in reality, but the PBC conversion made it a legal duty at the Board level. Management believes this will help hardcode such behavior into the company’s DNA for the long-term — beyond the tenures of Gassner, Wallach & co.

Understaffing sales. Management believes in purposefully understaffing its sales team because it leads to better sales behavior.910 They don’t want reps using aggressive tactics to make a quarter or go for the last dollar; they want to incentivize long-term relationship building. Maintaining a high number of opportunities per rep and achievable quotas helps accomplish this.

Annual contracts. When Veeva launched, its contracts were annual which was a departure from the multi-year industry standard. Primarily Veeva did this because it didn’t want to discount its offering, it should be noted. But Veeva also did it to establish a mindset of having to win a customer’s business every year — to ward off laziness.

While this type of behavior sacrifices some near-term profits, it’s great long-term stewardship. They do right by their customers. They deliver great products. They are okay perhaps being a little underpriced relative to the value they provide. They don’t go for the last dollar. This all results in happy customers. Happy customers buy more products and happy customers don’t churn. From its 2014 investor day:

“The last one is customer success. For those of you who have spent a lot of time with us, you know that this is not just lip service. This is what drives our company, but it is also what may keep other companies out. Because if you're going to go start a software company, you're not going to take on a company that has a big installed base of customers that are happy. You don't do that.

Enterprise software is hard. You don't want to rip that stuff out. So you have to be unhappy for a couple of years before you really want to throw out an enterprise software system. So the success that we have, our customers want us to do more, like the call that Peter got, the calls that we get every week. ‘Hey, are you going to go into this? We're going to do a project. I really don't want to buy it from that niche point vendor, would you please do it and we'll just add it to the Veeva landscape.’

So it's hard to compete against an enterprise software company with happy customers. I would never start a software company to go compete against SAP in life sciences. They're well respected, the people are humble, they're still working hard even though they've sort of sold out the patch. You wouldn't do that because companies are happy with SAP.

By the same token, they're happy with Veeva. And so we're not so much of a target. And we actually haven't seen any companies start and compete with us with multi-tenant cloud applications in any of the markets that we compete with.”

Host of Emerging Products

Veeva has developed a host of new applications over the last 4+ years that have really just begun to mature and generate revenue.

The chart below from Veeva’s latest investor day shows certain of its large product categories by product maturity and market share. As you can see, most are still in the bottom-left quadrant.

These products are in markets that are generally large and underserved by smaller, legacy competitors.

I believe this has Veeva well-positioned for its next leg of growth — I discuss extensively later on.

Great Team

Peter Gassner has served as Veeva’s CEO since the company’s founding. Gassner and team (the senior team has an average tenure of ~10 years) have a distinguished track record.

Built a ~$48bn market cap company on just $7m of VC capital

Grown revenue by 13x since its IPO in 2013, a CAGR of 26% over 11 years

Achieved a GAAP operating margin in the mid-20%s and a non-GAAP operating margin in the low-40%s, both best-in-class vs. software peers

All while setting the company up for a strong next leg of growth with a host of emerging and promising products

While getting up there in age, I’d expect Gassner to lead the company for at least the next 5 years.

Tremendous Financial Model

It’s got everything you could ask for:

High gross margins

High operating margins

Minimal capital requirements

High revenue per employee

Substantial consistent excess cash flow

High ROE

100%+ net dollar retention

Exceptional CLTV/CAC metrics

“Rule of 40” vs. peers:

CAC payback vs peers11:

About as Non-Cyclical as You Can Get

Veeva supplies mission critical systems to a non-cyclical end market. Patients need their medicine no matter the macro environment.12 ~83% of Veeva’s revenue is subscription-based.

Well Positioned on AI

In short, Veeva seems extremely well positioned for AI. I think for Veeva, AI will be a “sustaining” technology and not a “disruptive” one. And I think Veeva will benefit from a larger TAM, even more compelling products and/or internal efficiency gains. I examine later in greater detail.

Product Overview

Veeva’s product portfolio extends across the “commercial” (i.e. sales & marketing) and “drug development” (i.e. clinical trials through manufacturing and safety monitoring) functions of its life science customers.

This is what Veeva is going for, essentially (from its 2017 investor day):

SAP can handle the ERP; Veeva will take everything else…13

Today Veeva has 50+ applications that fall into 5 main product categories:

Commercial Systems (e.g. CRM, PromoMats, MedComms, Crossix, Compass)

Drug Development Systems:

Clinical Operations (e.g. eTMF, CTMS, RTSM)

Clinical Data Management (e.g. EDC, CDB)

Regulatory & Safety (e.g. Safety, Submissions)

Quality (e.g. QualityDocs, QMS, LIMS)

As you can see above, Veeva’s solutions look like an “alphabet soup” and are not easy to keep straight upon first pass (or second or third…).

Below I’ll try to shed some light on each area.

Commercial Systems

Veeva’s first product was a life science specific CRM developed on top of the Salesforce platform and introduced in ~2007. Today Veeva dominates this niche, with ~80% market share of all pharma sales reps globally.

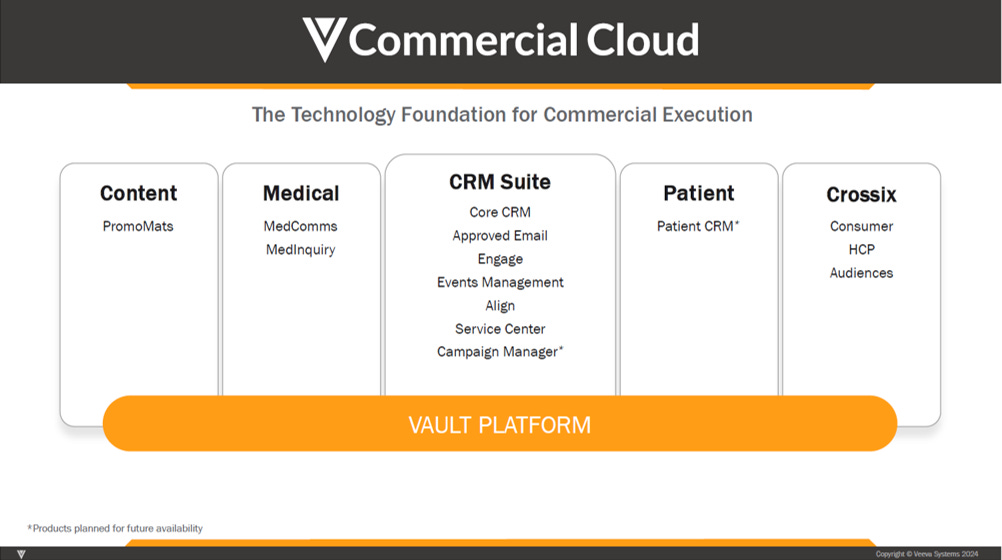

Over time Veeva developed a suite of complementary add-on applications, which altogether Veeva refers to as its “Commercial Cloud.”

Below is a look at how some of its core commercial products have penetrated the world’s top 20 pharma companies over time.

Note: the top 20 pharma charts that follow are based on “unofficial” data. Veeva does not formally report on these metrics, say every quarter. Rather, they provide intermittent disclosures, such as after a new top 20 win, in earnings releases or on investor calls. So while I think they’re useful, they won’t be fully accurate (and some could be materially off).

Veeva’s count of top 20 pharma customers is an important metric because the industry is disproportionately top-heavy — the top 20 represent approximately half of all industry revenue.

Note the CRM line and the PromoMats line are overlapping — they both count 19 of the top 20 pharma companies as customers, which was first disclosed by the company at its 2017 investor day. Veeva’s top 20 CRM customer count will likely tick down a bit as a result of a CRM platform shift that is underway — I discuss this later. Also the Compass/Crossix wins solely represent brand wins (of at least one) within a top 20 pharma customer (and are far from winning these customers’ entire portfolio of brands).

As we can see above, Veeva has dominated CRM/PromoMats for many years, and is only just beginning to scratch the surface in the Crossix/Compass markets.

Below is some detail on the commercial suite beyond the CRM:

PromoMats (announced 2011): content management application supporting the full lifecycle of promotional content. It enables content creation, review and approval (a critical function in life sciences), digital asset management (DAM), etc. PromoMats is connected with CRM for automatic distribution of promotional content via applications like CLM (Closed Loop Marketing) and Approved Email

MedComms (announced 2011): content management application supporting the specific needs of Medical Affairs (a function within the pharma industry that focuses on communicating scientific and clinical information about a company’s products to HCPs and the public). It enables content creation, review and approval, storage, management, and distribution.

Approved Email (announced 2013): compliance management for email communications with HCPs (healthcare providers)

Events Management (announced 2015): end-to-end compliant event management

Align (announced 2015): sales rep territory management

Crossix (acquired 2019): (1) marketing spend measurement & optimization and (2) programmatic advertising. Crossix is supposedly the clear market leader in measurement and earlier in programmatic advertising.14

Service Center (announced 2023): application for inside sales, contact center, and hybrid reps that enables inbound and outbound engagement across channels [still in early development]

Campaign Manager (announced 2024): application for marketers to create and execute HCP campaigns [still in early development]

Veeva also has a set of data products that tie mostly into the commercial suite, designed to optimize and enhance the S&M function. Veeva calls this its “Data Cloud.”

OpenData: global reference data of healthcare professionals (HCPs) and healthcare organizations (HCOs). It contains HCP names, addresses, contact information, specialty, compliance data (license information and industry identifiers), and affiliations (and is available in 100+ countries). I believe the vast majority of Veeva’s CRM customers also subscribe to OpenData.15

Link: deeper data on key accounts/key opinion leaders, etc. A “life science-specific LinkedIn on steriods”16

Pulse: benchmarking data based on anonymized commercial activity across Veeva’s entire CRM customer base. Veeva is introducing the Pulse product within R&D as well (for its applications that help manage clinical trials)

Compass:

Compass Patient: Compass Patient is anonymous patient longitudinal data, including dispensed prescriptions and procedures and diagnoses for the U.S. market

Compass Prescriber: Compass Prescriber is projected prescriptions and procedures at the HCP, HCO and Zip level for retail and non-retail products. It covers more than 4,000 brands for the U.S. market

Compass National: Compass National is projected prescriptions and procedures at the state and national level for retail and non-retail products. It also covers more than 4,000 brands for the U.S. market.

Drug Development Systems

Starting in 2012, Veeva began introducing software for the drug development function. This function is basically entirely separate from commercial, so this was not an “add-on” product to its existing suite, but more of an exercise in “starting from scratch.”

Today, Veeva’s “development” revenue represents ~50% of its total revenue, and is expected to represent about 2/3rds of total revenue by 2030.

Clinical Operations

Veeva’s clinical operations suite helps life science companies build and execute clinical trials.

As you can see below, Veeva has steadily built a dominant position in the market. Veeva counts 19 eTMF customers and 17 CTMS customers in the top 20 as of Q1’FY26 (Veeva expects the final top 20 to select Veeva eTMF this year, per the Jun-25 William Blair conference).

Veeva’s first product in the suite was eTMF, introduced in 2012. eTMF, or electronic trial master file, is a content management platform for clinical trials. It houses all documents related to clinical trials, and provides full enterprise content management capabilities for upload, version control, QC/approval, and real-time co-authoring with Microsoft Office for study documents.

As of Q1’FY26, 19 of the top 20 pharmas use it (450+ customers total), as do at least 4 of the top 6 CROs. The success of eTMF formed an important beachhead within clinical ops.

Veeva followed up eTMF with CTMS (Clinical Trial Management System), introduced in 2017. CTMS acts as the hub for clinical trial monitoring and management (for both insourced and outsourced trials). CTMS was designed to work seamlessly with eTMF, and together they form the core set of applications needed for clinical ops.

Veeva’s broader clinical ops suite:

Study Startup (announced 2015): manages the start-up activities of a clinical trial, including feasibility, qualification, and activation of research sites.

Site Connect (announced 2020): allows sponsors and research sites to collaborate on a trial by automating the flow of information to and from sites during start-up, execution, and closeout

Payments (announced 2020): manages reimbursements to research sites and tracks study budgets

RTSM (Randomization and Trial Supply Management; acquired in 2021): used by sponsors, CROs, and sites on clinical trials to randomize subjects and manage trial supplies

Study Training (announced 2022): manages GCP and study-specific training for research sites, CROs, and sponsor personnel. It provides document, video, and SCORM/AICC training, in addition to quizzes and classroom capabilities based on curricula and training requirements

Disclosures (announced 2023): manages the sharing of study registrations and results disclosures with registries

OpenData Clinical (announced 2023): provides compliant reference data on global investigators and research sites

Clinical Data Management

Veeva’s clinical data management suite helps life science customers collect and process the data generated by a clinical trial.

This is an area of very high conservatism for life science customers, who are quite reluctant to move off of systems that work “well enough”. Yet as we can see below, after ~6 years of development, Veeva has seen a nice uptick in customers over the last few years.

The EDC (Electronic Data Capture) application was the first product in the data management suite. Introduced in 2016, it was designed to tie into Veeva’s eTMF product. The EDC provides an end-to-end environment to collect, review, and process trial data about patients. The EDC served as a beachhead within the clinical data management space — similar to eTMF in clinical ops.

Veeva followed up EDC with CDB (Clinical Database) in 2018. The CDB aggregates, cleans, and transforms clinical data from all sources (including Veeva’s EDC, third-party EDCs, labs/imaging, ePRO, etc.). This creates a unified and harmonized dataset for a comprehensive view of trial data. It's an environment where the customer can clean and format their data so that it ultimately can be submitted to a health authority.17

Veeva’s eCOA (electronic Clinical Outcome Assessment) solution is the latest addition to the suite (announced in 2022). The eCOA captures questionnaire responses directly from clinical trial patients (ePRO), clinicians (eClinRO) or patient caregivers (eObsRO) using an app or webpage. Sponsors manage the eCOAs through their own interface, and a central library allows them to reuse eCOAs across studies, where appropriate. Sites have a simple access point to manage their participants and can review eCOA data and adherence.

Regulatory & Safety

After a clinical trial wraps, a pharma company or trial “sponsor” must build a regulatory package, submit it to the health authorities and then continue to demonstrate that its drug is safe and efficacious post trial. Veeva’s Regulatory and Safety suites support these functions.

Similar to CDMS, Veeva has been steadily gaining share over time in its RIM (Regulatory Information Management) suite. In Safety, another area of extreme conservatism for life sciences customers, Veeva, just in Q4’FY25, doubled its number of top 20 customers from two to four.

The RIM suite started with Submissions which was announced in 2013. Like eTMF, this is a content management application. It is used to plan, author, review, and approve regulatory submissions. Veeva expanded the suite with:

Submissions Archive (announced 2015): secure repository of applications submitted to health authorities

Submissions Publishing (announced 2017): generates electronic submissions for global health authorities

Veeva Registrations (announced 2015): allows sponsors to plan, track, and report on global product registrations as well as handle health authority correspondence and commitments

Once drugs have been licensed for use, sponsors must continue to monitor their effects, especially in order to identify and evaluate previously unreported adverse reactions. This is a practice known as “pharmacovigilance.”

Veeva’s Safety applications operate as a unified pharmacovigilance system. Veeva Safety (announced 2019) is a individual case safety report (ICSR) management system that manages the intake, processing, and submission of adverse events for clinical and post-marketed products (also called Adverse Event Management). Other applications in the Safety suite include:

SafetyDocs (announced 2019): content management for safety-related content and processes

Signal (announced 2020): tools for signal detection from various data sources, utilizing advanced statistical methods to identify potential safety issues

Safety Workbench (announced 2023): application designed for complex reporting and data analysis on large volumes of data within the safety suite

Quality

The Quality suite relates to the drug manufacturing process. Once a drug is approved, a sponsor must ensure its manufacturing processes meet certain quality standards.18

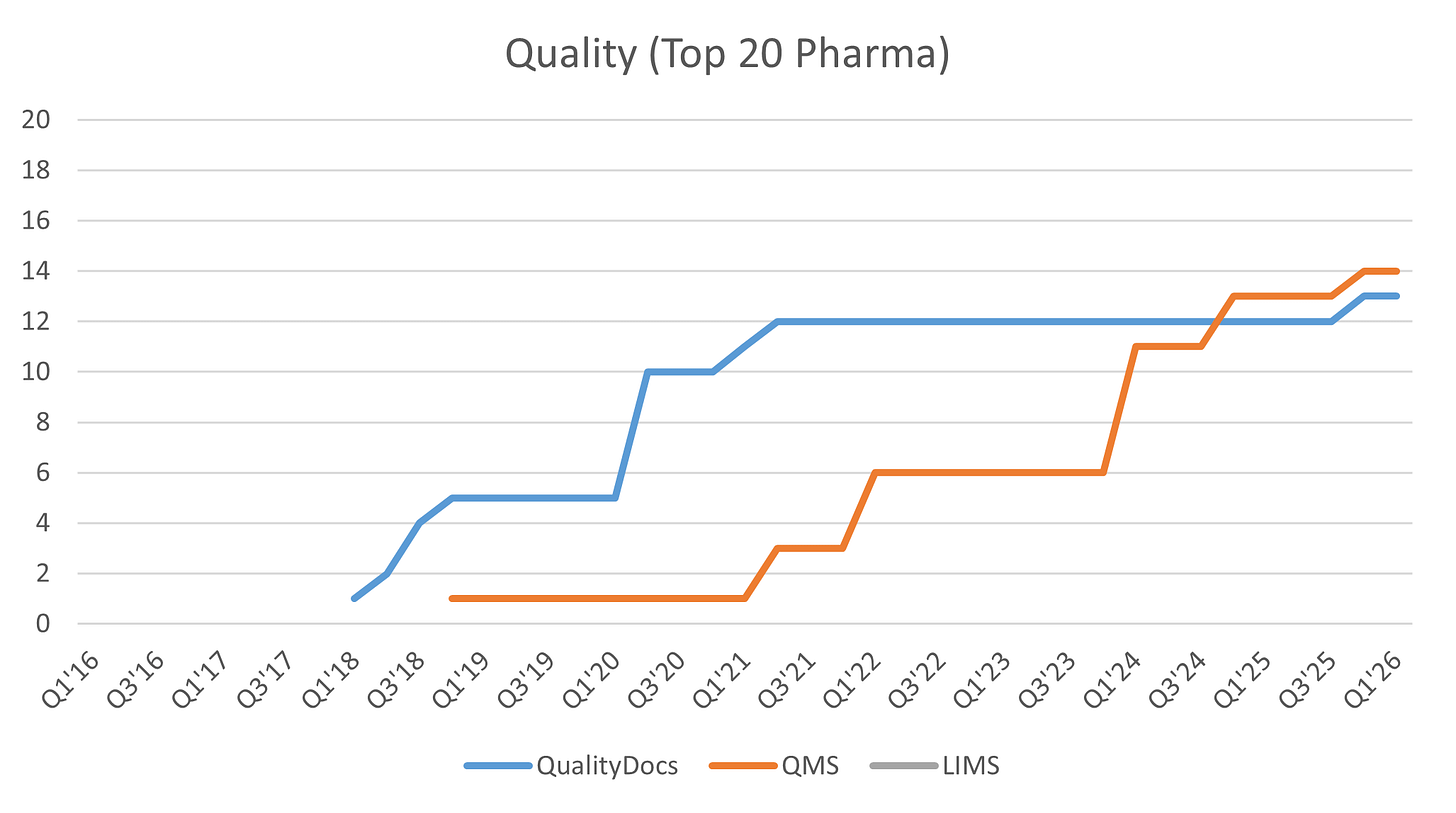

Veeva, again, has generated strong momentum in the suite, with QualityDocs and more recently QMS winning over 50% of the top 20 pharmas as customers. The LIMS application, announced in 2021, I believe has yet to win a top 20 pharma customer.

QualityDocs was Veeva’s first foray into the space, announced in 2013. QualityDocs is the industry-leading GxP quality content management application (for standard operating procedures, quality agreements, batch-related documentation, etc.), with 13 of the top 20 pharmas using the product as of Q1’FY26.

Following QualityDocs came QMS (Quality Management System) in 2016. QMS is a system designed to manage life sciences-specific quality processes. It provides best practices for handling complaints, deviations, audits, and change control. It also allows external partners to access the system to collaborate on investigations, audit findings, and corrective actions.

LIMS (announced 2021; Laboratory Information Management System) is another key product in the suite, allowing customers to manage laboratory operations more efficiently and compliantly.19

Additional products in the Safety suite include:

Training (announced 2018): a learning management system (LMS) designed for GxP compliance

Validation Management (announced 2021): streamlines commissioning, qualification, and validation activities across computerized systems, facilities, utilities, equipment, and processes

LearnGxP (acquired in 2021): an accredited training library that can be deployed with Veeva Training or other learning management system

Batch Release (announced 2023): automates aggregation, reviews, and traceability of batch-related data and content to enable faster, more confident GMP release and market-ship decisions

Next ~5 Yr Opportunity

My TL;DR view regarding the next five years is that I believe Veeva will gain significant share across the following large product categories: EDC/CDB, eCOA, RTSM, Safety, LIMS, QMS and CTMS. I believe these gains will power Veeva’s revenue from ~$3bn to ~$6bn by 2030.

It’s not an easily digestible bull case, but perhaps therein lies a bit of opportunity for investors. It’s a broad-based opportunity for Veeva across a number of areas that are (1) not easy to necessarily understand, (2) not the easiest to size from a TAM perspective and (3) subject to varying degrees of competition.

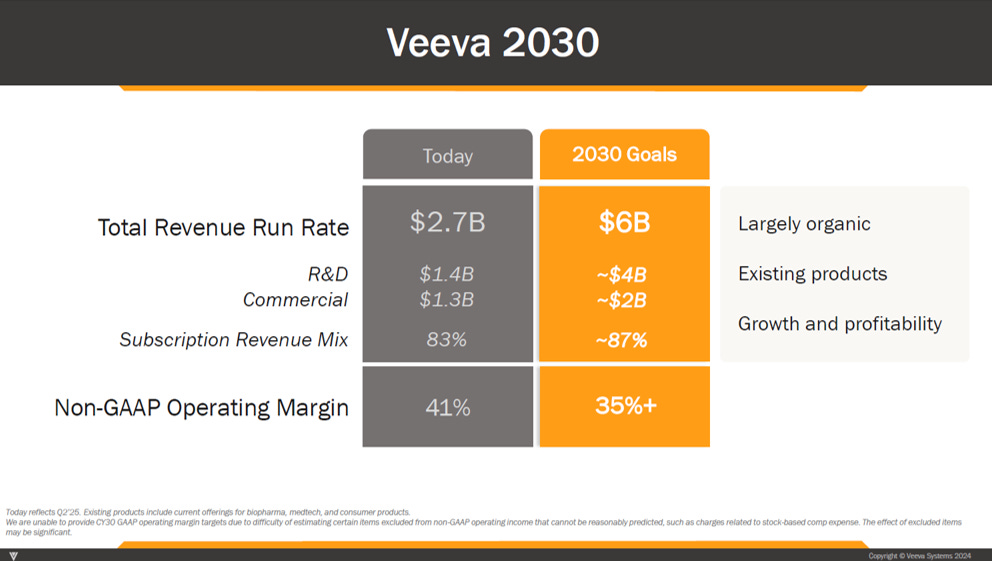

Management’s 2030 Revenue Target

But before examining, we should note that we actually have a management target for 2030 revenue (they provided one at their 2024 investor day).

Management believes Veeva will get to a $6bn revenue run rate by calendar year 2030 (~$4bn from R&D and ~$2bn from Commercial).

And notably, management is batting 1000% when it comes to hitting long-range financial targets. They’ve previously laid out 2 long-range financial targets — $1bn in run rate revenue by 2020 (set in 2015) and $3bn in run rate revenue by 2025 (set in 2019).

Veeva achieved both targets about a year early.20

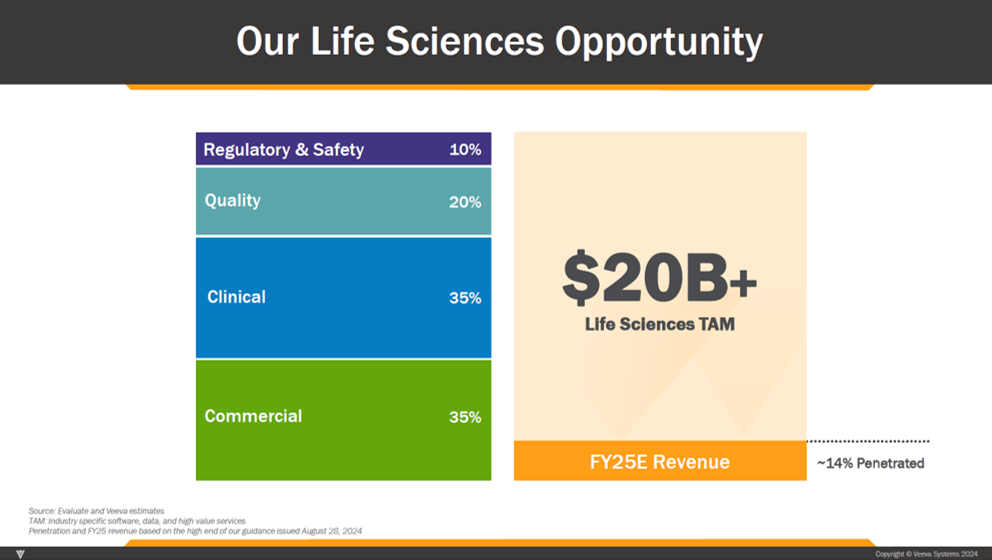

TAM Discussion

Handicapping growth by product area starts with a look at TAM by product area.

Veeva management outlines a TAM of $20bn across its current set of application areas. Within that, Commercial and Clinical (Ops + Data) represent TAMs of approximately $7bn each, Quality a TAM of $4bn and Regulatory & Safety a TAM of $2bn.

While Veeva discloses TAM at a high level for each of its product areas, it does not at the application level. So we are left to make educated guesses here based on management commentary.

In terms of Veeva’s market share by application, management kindly broke this out for us in very nice detail at its latest investor day:

Here is the commentary that came with the chart above, which summarizes some of management’s thoughts regarding its best medium-term opportunities:

“Zooming back out, this is now a broader view of Veeva's major product opportunities across the business. Five of our products are clear market leaders today, CRM, PromoMats, eTMF, Submissions and QualityDocs. Each of these were introduced more than 10 years ago, and they're some of our most mature products. Together, they account for more than half of our subscription revenue today, and they still have some room to grow. After those, we have a lot of products that are in or entering the reference selling stage, CTMS, QMS, Crossix, Link, EDC, Safety and Site Connect to name a few.

These products are the key drivers of the 2030 plan. And then there continues to be a strong pipeline of newer products that are closer to the early adopter phase, including Compass, eCOA, RTSM and LIMS.

These products will continue to contribute through 2030, but more of their contribution will likely be after 2030.”

More color21

Below we’ll try to piece together an understanding of which products are most likely to drive incremental revenue and by how much over the coming ~5 years.

EDC / CDB

Other than CTMS/QMS (more on those later), EDC/CDB is perhaps the easiest area of Veeva’s growth to handicap.

As you can see from the top 20 pharma chart, Veeva has already increased its top 20 customer count from ~2 as of Q2’FY23 to ~9 as of Q1’FY26. With 9 out of 20, by my math you are already at around a ~50% share. Yet as you can see from the market share chart above, Veeva’s EDC product is maybe 10% penetrated, and its CDB product less than that.

The reason being is that Veeva’s EDC/CDB contracts ramp over ~3-5 years, with minimal contributions in years ~1-2. So revenue from these customers has simply yet to show up in a material way in Veeva’s financials.

From a Mar-24 Morgan Stanley Conference:

“So couldn't be happier in EDC. So as you mentioned, we have 8 of the top 20. So let me explain what that means. So that's 8 top 20 customers committing to starting all new clinical trials on Veeva's EDC software…Now these are structured typically by your enterprise customers as predefined multiyear ramping ELAs. So they'll start out small in year 1, and then they'll ramp year 2, 3, 4, it's usually 4 to 5 years before you get to terminal value. So those wins, those 5 over the last 12 months have not meaningfully contributed to our financials at this point but they will as you look out and they ramp in the future.”

And from Q1’FY25 earnings:

“On the EDC side, these are typically longer in terms of duration of the original arrangement. And the first couple of years of those arrangements are relatively small. So while there will be some contribution, I don't expect it -- us to see a material contribution there, and that's included in the guidance that we've given today.”

Therefore, Veeva might conservatively have 33% of this category’s revenue already locked up, without having to win a single new customer. And with the momentum Veeva has shown, it seems likely that 50% market share is a conservative estimate looking out to 2030 (which is the percentage I’m using in my forecast — more on that below).

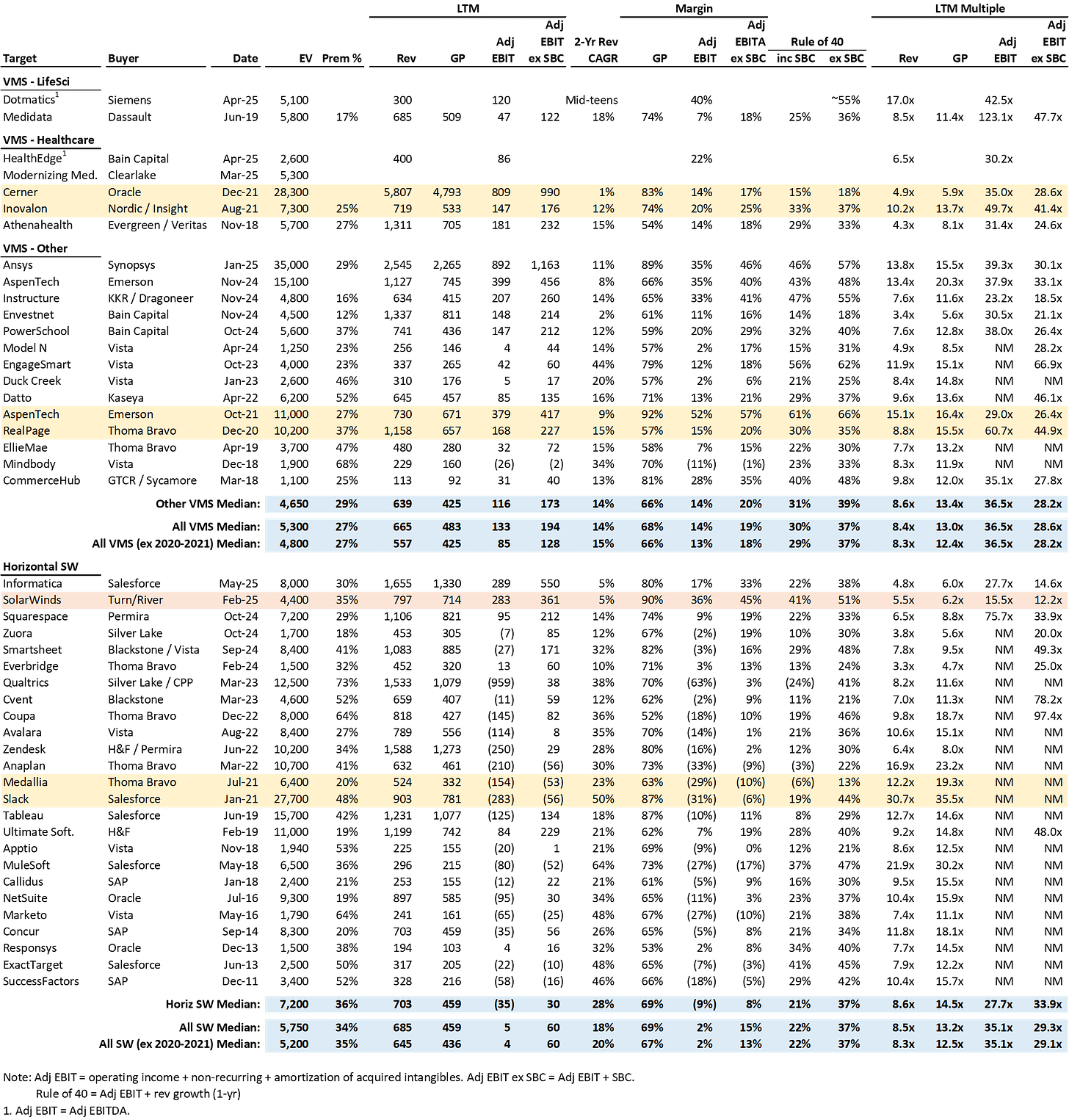

Interestingly, this is an area where, despite Veeva’s strong momentum, it is dealing with one of it’s toughest competitors in Medidata.

Medidata was founded in 1999 and its flagship Rave EDC product became widely adopted by the life sciences industry, which helped replace paper-based clinical trial processes. Medidata went public with around $100m of revenue in 2009 and grew to ~$700m in revenue before being acquired by Dassault in 2019 (10-yr revenue CAGR of ~20%) for $5.8bn (~8.5x LTM revenue).

Veeva believes it is winning vs. Medidata and others due to having (1) a better EDC product (it’s a true cloud product and includes certain important functionality that Medidata and others do not), and (2) an integrated clinical ops and data management suite.22

Gassner sees a path to dominance in EDC. From Q1’FY26 earnings:

“You touched on the eTMF, and I'll just spend a little bit there. I'm really excited about that. The 19 top 20s, and we feel like we have a pretty good path to have 20 of the top 20 on eTMF…

And I'm confident over time, actually, EDC will get there. I think — but it will take time. Today, we have 9 out of the top 20 are using our EDC. Now some of those are very early and those are multi-year ramp deals. I think we have a path to additional top 20s in EDC. I don't see anything imminent right away, but I'm sure customer success will get there over time because we have a structural advantage. People want to integrate a clinical platform from the clinical operations to clinical data management, even reaching out to the research sites.”

More color23

I estimate EDC is a ~$1bn TAM, and together with CDB represent almost a quarter of the $7bn total Clinical TAM. Management has indicated that EDC is one of its largest single product categories on multiple occasions.

RTSM / eCOA

RTSM and eCOA are key elements of the clinical suite and represent very large product categories.

According to management, RTSM/eCOA are each roughly equivalent in size to EDC. From its Q4’FY25 earnings:

“Just to give a perspective, roughly speaking…EDC is one of our larger product line areas, larger opportunities, but RTSM is roughly equivalent to EDC. And eCOA, on its own, is roughly equivalent to EDC. So these are not small areas, they're big areas.”

In fact, RTSM may actually be larger than EDC, representing Veeva’s single largest category (ex Compass). From a Dec-24 Raymond James conference:

“On the clinical side, we talk a lot about EDC and CDMS and some of our legacy products in eTMF and CTMS, but RTSM kind of quietly is our largest single product area opportunity.”

RTSM/eCOA haven’t been the strongest areas of focus yet for Veeva. Certain other apps are more “central” within clinical ops — namely eTMF, CTMS, EDC and CDB. Winning those categories are thus more helpful towards securing the entire suite. Additionally, RTSM and eCOA are areas of very high conservatism for life science customers. From Q4’FY24 earnings:

“RTSM and ePRO first, I would say, these are 2 areas where life sciences is going to be cautious. The randomization and trial supply management, that's very, very critical. If that's done incorrectly, you could have patient safety problems. You could wipe out a significant part of the investment in your whole trial. So they're going to be cautious. Companies are going to try some trials first and see how it goes, rightfully so. And in the ePRO area, the patient reported outcomes, that's a patient-facing thing. So again, they're going to be extra sensitive on that.”

But with Veeva now progressing well in the core areas of clinical ops and data, it is increasingly turning its focus to RTSM/eCOA. And as competing solutions get longer in tooth, and as Veeva’s products continue to mature, I believe Veeva will see material gains here.

One reason is that the competitive set is not strong. Unlike with EDC, Veeva management is not shy about slighting its competitors in RTSM/eCOA. Another reason is that the “suite effect” is especially motivating for customers in RTSM/eCOA because these applications work so closely with the EDC.

From Q4’FY24 earnings:

“Right now, the industry is not well served. If you look at the sort of, I would say, the professionalism of the ePRO [aka eCOA] applications out there or the RTSM applications out there, they're not of the level of professionalism of Veeva, of what Veeva is doing. Our products are getting there. So that's one thing, which is both the products and the services.

And then I think the real topper is the integration, the process integration, for example, between our RTSM and ePRO. We had a discussion last week with some clinical leaders at a top 20 pharma. And when we were discussing the integration that we will do between our RTSM and our EDC and how that affects the prescreening — the screening process and the ability to get patients into the right trials, this can be transformational.”

More support24

Today, Veeva has essentially no market share in either RTSM or eCOA. I assume by 2030 Veeva can get to 20% share in each category.

I assume the TAM for RTSM is $1.2bn and the TAM for eCOA is $1bn.

Safety

Safety is similar to RTSM/eCOA in that (1) this is an area of very high conservatism for life sciences customers, and (2) according to management, the competitive set is not strong.

On conservatism, from Veeva’s 2022 investor day:

“I would say safety is maybe the most conservative area of life sciences because of what you're dealing with. And because if your safety system doesn't operate, your pharmaceutical company can actually be shut down. You can't operate without one. So it's super, super important…

[Let's take] our pharmaceutical CRM product. Historically, companies might start in one division or one region or country. Safety system is not like that because the interconnected nature of health authorities, it's literally one day, the whole system [is moved] over.

So that's why — if you talk about the stickiest of our systems ever, it may end up being our safety system…Customers know they're making a 20-year decision.”

On the competitive set (and more on conservatism) from Veeva’s 2021 investor day:

“[Safety] is a big, complex area, and we're now in year 2. We launched into this space because there are 2 major incumbents that the industry is not satisfied with. They're looking for better execution and more innovation.

And safety is an incredibly important area. If the safety system goes down, the product stops being sold. The fact that we're bringing safety to the cloud is also important. It means our customers won't have to upgrade every time there's a regulation change, which is what they have to do today.”

More on the competitive set, from a Dec-24 Raymond James conference:

“So safety is an area that's been dominated by 2 legacy providers, one that got acquired by a larger company, Oracle, and then one is more of an independent player, both kind of legacy on-premise type systems, trying to make the move to the cloud. We all know that, that's a very difficult transition to go from on-premise to cloud-based computing.

But it's also a — so the competitive environment, it's not as strong. It's a very old legacy model, but these are also systems that are very sticky, right? Once you get that safety system in place, you actually don't want to touch it a whole lot until the pain of maintaining and supporting and upgrading becomes so great that it's actually better to move. So there's a lot of conservatism in that space.

So as time goes on, those systems get older and our product has matured. And now our product is very mature, and we've added now a suite of products around the core safety area. So it used to be just Safety and then we added SafetyDocs. And now we have products around signal detection, being able to look at data outside of the industry and draw comparisons and try to predict the safety events and also analyzing and looking at your own internal company data.

So the suite of products, the maturity of the product offering has all come to create this kind of perfect storm that will play out over a number of years, right? I don't want to kind of over-index on how fast it's going to go, but we're executing well there. I feel good about that market. It feels like we're at a nice inflection point.”

This is an area where customers are reluctant to switch, but where Veeva will have an increasingly more compelling product vs. its competitors over time. Thus Veeva should gain share. Additionally, we seem to be on the cusp of a couple potential accelerants to Veeva’s market share gains. From Q2’FY25 earnings:

“Another accelerant, I would say, is as our EDC product gets more traction and we have customers start hooking our EDC product to our Safety product, there's significant savings there, significant savings. People can be re-purposed to do other things when that connection is done, so that would be — that would get noticed.

And there may be some type of breakthrough that could happen over time, too. Remember, this Safety [product] is on the Vault platform. So it has the complete flexibility of the Vault platform, including the Direct Data API. So what type of AI things can be done on top of that AI, that Direct Data API? What type of AI things?

That will be different than can be — what can be done on the legacy, and that might cause some type of a tipping point.

I believe our strategy for Safety is quite good because we know what we're doing, and we're moving along. There are 2 legacy providers that won't be able to move along at some point and we have a structural advantage. I just don't know when that's going to start happening.”

Given (1) the benefits of integrating Safety → EDC (and Veeva’s growing number of EDC customers), (2) the outdatedness of the prevailing competitive offerings, and (3) the increasing strength of Veeva’s product (+ soon to be released AI functionality), this feels like another market where Veeva is on the cusp of inflecting market share towards 50%+ (from ~10% today per Veeva’s chart above). Adoption has been slow due to a very conservative approach from customers in this area, but I’d expect the dominoes to start falling relatively soon. Given the 2 top-20 customer wins in Q4’FY25, it may be happening now.

I estimate the entire Safety suite (including Signal, etc.) is ~$1.2BN of TAM and that Veeva can capture ~33% of it by 2030. Given they have 20% of the top 20 pharmas today, this seems very attainable.

LIMS

LIMS is another significant opportunity.

It resides within the Quality suite, integrating with QMS and QualityDocs. Veeva’s Quality suite has been taking share, and LIMS is a next step for those customers planning to standardize on Veeva across the suite.

From Q1’FY24 earnings:

“Quality is a big area for us…We set out to build that. We have the early plans of doing that for roughly 10 years ago, and it takes a long time to execute on that.

We're very excited. What's fueling the momentum there is customer success. First of all, these systems are not things you change out easily or lightly. Long implementations, and you don't do it unless you need to do it. So each customer has their own timeframe when their existing systems are running out of gas.

I would say they're not investing much these days in their legacy systems because there's broad awareness that Veeva is probably a better alternative. I do get the feeling now for most customers, they think they probably will be going to Veeva for our core established products — training, QualityDocs, QMS. And the question is when? And then there's a lot of wait and see about our new products — Validation and LIMS. ‘Hey, is that product going to be real?’

…It's a long, long replacement cycle. When we talk about a long runway for growth ahead, those are the types of things, the seeds we've planted in, things like LIMS where we don't even have our first customer.”

LIMS currently has no top 20 pharma customers — however it is an essential application in the Quality suite. From its 2022 investor day:

“We're just looking for our first early adopters there [in LIMS], that's maybe the biggest application of them all in the quality area. That's for the workflow around testing — during and after the manufacturing process — quality controls, because when you're making a medicine that goes into the human body, you better believe that's tested rigorously, right, for I think, for very obvious reasons...”

As this product matures, I expect Veeva will begin making inroads.

I estimate LIMS is a $1bn market (it’s the largest application within Quality — a $4bn market), and that Veeva will win 15% market share by 2030.

Summary

Below I lay out my application-level TAM estimates (as well as my estimated 5-year market share gains for Veeva). This is highly unofficial and built on assumptions layered upon assumptions. But I think it’s a helpful exercise nonetheless.

My current estimated Veeva market shares generally line up with the chart Veeva provided. The current revenue of ~$3bn those market shares imply lines up with Veeva’s current run rate revenue (including ~$1.5bn from commercial and ~$1.5bn from R&D).

Based on my estimated 2030 market shares for Veeva, I get to an implied revenue of ~$6.2bn in 2030. Highlighted in yellow are the key product areas discussed above. The only areas not discussed are QMS/CTMS, where like EDC, the customers have already been won (17 of 20 in CTMS; 14 of 20 in QMS) but revenue ramps over time.28 The biggest drivers of growth are EDC/CDB, followed by Safety, QMS, CTMS, RTSM, eCOA, and LIMS.

To recap, I think the assumptions underlying this analysis are reasonably conservative:

50% in EDC/CDB seems low given Veeva already has won 45% of the top 20 pharmas as we sit here today in mid 2025. A counter is that new customers ramp over 4-5 years

20% share for RTSM/eCOA seems reasonable given (1) Veeva’s momentum in the overall clinical suite, (2) the benefits of further standardizing on Veeva RTSM/eCOA and (3) the lack of competitive products in the space. A counter, again, is that these products will likely ramp over a number of years, similar to EDC

33% in Safety (across the whole Safety suite) despite (1) clear signs that Veeva market share is starting to inflect (20% of the top 20 pharmas are on the core safety product), (2) the lack of competitive products in the space, (3) the benefits of Safety integration with EDC (where Veeva is picking up share fast) and (4) the coming benefits from AI functionality (that competitors will very likely struggle to replicate)

I assume relatively little market share expansion in Commercial which might be overly conservative over a 5-year window

I’m assuming no growth in overall TAM over 5 years. In theory, TAM likely expands to ~$25BN or so from just industry growth. Including AI, perhaps much more than that

While again, this exercise is highly imprecise/directional, I believe it provides comfort that Veeva can get to $6bn by 2030. These do not seem like heroic assumptions that get us there.

Beyond 5-Yr Opportunity

After getting to $6bn in revenue, in order to continue to support a healthy multiple (anything like where it currently trades), the market would need to believe that significant growth was still in store. That might seem daunting for a vertical specific provider with already high market share ($6bn in revenue against a $20bn TAM would represent 31% market share in 2030).

But I actually think there is reason to believe that healthy growth could be sustained, even beyond 2030. The drivers of which are discussed below. Importantly, we’d be able to monitor these drivers in advance of becoming “reliant” on them.

Continued Growth of RTSM/eCOA/LIMS/Safety/EDC/CDB

Based on my estimates outlined above, I have RTSM/eCOA getting to ~20% market share, LIMS to ~15%, Safety to ~33%, and EDC/CDB to ~50%.

Once these markets begin to flip, I believe they are “leader-take-most” type of markets.29 Why buy from a competitor to Veeva if (1) the product is worse, (2) they are less incentivized than Veeva to make integrations work, and (3) they seem likely of falling only further behind as Veeva takes share.

You can see this effect in Veeva’s most mature categories — CRM and eTMF. Veeva completely dominates these categories, with 90%+ share across the top 20 pharmas.

Thus, I’d expect there to be continued material runway across these products, even after 5 years.

Compass

Compass is, by far, Veeva’s largest single-product opportunity. It is also the area in which Veeva finds its toughest competitor, by far, in IQVIA.

This market is effectively pharmaceutical sales data, which is pieced together through a variety of data sources. The industry relies on this data for many of its commercial processes (and some R&D processes as well). The data helps companies do things like find prospective patients for a certain pharmaceutical product. It further helps identify the doctors who may be treating those patients so that a company’s commercial team can call on them. It's also used for things like incentive compensation (is a sales rep increasing share in a specific territory?) and sales team design (how large should a sales team be? how should rep territories be divvied up?).

Here’s an example use case from IQVIA’s 2024 investor day:

“A top 10 pharma client was launching its existing asset for a new rare renal condition. The condition is difficult to diagnose and patients are difficult to find. Given these challenges, our client wanted IQVIA's support to find accurate patient populations as opposed to relying on clinical literature alone. They also wanted us to help them identify the right physicians who would benefit most from being aware of this asset.

IQVIA deployed our AI-based analytics model to find undiagnosed patients, leveraging multiple connected data assets comprising nonidentified patient information from claims, EMR and lab data, to name a few.

We then applied IQVIA's superior AI algorithms on these data sets to lend characteristics of patients with this condition. Once the model validated patients, we enhanced it further by mapping to treating physicians. As a result, we were able to help our client identify 9,500 more HCPs with the potential to treat 25,000 more patients with this rare renal condition.”

IQVIA has been the dominant player in the space for decades. It is publicly traded — generating about half its revenue from technology/info solutions and the other half from its CRO (its actually the largest CRO in the world).

IQVIA’s CRO segment generated $8.5bn in revenue and $1.9bn in operating profits in 2024. The Technology & Analytics Solutions (TAS) segment generated $6.2bn of revenue and $1.5bn of operating profit in 2024. The TAS segment has been growing in the low single digits.

The TAS segment is comprised of software applications, consulting services and a huge number of different data products. From 2024 investor day:

“A top 5 global pharma company is licensing 630 unique IQVIA capabilities across 87 countries. Our information assets are used by thousands of their analysts, managers and executives worldwide and importantly, across multiple use cases, spanning prelaunch planning, market opportunity sizing, M&A strategies, go-to-market activities and investor relations, just to name a few.”

I estimate the total TAM for this market is ~1/3rd of IQVIA’s overall TAS revenue (or ~$2bn). That would represent ~10% of Veeva’s overall TAM estimate of $20bn. Today, Veeva likely generates <$25m from Compass despite having been focused on the category for ~5 years.30

Veeva launched Compass Patient in 2020. Five years later, in Jan-25, they introduced Compass Prescriber and Compass National. These latest two Compass products allow Veeva to, in theory, now offer a full replacement product for IQVIA. It’s the first time in decades there has been a competitive offering in the market.

Veeva is attempting to differentiate from IQVIA through:

Better patient data. Veeva claims to take a “modern approach” to data collection. Using best-in-class technology (they would argue) they are able to collect data and synchronize it from many overlapping data sources — more data sources than IQVIA, presumably. They claim this leads to richer, more accurate patient-level data. IQVIA, on the other hand, seems to rely moreso on exclusive data relationships with certain national retail pharmacies (e.g. CVS, Walgreens, etc.). While this has led to a monopoly in the space for decades, Veeva has seemingly found a way around this, and perhaps this new way has its advantages.3132

Faster data. Due to the way that Veeva collects data, Veeva is able to refresh its data daily (which IQVIA cannot, presumably). This seems like a not insignificant differentiator for certain types of customers. For a certain type of customer, the ability to act almost immediately as new opportunities arise (e.g. calling on a HCP the day after a certain diagnosis, etc.) should be important.

Integration with Veeva Software. This seems like it would ultimately be the biggest differentiator for Compass. Assuming Compass can arrive at some level of parity with IQVIA, then tightly integrating Compass with Veeva’s commercial software (where Veeva dominates) should be a clear differentiator.

Veeva has been able to win brands within two top 20 pharmas but remains far from a full ELA.

There is little risk that Veeva would replace IQVIA on an existing brand. Customers would be very reticent to disrupt the commercial functions of a brand given its limited patent life. However, because all brands do come off patent eventually, it creates a natural churn and opportunities for Veeva to jump in on the next one.

Despite the difficult road ahead in Compass, Gassner nonetheless outlined a optimistic case on the Q4’FY25 earnings call:

“We haven't seen really a trend to ELAs yet. We're still on the brand by brand. I think that trend to ELAs, large enterprise ELAs, we might be a year or so out for that, but the trend is kind of inescapable.”

Paul Shawah (EVP Strategy) outlined a similarly optimistic outlook at the Jun-25 Baird conference:

“In many areas, our product is already the very best in the marketplace. And I say it that way because there's some — it varies by therapeutic area. But there's an incumbent in place and there's a lot of effort to switch out the incumbent even though you have a better data product, and you can prove that you have a better data product. So we have to prove this brand by brand.

It's the buying cycle in life sciences that takes time. You buy one brand, you establish success and you move on to the next one. And that's the cycle that we're going through right now. And we've seen some enterprise customers start small with one and then expand to multiple brands and then expand to an ELA. That's the pattern we're looking for, and I think that's what will play out over the next several years.”

We will be able to monitor Compass’ progress over these next few years. An increasing number of brand wins, and eventually full ELA wins, would be great signs for Compass.

This market will be a slog33, but Veeva has had a tendency to overdeliver.

Commercial Reacceleration

The big recent development in the commercial suite, announced Dec-22, is that Veeva is moving its CRM off of the Force.com platform and onto its own internally developed one (the same platform that sits underneath the rest of their applications, called the “Vault” platform). As a result, all of Veeva’s CRM customers must migrate over from the “Veeva CRM” to what they are calling the “Vault CRM” by 2030.

This will likely cause somewhat of a pause in momentum on the commercial side of the business as customers focus on CRM migration.

The good news, however, is that by migrating off of the Salesforce platform, Veeva (1) will no longer pay Salesforce a royalty for use of the Force.com platform, (2) can now target MedTech customers on the commercial side (Veeva was prohibited under their agreement with Salesforce; MedTech is about a quarter of the life science industry3435) and (3) can now develop a marketing automation application (which will be called “Campaign Manager”) and a customer support application (which will be called “Service Center”). Again, Veeva was prohibited from doing this under their agreement with Salesforce.

Thus, we might see a reacceleration in commercial as we get closer to 2030. Campaign Manager and Service Center are substantial opportunities — I estimate ~$800m combined. And they are areas where smooth integrations with CRM, PromoMats and Crossix — areas where Veeva has huge market share — would make a great deal of sense. Further, the competing products in the space (Adobe, Salesforce) are not built specifically for life science, opening the door further for Veeva, which will tailor its solutions to the industry.3637

Horizontal App

At its most recent investor day in Nov-24, Veeva announced that it was in the very early stages of building a strategy in “horizontal enterprise applications.” This was pretty surprising, as this new strategy would have nothing to do with its life science business.

Not much was revealed about it until Q1’FY26, when Veeva announced that its first horizontal application will target the CRM area. Veeva also announced that the application will likely be ready for pilot customers by year end.

Here’s additional color they provided from Q1’FY26 prepared remarks:

“We aren’t looking to develop a solution that’s just incrementally better. We are taking the hard and more rewarding path to deliver fundamentally new innovation to the market. Our success will be determined over the long term, but I am encouraged by our early progress.”

Veeva picking CRM seems like the best possible outcome — Veeva has a ton of CRM expertise and Gassner knows the Salesforce product/platform like none other (he led the Force.com platform team in its early days). Veeva seems to see an opening, where by building from scratch on a newer technology platform, they can offer a product that is fundamentally better than legacy offerings.

Below is commentary from Q4’FY25 earnings which provides some additional color:

Gabriela Borges (Analyst)

“You made an earlier comment on your thinking around horizontal applications longer term and version 1 versus version 2. I'd love to hear your thoughts if you're willing to share them, what do you think the limitations are with the version 1, the cloud SaaS applications today? And where do you think version 2, from an innovation standpoint, could really shine?”

Peter Gassner (CEO)

“I don't think there's any one particular area. I think there's a core set of things [that are] better, stronger, faster, right? Accumulation of 5, 6, 7, 8 things that have been core learnings and then putting that together. And so when you put those together, it has a compounding effect, I would say that. Also, AI will change the user interfaces on the operating systems over time, not tonight, but sometime over the next 5 years, there'll be some fundamental change just in the way that the graphical user interface or the browser-based interface change things.

I think a platform that's designed with that in mind, that knows, yes, it's going to be used as a core system of record -- some of us have heard this thing from the Microsoft CEO about these system of record applications, SaaS applications are going away. I don't believe that. I don't think any of our customers are removing their SAP application anytime in the next 100 years. But there is going to be a way to use AI to dip into multiple of these applications and add value, and that's going to be a critical component. I think the newer SaaS platforms are going to be designed with that in mind because it's obvious that's coming. I think it's pretty hard to retrofit, pretty hard.”

In a cursory review of the “AI-native” CRM landscape you have solutions like Clay in particular that do seem fundamentally better than legacy options. Many of these solutions might increasingly look like humans managing AI agents (AI finds a set of prospects for a campaign and drafts introductory emails — the user then edits & sends — the AI then puts these prospects into your pipeline, tells you when to follow-up, etc.). From its commentary, Veeva seems to be sensing an opening in this type of vein.

When listening to Gassner describe the Vault platform, a lot of what they built would seem quite transferable to an AI-native platform.38 The Vault platform (1) is good at managing both data and content (documents, videos, etc.), (2) deals well with complex workflows, (3) is less relational database and more elasticsearch, (4) offers security down to the field level (which it calls “atomic security”). And more recently, Veeva has introduced the hyper-efficient Direct Data API, which will surely come with their new CRM offering.

I wouldn’t expect anything too material to come of this over the next five years, but it’s an important initiative whose trajectory should be monitored.

AI

Last but not least — AI.

As discussed below, the AI opportunity is a very interesting one for Veeva. I have AI in the beyond 5-year bucket, but I’d be surprised if we didn’t see the impact much sooner.

AI Opportunity

Veeva’s advantages re AI:

Customers are stuck on Veeva. Super sticky, vertical-specific, system of record software

Lot of rope to innovate. Significant customer goodwill + reputation for product excellence + high levels of regulation + decimated competitive landscape = Veeva will be given extensive time/opportunity to deliver on promise of AI

Extensive application suites

For agents that need to dip into multiple different applications to achieve an outcome, that should be straightforward for Veeva

Veeva will have many AI opportunities across their set of 50+ applications

Significant “proprietary” customer data assets. Trial data; all documents from trials, safety, quality, regulatory; correspondence with regulators; sales correspondence; etc., etc. All well-organized on the Vault platform in the cloud. Competitors can’t access this data and are increasingly locked out as Veeva’s market share grows.

Significant “proprietary” external data assets. All Link + Compass assets. This data is not at all easy to assemble — Veeva’s Compass offerings in particular took 5+ years to develop into just an initial version of a product (the only other group that has this data is IQVIA). Thus, like its internal data assets, these external data assets are highly proprietary in nature

Collection of great product people who are steeped in life sciences

This is a very nice set of building blocks.

Veeva’s AI journey thus far:

2015. Way back in 2015, Veeva introduced a product called CRM Suggestions. It was an embryonic form of AI, offering suggested actions to sales reps based on certain real-world patient activity.39

2019. At its 2019 investor day, Veeva discussed AI functionality it had already layered into its Safety product.40

Oct-21. Veeva released its “TMF Bot,” which used a customer’s existing data to classify documents uploaded to its eTMF application “automatically, quickly and accurately”

Nov-22. When ChatGPT was released, Veeva seemed to recognize the importance/breakthrough nature of it, but I’d say expressed a more skeptical initial reaction.41

2023-2024. Over the next couple years, as the importance of AI became more apparent, Veeva’s AI strategy coalesced around a three-pronged plan: Veeva application “bots”, its Direct Data API, and an AI partner program. See below from its 2024 investor day:

Veeva application “bots.” In addition to “TMF Bot,” in Nov-24 Veeva announced “MLR Bot,” “CRM Bot” and “CRM Voice Control”. MLR Bot, which will sit within PromoMats, will perform quality checks before Medical, Legal, Regulatory (MLR) review and approval. MLR Bot will use a Veeva-hosted LLM, and accelerate MLR review by performing brand guidelines, market, channel, and editorial checks. CRM Bot embeds the LLM of a customer’s choice into Vault CRM to enable a range of tasks including pre-call planning, suggested actions, and recommended content. These “bots” will be available starting in late 2025.

Direct Data API. Veeva introduced its Direct Data API in Feb-25. The company characterizes it as a “new class” of API for easy, high speed access to Vault data without impacting application performance. Veeva claims it’s “up to 100 times faster than traditional APIs” and transactionally sound across large datasets. Through the API, a customer may “reliably extract full or incremental data to power AI applications, analytics, and system-to-system integrations.” According to management, the API took ~2.5 years to develop.42

AI partner program. Veeva launched its AI partner program in Apr-24, allowing partners to develop GenAI solutions that integrate seamlessly with Veeva applications.

Apr-25. Veeva announced it’s most aggressive stance on AI to date. Starting in late 2025, Veeva announced that all of its applications will feature “AI Agents” and “AI Shortcuts.” My limited understanding is that the “AI Agents” will be like giving an LLM access to everything in your Veeva app. However, some of the Agents may have more advanced functionality. “AI Shortcuts” seem to allow users to customize the automation of certain repetitive processes/tasks.

Illustrative AI Opportunities

Below are a few examples of how Veeva could potentially employ AI across its suite of solutions.

Example #1: Safety Signal

Veeva’s Safety suite offers “end-to-end” adverse event management. It handles AE intake, medical review, case processing, data analysis/signal detection and regulatory submissions within an unified system. Within its existing suite, Veeva has an application called Signal which helps mine the adverse event data a customer collects for “signals” that might indicate issues requiring further attention.

Applying modern AI capabilities within the Signal application would seem to present a clear opportunity for Veeva. Signal detection is the process of identifying potential safety concerns from vast, unstructured data sources such as clinical trials, EHRs, and spontaneous reports. Integrating ML tools into signal detection will improve the speed and accuracy of identifying potential safety signals.

Example #2: Regulatory Content Writer

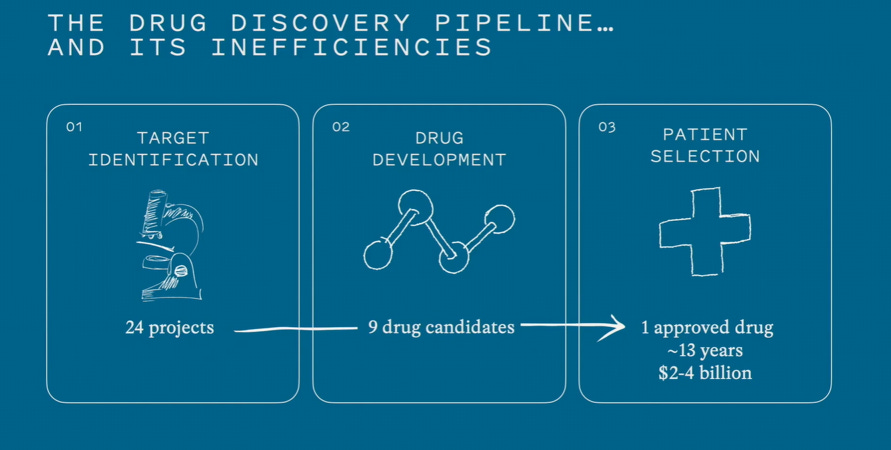

In a clinical trial, as the final step before regulatory review, a sponsor must submit a clinical-study report. According to this McKinsey report, drafting the clinical-study report typically requires eight or more weeks to complete. McKinsey believes that GenAI-based tools can cut this time almost in half by generating an “80 percent right” first draft “from the underlying protocol, statistical-analysis plan, and tables, listings, and figures — within minutes.” Medical writers would thus be freed up to focus on sections of the report that require “a more complex clinical interpretation.”

Veeva is exceptionally well positioned to offer a GenAI-powered regulatory content writer. Veeva not only holds a huge repository of these reports in its Submissions Archive that would help train such a writer. But it also manages all trial information/data across eTMF/CTMS/CDB/etc. that would need to be accessed to draft these documents.

At its May-25 commercial summit, in his keynote, Gassner actually mentioned that Veeva was indeed working on “an authoring bot in regulatory.” I believe an AI-powered writer could be used not only in the drafting of initial reports, but also in the back-and-forth correspondence that follows between a sponsor and its regulatory agencies.

Example #3: Clinical Trial “Co-Pilot”

The McKinsey study summarizes this opportunity well:

“Gen AI can rapidly analyze vast quantities of structured and unstructured data. It is therefore a powerful study-team companion, which can share insights and suggest effective interventions to improve the outcomes of clinical trials. Several best-in-class pharmacos have already created “clinical control towers”—advanced analytics platforms that support operational decision making during clinical development by providing a single source of insights to speed up clinical trials. These AI co-pilots accelerate the trials by empowering study teams in at least three important ways: conversational AI capabilities provide tailored, actionable insights in an engaging format; smart alerts promote proactive, early interventions; and the automatic drafting of communications makes coordination with cross-functional team members more effective. These tools also promise to speed enrollment by automating analyses, proactively addressing enrollment challenges, and boosting collaboration.”

Given Veeva provides the “control tower” application in CTMS, controls the trial data in its CDB, can control the collection of the data through EDC/eCOA, etc., etc., the company is in an ideal position to provide “co-pilot” functionality. A co-pilot would need to seamlessly dip into all these applications to maximize its usefulness.

Veeva is already in the process of releasing a Pulse product for clinical trials, which would be another key building block for a co-pilot product.43

Example #4: CRM “Co-Pilot”

Veeva has already announced a CRM Bot, available in late 2025. This will feature “proactive recommendations and insights, including suggested actions with one-click execution, and content to streamline tasks and enhance productivity.”

What’s interesting here is Veeva already has its CRM Pulse product, which is an analytics engine powered by the activity of its CRM customers. Amongst other things, the pulse product can:

See errors and gaps in targeting and engagement processes by comparing to industry averages

Know which HCPs reps should see, but aren’t

Know which HCPs reps shouldn’t see

Identify the best channels and frequency for engagement

Understand field team productivity vs. the industry

These types of insights would be highly useful if made available in a co-pilot/bot product.

But another very interesting opportunity would be to tie/attribute salesforce activity to actual real-world outcomes using Veeva’s Compass products.

The Compass products provide visibility into patient and HCP activity within the U.S. healthcare system. By “closing the loop” from salesforce activity to real outcomes, Veeva could build an AI engine that would be extremely effective as well as extremely difficult to replicate by a competitor.

Path Ahead

Adding these types of capabilities to its products should only increase Veeva’s differentiation. They would make Veeva’s products better, and I don’t think they’d be easily replicated by competitors.

In fact, you could envision scenarios where these models create self-reinforcing flywheels — where greater use of say a Regulatory Content Writer makes it better over time, which then attracts even greater usage.

Materially better products — if nothing else — would in theory lead to faster market share gains.44 If you are a large pharma company that cannot use Veeva’s AI-powered authoring bot, spending weeks instead of minutes drafting clinical reports, you’ll be at a real disadvantage. It would create a strong impetus to adopt not only Veeva’s RIM suite but perhaps also its clinical ops and clinical data suites, which would need to be tapped into to draft these documents.

AI TAM

According to the McKinsey report referenced above, it expects GenAI to produce between $60-100bn in annual value for the industry. Most of this value falls within areas where Veeva is the key technology provider (all but “research and early discovery” below).

If we take the low-end estimate of $45bn ($60bn ex “research and early discovery”), and cut it by two-thirds, that would equate to a TAM expansion of $15bn. This would almost double Veeva’s current TAM of ~$20bn.

Here is a more detailed summary of potential value creation opportunities within just the clinical development function, from another McKinsey report:

Perhaps the most bullish data point for AI came on Veeva’s latest Q1’FY26 earnings call, where Gassner made the following statement:

“I'm very bullish about what Veeva can bring with AI for the life sciences industry. I think if you look over the next 3, 4, 5 years out to 2030, I think Veeva can help increase life sciences efficiency by 15% or so with Veeva AI. That's a huge number when you look at that. So I really think it will be a step change.

Why am I so bullish on it? Because Veeva has the core applications, and we're building the AI very deeply embedded in the core applications. So when we build AI, we're not building a generic AI. We're building a medical legal regulatory approval agent, a CRM agent that does pre-call planning, a safety AI agent that can transcribe pretext into a safety case, so deep AI applications. And you need the deep core applications and the AI working together.

And that's where the magic will happen. It's just very, very, very clear to me. That's what I'm excited about.”

A 15% increase in efficiency applied to a $2 trillion industry is a whole lot of efficiencies — around $300bn in theory. If we say Veeva captures just 10% of that, that would represent something like a $30bn expansion to its TAM.

While this sounds hyperbolic (and probably is?), there might be no one on earth better qualified than Gassner to understand this, and Gassner generally isn’t someone who’s prone to hyperbole.

How High Will Margins Go?

Veeva’s GAAP operating margins have improved by ~500 bps over the last ~10 years, going from around ~19% (FY10-FY15 average) to around ~24% (FY21-FY25 average). Veeva’s non-GAAP operating margins have improved by ~1,800 bps (21% → 39%), with the 1,300 delta between GAAP and non-GAAP being SBC.

I think Veeva can generate an additional ~800 bps of non-GAAP (~1,000 bps of GAAP) margin improvement over the next 5 years.

Gross Margins

Gross margins have increased from ~58% (FY11-FY15 average) to ~72% (FY21-FY25 average). That’s ~1,400 bps total over ~10 years, or ~140 bps per year.

This was a result of (1) increased subscription gross margins, driven by a shift away from the Force.com platform (or from commercial revenue to R&D revenue):

And (2) increasing subscription revenue (which carries a higher GM; see above) as a % of overall revenue:

GMs should continue to increase. Subscription revenue as a % of overall is expected to continue to increase, which will be one factor. Another will be that on the subscription side, Veeva will benefit materially from the discontinuation of the royalty it pays to Salesforce for use of the Force.com platform. As discussed, Veeva is moving its customers from Veeva CRM (built on the Force.com platform) to Vault CRM (built on Veeva’s Vault platform) over the next five years (with a hard cut-off in 2030).

Veeva still generates some ~30% of its subscription revenue on the Force.com platform (see below, from its Nov-22 investor day).

GMs are materially lower on this piece of its business vs. its in-house Vault platform. From a 2018 Deutsche Bank conference:

“The one thing that I would say as you sort of walk up the P&L from operating margin to gross margin, that you know, Karl, but it's important to make sure people understand as well, is there is a material difference in subscription gross margin between Vault and CRM, and Vault is better than CRM because of the royalty that we pay Salesforce because we built CRM on the Force.com. So the way that I think about it is we sort of have R&D dollars that are up in cost of goods sold in the form of a royalty to CRM. So CRM gross margin subs is probably in the 70, 72, 73 range where Vault gross margin is much closer to what you would consider to be pure SaaS gross margins up in the sort of higher 80s and maybe even dipping into the 90s.”

Additional support.45